- United States

- /

- Banks

- /

- NasdaqGS:CCB

Coastal Financial (CCB): Evaluating Valuation After Mixed Quarterly Earnings and Recent Net Interest Income Growth

Reviewed by Simply Wall St

Coastal Financial (CCB) just released its third quarter earnings, showing net interest income climbed compared to last year, but with a minor dip in earnings per share. Investors are weighing what these mixed results signal for the business in the future.

See our latest analysis for Coastal Financial.

After Coastal Financial’s mixed quarterly earnings, momentum in the shares has shifted. The stock price has risen 7.23% over the past 90 days and delivered an impressive 50.7% total shareholder return for the year. The strong long-term results suggest investor confidence remains high, despite some short-term volatility.

If recent performance has you thinking about wider opportunities, now’s a great time to broaden your horizons and discover fast growing stocks with high insider ownership

With strong long-term returns and recent gains, is Coastal Financial’s current valuation a bargain for forward-looking investors, or has the market already factored in the company’s robust growth outlook?

Price-to-Earnings of 33.7x: Is it justified?

Coastal Financial trades at a price-to-earnings (P/E) ratio of 33.7x, well above industry peers and typical market levels. This makes its valuation appear expensive relative to the broader US bank sector.

The price-to-earnings ratio compares a company’s current share price to its per-share earnings. For banks, it signals how much investors are willing to pay for future profit streams. A high P/E often reflects strong expectations for future growth or exceptional profitability, but it can also indicate the market may be overestimating prospects or underestimating risks.

In Coastal Financial’s case, the 33.7x P/E is not only higher than the US banks industry average of 11x but also exceeds the peer group’s average of 11.9x. This premium suggests the market is pricing in a considerable growth advantage or unique strengths not present in competitors. However, compared to the estimated fair P/E of 20.3x, the current multiple appears stretched even by optimistic standards, which could imply movement toward more typical valuation levels over time.

Explore the SWS fair ratio for Coastal Financial

Result: Price-to-Earnings of 33.7x (OVERVALUED)

However, slower short-term earnings growth or changes in market sentiment could challenge the optimism around Coastal Financial's elevated valuation.

Find out about the key risks to this Coastal Financial narrative.

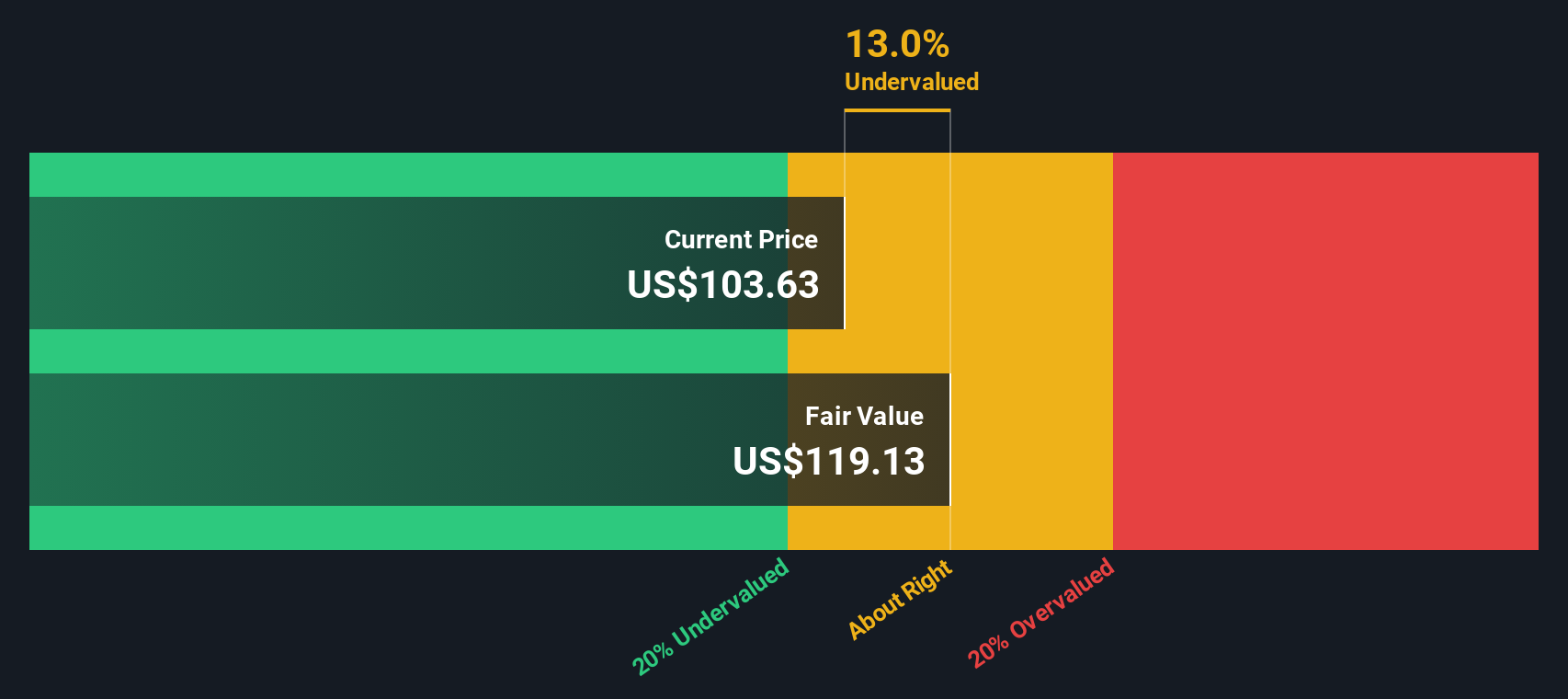

Another View: Discounted Cash Flow Signals Opportunity

Taking a different approach, the SWS DCF model estimates Coastal Financial’s fair value at $135.35 per share. This is 21.4% above its current price. This method suggests the stock could be undervalued, in contrast to what the high price-to-earnings ratio implies. Does this alternate perspective reveal an overlooked upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Coastal Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Coastal Financial Narrative

If you have a different view or prefer digging into the numbers yourself, you can shape your own perspective quickly with our tools. Do it your way

A great starting point for your Coastal Financial research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep their options open. Expand your horizons and spot unique opportunities that could change your portfolio. Act now so you don’t miss the standout performers everyone will be talking about next.

- Unlock the full potential of cash flow value by checking out these 870 undervalued stocks based on cash flows for companies the market is seriously underrated.

- Tap into unstoppable trends in healthcare technology by viewing these 32 healthcare AI stocks and see how AI is driving breakthroughs in medical innovation.

- Boost your regular income with these 16 dividend stocks with yields > 3% for stocks offering attractive yields and a track record of rewarding shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCB

Coastal Financial

Operates as the bank holding company for Coastal Community Bank that provides various banking products and services to small and medium-sized businesses, professionals, and individuals in the Puget Sound region in Washington.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives