- United States

- /

- Renewable Energy

- /

- NasdaqCM:MNTK

Undiscovered Gems in the United States to Explore This October 2024

Reviewed by Simply Wall St

In the last week, the United States market has been flat, yet it has seen a remarkable 40% increase over the past year with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying stocks that are undervalued or overlooked can provide unique opportunities for investors seeking growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| Chain Bridge Bancorp | 10.64% | 41.34% | 18.53% | ★★★★☆☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

ChoiceOne Financial Services (NasdaqCM:COFS)

Simply Wall St Value Rating: ★★★★★★

Overview: ChoiceOne Financial Services, Inc. is a bank holding company for ChoiceOne Bank, offering banking services to corporations, partnerships, and individuals in Michigan with a market cap of $278.11 million.

Operations: ChoiceOne derives its revenue primarily from interest income on loans and securities, with non-interest income from service charges and fees contributing a smaller portion. The company's cost structure includes interest expenses on deposits and borrowings, alongside operational costs. Notably, the net profit margin has shown variability over recent periods.

ChoiceOne Financial Services, with total assets of $2.7 billion and equity at $247.7 million, seems to be navigating its niche well. It holds deposits totaling $2.2 billion against loans of $1.5 billion, indicating a solid position in the financial sector. The bank's net interest margin stands at 2.8%, while it maintains a sufficient allowance for bad loans at 0.1% of total loans, showcasing prudent risk management practices. Despite shareholder dilution over the past year due to a follow-on equity offering worth $30 million, ChoiceOne trades significantly below its estimated fair value by 51%.

Montauk Renewables (NasdaqCM:MNTK)

Simply Wall St Value Rating: ★★★★★★

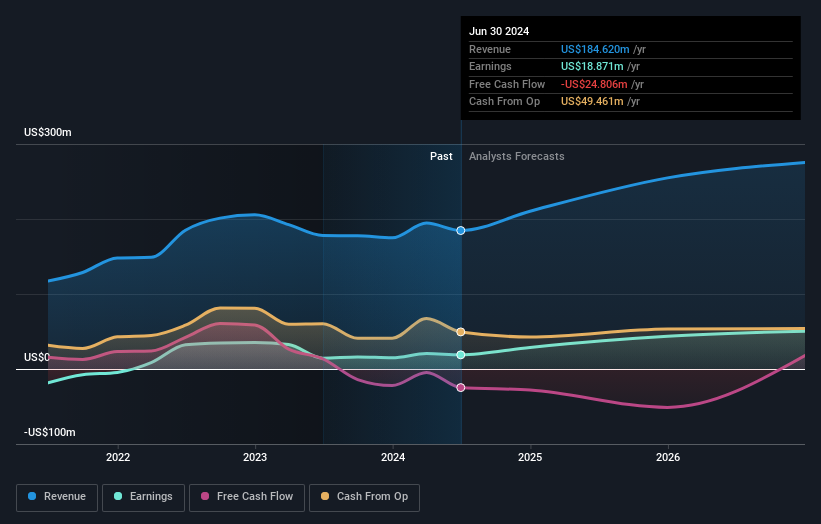

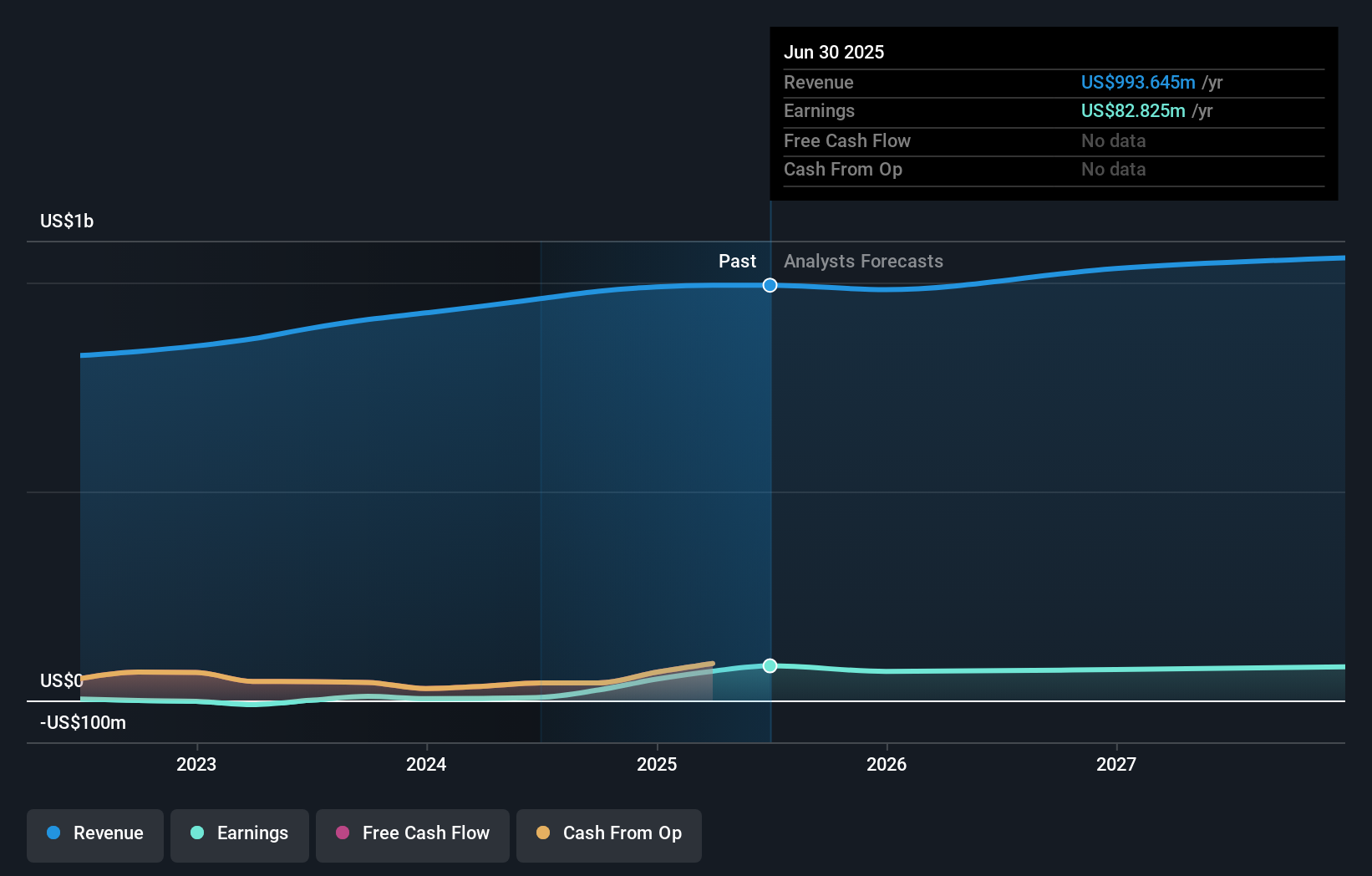

Overview: Montauk Renewables, Inc. is a renewable energy company focused on the recovery and processing of biogas from landfills and other non-fossil fuel sources, with a market cap of $776.74 million.

Operations: Montauk Renewables generates revenue primarily from Renewable Natural Gas (RNG) at $165.89 million and Renewable Electricity Generation (REG) at $18.73 million.

Montauk Renewables is making waves with its innovative approach to renewable energy, especially through projects like the swine waste-to-energy initiative in North Carolina. Their net debt to equity ratio stands at a satisfactory 6.5%, reflecting prudent financial management. Despite a recent dip in quarterly sales to US$43.34 million and a net loss of US$0.712 million, the company remains profitable overall and is not concerned about cash runway issues. The collaboration with Emvolon for converting biogas into green methanol showcases Montauk's commitment to sustainability and innovation, potentially boosting future revenue streams significantly.

Donegal Group (NasdaqGS:DGIC.A)

Simply Wall St Value Rating: ★★★★★☆

Overview: Donegal Group Inc. is an insurance holding company that offers property and casualty insurance to businesses and individuals, with a market capitalization of $476.59 million.

Operations: Donegal Group generates revenue primarily through premiums from its property and casualty insurance offerings. The company's net profit margin is a key indicator of its financial performance, reflecting the efficiency of operations and cost management relative to revenue.

Donegal Group, a property and casualty insurance player, has shown robust financial performance with earnings growth of 152% over the past year, outpacing the industry average of 27.7%. The company's debt to equity ratio improved from 9% to 6.8% across five years, indicating prudent financial management. Recent quarterly results highlight a notable turnaround with net income reaching US$16.75 million compared to a loss last year. Donegal's strategic focus on geographic diversification and high-yield investments seems poised to enhance its profit margins from 0.8% to an expected 4.6%, although challenges in commercial lines competition remain pertinent considerations for investors.

Summing It All Up

- Click here to access our complete index of 221 US Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MNTK

Montauk Renewables

A renewable energy company, engages in recovery and processing of biogas from landfills and other non-fossil fuel sources.

Flawless balance sheet with reasonable growth potential.