- United States

- /

- Banks

- /

- NasdaqGS:CHCO

City Holding (CHCO) Valuation: Weighing Fed Signals and Future Growth Potential

Reviewed by Simply Wall St

City Holding (CHCO) shares climbed after remarks from Federal Reserve officials signaled the possibility of interest rate cuts and a halt to quantitative tightening. These developments have improved prospects for regional banks amid shifting market expectations.

See our latest analysis for City Holding.

City Holding’s share price has seen renewed upward momentum, rising 3.68% over the past week following recent signals from the Fed. However, the 1-year total shareholder return is still negative at -4.46%. Despite a lackluster stretch earlier in the year, its five-year total return of 113.24% shows the bank’s long-term performance remains robust for patient holders.

If you’re interested in where else institutional momentum and insider conviction are colliding, now is a perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares rebounding on optimistic Fed signals, investors face a pivotal question: is City Holding’s current valuation leaving room for upside, or is the market already accounting for all future growth?

Price-to-Earnings of 14x: Is it justified?

Shares of City Holding currently trade at a price-to-earnings (P/E) ratio of 14x, which places them well above the US Banks industry average and peer group. At a last close of $122.64, this premium raises important questions about where investor optimism lies compared to sector benchmarks.

The price-to-earnings ratio measures how much investors are willing to pay today for a dollar of earnings. For a regional bank like City Holding, it reflects expectations around profitability, quality of earnings, and growth prospects. When the P/E is elevated relative to peers, the market is either pricing in superior future growth or assigning a premium for perceived stability and earnings quality.

At 14x, City Holding’s P/E is noticeably higher than the industry standard of 11.2x and the peer group average of 11.5x. This indicates that the market is assigning a significant premium to the stock. However, the estimated fair P/E ratio for City Holding stands at 9.4x, suggesting the current multiple exceeds levels justified by underlying fundamentals. Markets often gravitate toward fair value over time if company performance does not deliver to expectations.

Explore the SWS fair ratio for City Holding

Result: Price-to-Earnings of 14x (OVERVALUED)

However, slowing revenue growth and muted net income gains could pressure future returns. This may challenge investor confidence if performance falls short of expectations.

Find out about the key risks to this City Holding narrative.

Another View: Discounted Cash Flow Suggests Value

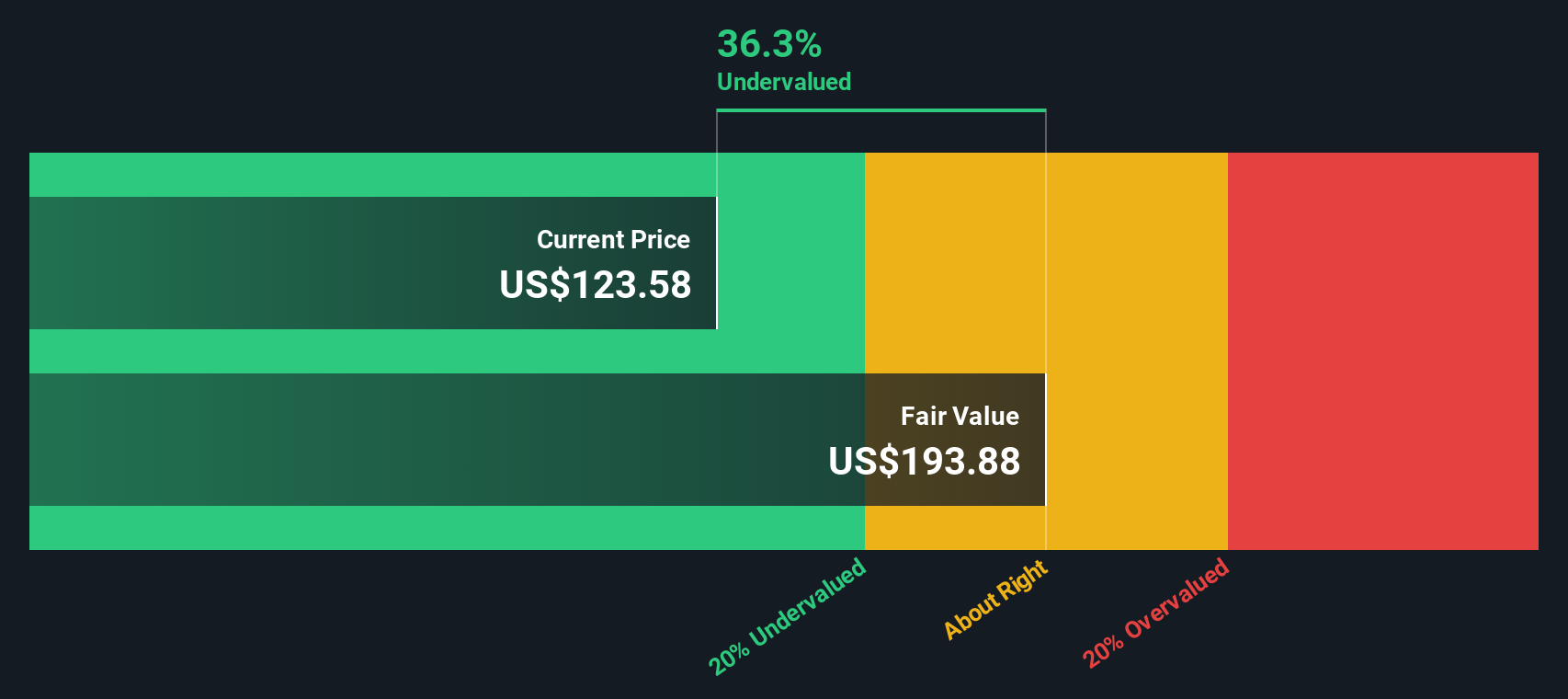

While City Holding’s P/E ratio appears expensive compared to industry standards, our SWS DCF model presents a different perspective. The stock is trading at nearly 40% below its estimated fair value, which suggests a considerable margin of safety for long-term investors. Which approach will prove more accurate?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out City Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 925 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own City Holding Narrative

If you prefer your own analysis or want to dig deeper into the figures, you can easily assemble your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding City Holding.

Looking for more investment ideas?

Stop waiting for the perfect pick and get ahead of the crowd with fresh opportunities in growing or undervalued sectors. These handpicked screeners can help you target your next standout investment:

- Capture yields that beat the average by checking out these 14 dividend stocks with yields > 3%. This screener offers consistent payouts and strong fundamentals for income-focused portfolios.

- Ride the wave of technological progress by targeting these 30 healthcare AI stocks, which is poised to shape the future of medicine with the use of artificial intelligence in diagnostics and treatment.

- Supercharge your watchlist with these 925 undervalued stocks based on cash flows, featuring options that analysts believe are still trading below their real potential before the market catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHCO

City Holding

Operates as a financial holding company for City National Bank of West Virginia that provides banking, trust and investment management, and other financial solutions in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success