- United States

- /

- Banks

- /

- NasdaqGS:COLB

Columbia Banking System (COLB) Margin Gains Reinforce Bullish Valuation Narratives

Reviewed by Simply Wall St

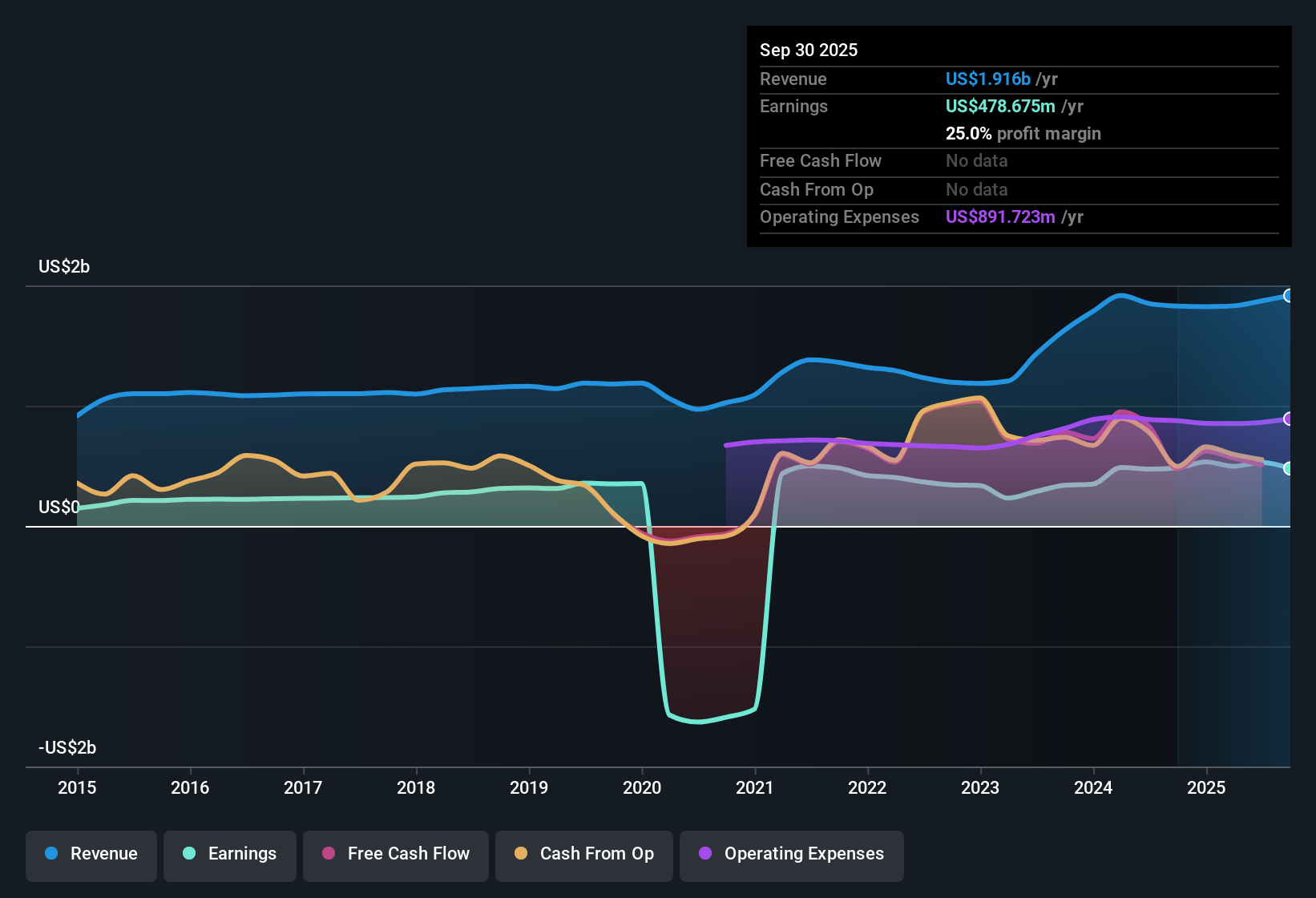

Columbia Banking System (COLB) posted a net profit margin of 28.2% for the most recent period, up from 25.6% last year, and has delivered earnings growth averaging 42.8% per year over the past five years. The company is forecast to grow EPS by 26.4% annually and revenue by 11% per year, both outperforming the broader US market benchmarks. This combination of accelerating margins, forecasted growth, and strong historical performance puts the spotlight on Columbia Banking System’s current positioning for investors.

See our full analysis for Columbia Banking System.Next, we will see how these results stack up against the stories investors are telling. Sometimes the numbers back up the buzz; other times they turn it upside down.

See what the community is saying about Columbia Banking System

Analyst Price Target Narrowly Above Market

- The consensus analyst price target for Columbia Banking System stands at $29.46, only about 10% above the current share price of $26.80, underscoring muted expectations for near-term upside.

- The analysts’ consensus view points out that future gains depend on ambitious forecasts of revenue at $3.5 billion and earnings of $1.3 billion by 2028, with a projected profit margin expansion from 28.2% to 36.9%.

- Consensus narrative notes most analysts see the shares as fairly priced today, so much rests on Columbia delivering cost efficiencies and higher fee-based income to justify even modest upside.

- They highlight the risk that if integration stumbles or digital innovation lags, share price movement could stay muted despite long-term growth targets.

To see which analyst expectations are driving this balanced perspective, read the full consensus narrative for Columbia Banking System. 📊 Read the full Columbia Banking System Consensus Narrative.

Trading Well Below DCF Fair Value

- Columbia Banking System’s current share price of $26.80 is less than half the latest DCF fair value estimate of $56.28, revealing a significant valuation gap by discounted cash flow models.

- The analysts’ consensus view draws attention to the company’s DCF valuation advantage, but tempers outright optimism by citing only modest analyst price target upside while emphasizing robust projected growth.

- Consensus narrative notes the combination of high-quality earnings and double-digit growth forecasts supports a compelling value argument.

- But they also remind investors that DCF-based potential only matters if upcoming integrations deliver, and operational execution translates to higher margins and stable asset quality in unpredictable regional markets.

PE Ratio Discount to Peers, Premium to Industry

- The company trades at a PE ratio of 15.2x, lower than peer averages at 24.9x but higher than the broader industry average of 11.1x. This highlights both a relative discount among select comparables and a premium over the sector overall.

- According to the analysts’ consensus view, this mixed valuation profile reflects investors’ willingness to pay up for Columbia’s growth and margin expansion story versus typical banks, though it also signals caution pending demonstrable execution on integration and digital initiatives.

- Consensus narrative notes that as long as profit margins and top-line momentum are delivered, the current premium to industry should be sustainable, but any missteps could see the valuation compress toward sector norms.

- They stress that the balance of rewards—growth, value, and proven execution—currently outweighs flagged risks, pending confirmation of upcoming financial targets.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Columbia Banking System on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your take on the data? Share your viewpoint and transform it into a personalized narrative in just a few minutes. Do it your way

A great starting point for your Columbia Banking System research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Columbia Banking System’s valuation is appealing, limited near-term upside and execution risks could hold back share price growth if performance falters.

If you favor steadier companies with more consistent results and fewer surprises, screen for reliable performers using stable growth stocks screener (2103 results) that deliver stable growth across changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLB

Columbia Banking System

Operates as the Bank holding company of Columbia Bank that provides banking, private banking, mortgage, and other financial services in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives