- United States

- /

- Banks

- /

- NasdaqGS:CFB

Exploring Apogee Enterprises Alongside Two Other Promising Small Caps

Reviewed by Simply Wall St

The United States market remained flat over the last week but has shown significant growth with a 32% increase over the past year, and earnings are forecast to grow by 15% annually. In such a dynamic environment, identifying stocks with strong fundamentals and growth potential can be key to uncovering promising opportunities, as exemplified by Apogee Enterprises and two other small-cap contenders.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| River Financial | 122.41% | 16.43% | 18.50% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| Chain Bridge Bancorp | 10.64% | 41.34% | 18.53% | ★★★★☆☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Apogee Enterprises (NasdaqGS:APOG)

Simply Wall St Value Rating: ★★★★★★

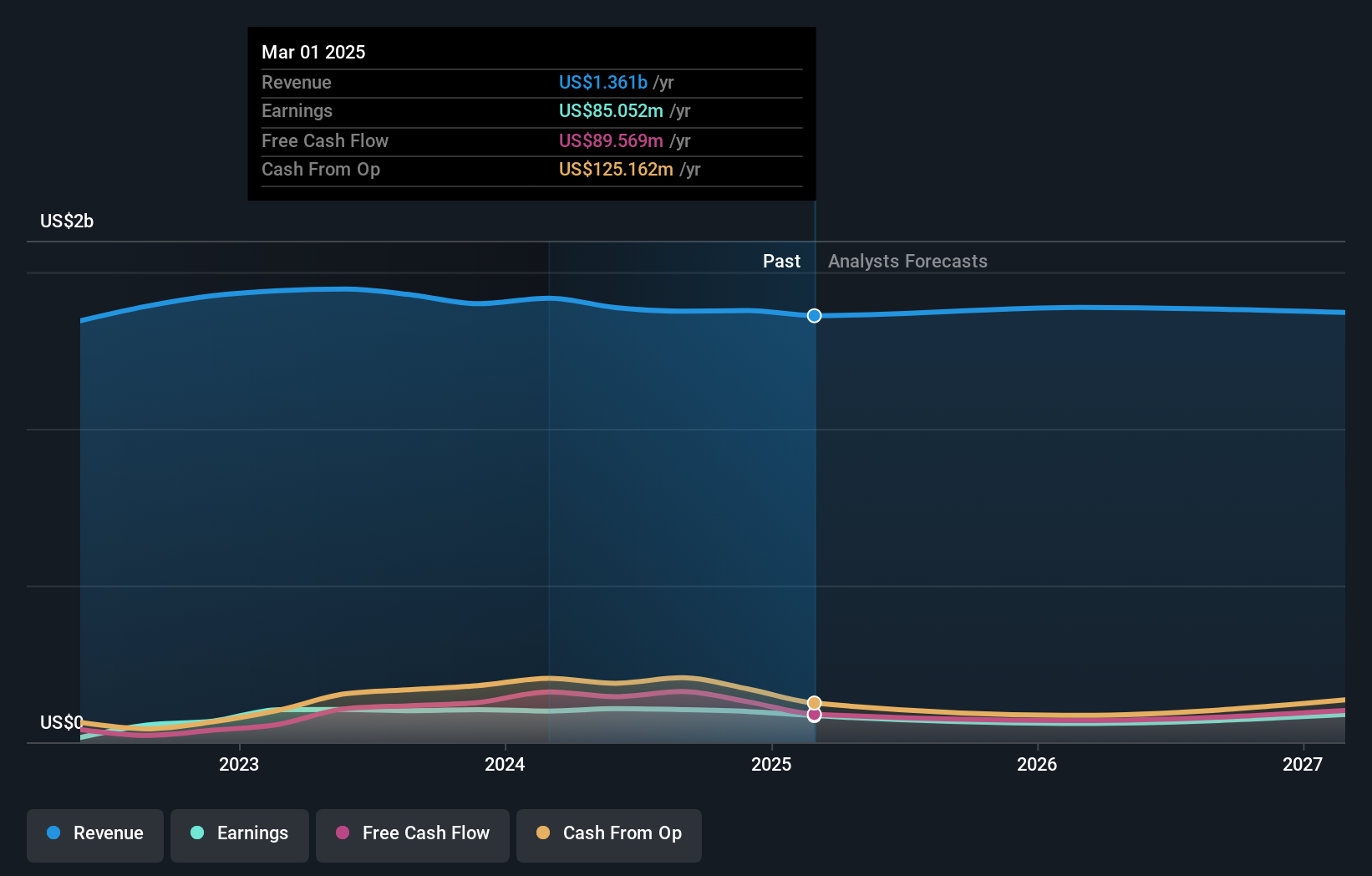

Overview: Apogee Enterprises, Inc. specializes in architectural products and services for building enclosures, as well as glass and acrylic products for preservation and enhanced viewing, with operations in the United States, Canada, and Brazil; the company has a market cap of approximately $1.84 billion.

Operations: Apogee Enterprises generates revenue primarily from its Architectural Framing Systems and Architectural Services segments, contributing $553.30 million and $397.99 million respectively. The company also derives income from its Architectural Glass segment at $363.96 million, and Large-Scale Optical products at $94.16 million, with intersegment eliminations of -$33.88 million affecting the total revenue calculation.

Apogee Enterprises, a notable player in the building industry, has shown robust financial management with its debt to equity ratio decreasing from 54.2% to 12.2% over five years and interest payments well covered at 39.5x EBIT. The company's earnings have grown impressively by 26.6% annually over the past five years, although recent growth of 3.2% lagged behind the industry's 9.9%. Apogee's ongoing share repurchase program reflects confidence in its valuation, having bought back shares worth US$10.91 million recently while maintaining a price-to-earnings ratio of 17.7x below the US market average of 18.4x.

- Unlock comprehensive insights into our analysis of Apogee Enterprises stock in this health report.

Evaluate Apogee Enterprises' historical performance by accessing our past performance report.

CrossFirst Bankshares (NasdaqGS:CFB)

Simply Wall St Value Rating: ★★★★★★

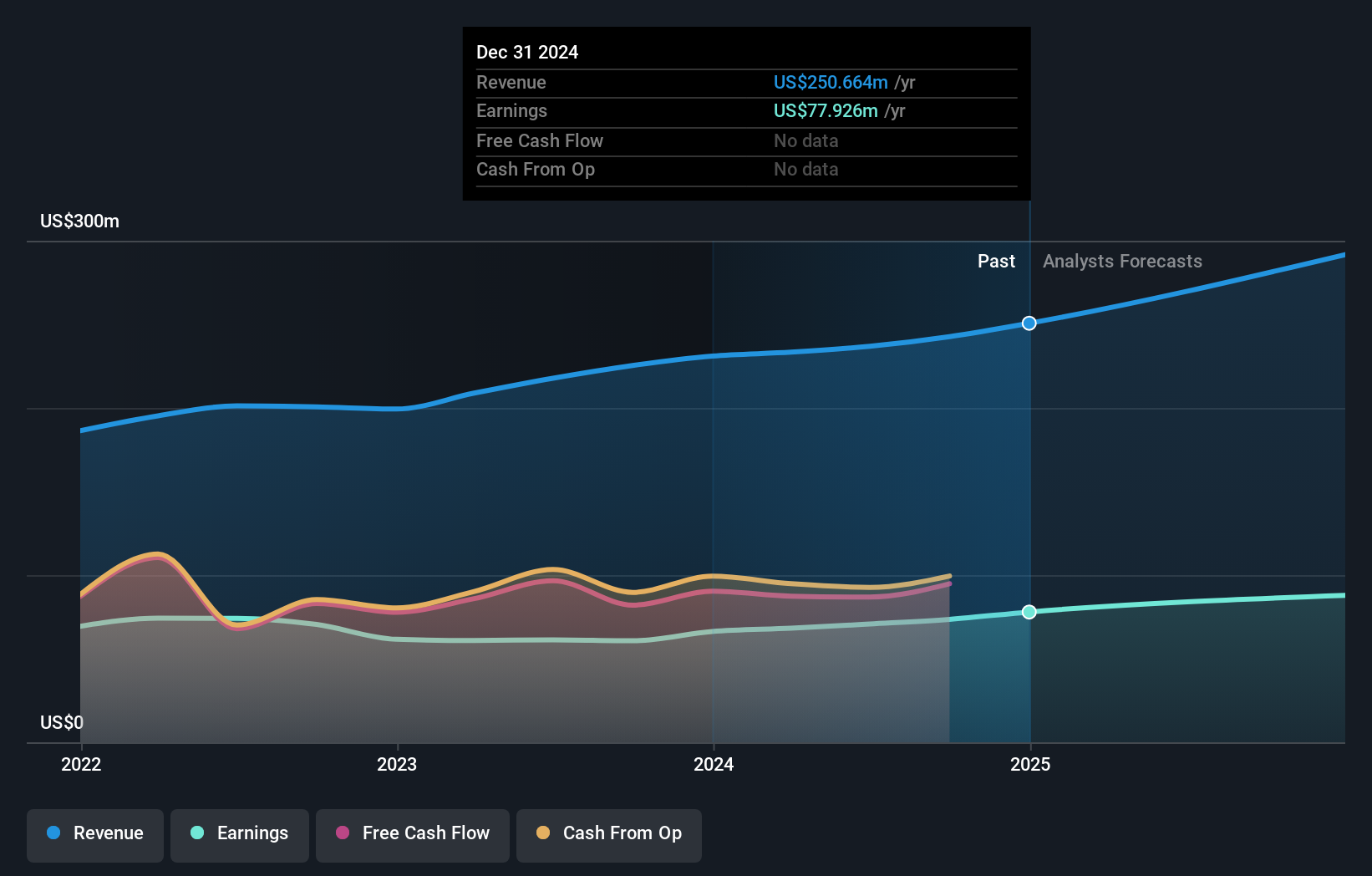

Overview: CrossFirst Bankshares, Inc. is a bank holding company for CrossFirst Bank, offering a range of banking and financial services to businesses and individuals, with a market cap of $792.53 million.

Operations: CrossFirst Bankshares generates revenue primarily from its banking segment, amounting to $236.86 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

CrossFirst Bankshares, with assets of US$7.6 billion and equity at US$727.9 million, shows a robust financial stance. Its total deposits stand at US$6.7 billion against loans of US$6.3 billion, reflecting a balanced approach to lending and funding primarily through low-risk customer deposits (97%). The company has an impressive allowance for bad loans at 640% and maintains high-quality earnings with a growth rate of 15.4%, outpacing the industry average significantly. Recent buybacks saw CrossFirst repurchase 237,108 shares for US$3.03 million between April and July 2024, indicating confidence in its valuation as it trades well below estimated fair value by about 58%.

Centrus Energy (NYSEAM:LEU)

Simply Wall St Value Rating: ★★★★★☆

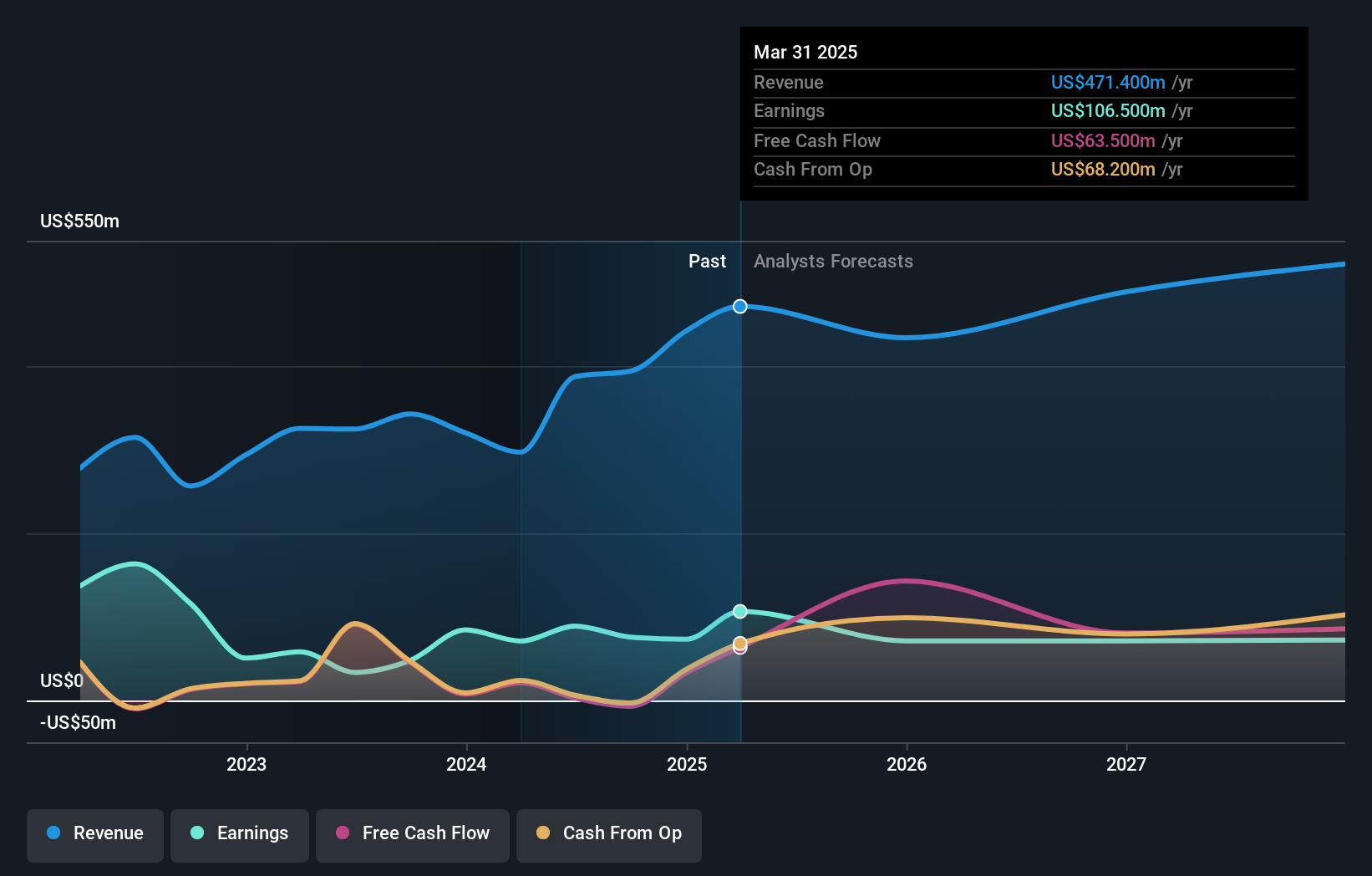

Overview: Centrus Energy Corp. is a company that provides nuclear fuel components and services to the nuclear power industry across the United States, Belgium, Japan, and other international markets with a market cap of $1.10 billion.

Operations: Centrus Energy generates revenue primarily through its Low-Enriched Uranium (LEU) segment, contributing $320.80 million, and Technical Solutions, adding $71.80 million. The company's market cap is approximately $1.10 billion.

Centrus Energy, a nimble player in the energy sector, has been making waves with its impressive financial performance. The company reported a revenue of US$189 million for Q2 2024, a significant leap from US$98.4 million last year. Net income also surged to US$30.6 million from US$12.7 million previously, while earnings per share jumped to US$1.89 from USD 0.84 in the same period last year. Despite recent shareholder dilution and volatile share prices, Centrus boasts high-quality earnings and trades at nearly 59% below estimated fair value, indicating potential undervaluation in the market.

- Click here to discover the nuances of Centrus Energy with our detailed analytical health report.

Understand Centrus Energy's track record by examining our Past report.

Turning Ideas Into Actions

- Explore the 219 names from our US Undiscovered Gems With Strong Fundamentals screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CFB

CrossFirst Bankshares

Operates as the bank holding company for CrossFirst Bank that provides various banking and financial services to businesses, business owners, professionals, and its personal networks.

Flawless balance sheet and undervalued.