- United States

- /

- Banks

- /

- NasdaqGS:CASH

Are Shares of Pathward Ready to Rebound After Recent Price Gains and Industry Volatility?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Pathward Financial is undervalued or primed for a bounce, you're in the right place for a clear-headed look at where things stand.

- The stock has climbed 1.8% over the last week and 5.0% in the past month, but is still down 1.4% year-to-date and 14.6% over the last year, despite a substantial 109.3% return over the last five years.

- In the past several months, industry developments and changing investor sentiment around the banking sector have influenced share price movements. Broader market trends and fresh strategic initiatives at Pathward Financial have also provided new context for this volatility.

- Currently, Pathward Financial scores a solid 5 out of 6 on our valuation checklist, which suggests there could be real value here. Let’s look at how this score compares to different valuation approaches, and be sure to stick around for an additional method to help decode valuation at the end.

Find out why Pathward Financial's -14.6% return over the last year is lagging behind its peers.

Approach 1: Pathward Financial Excess Returns Analysis

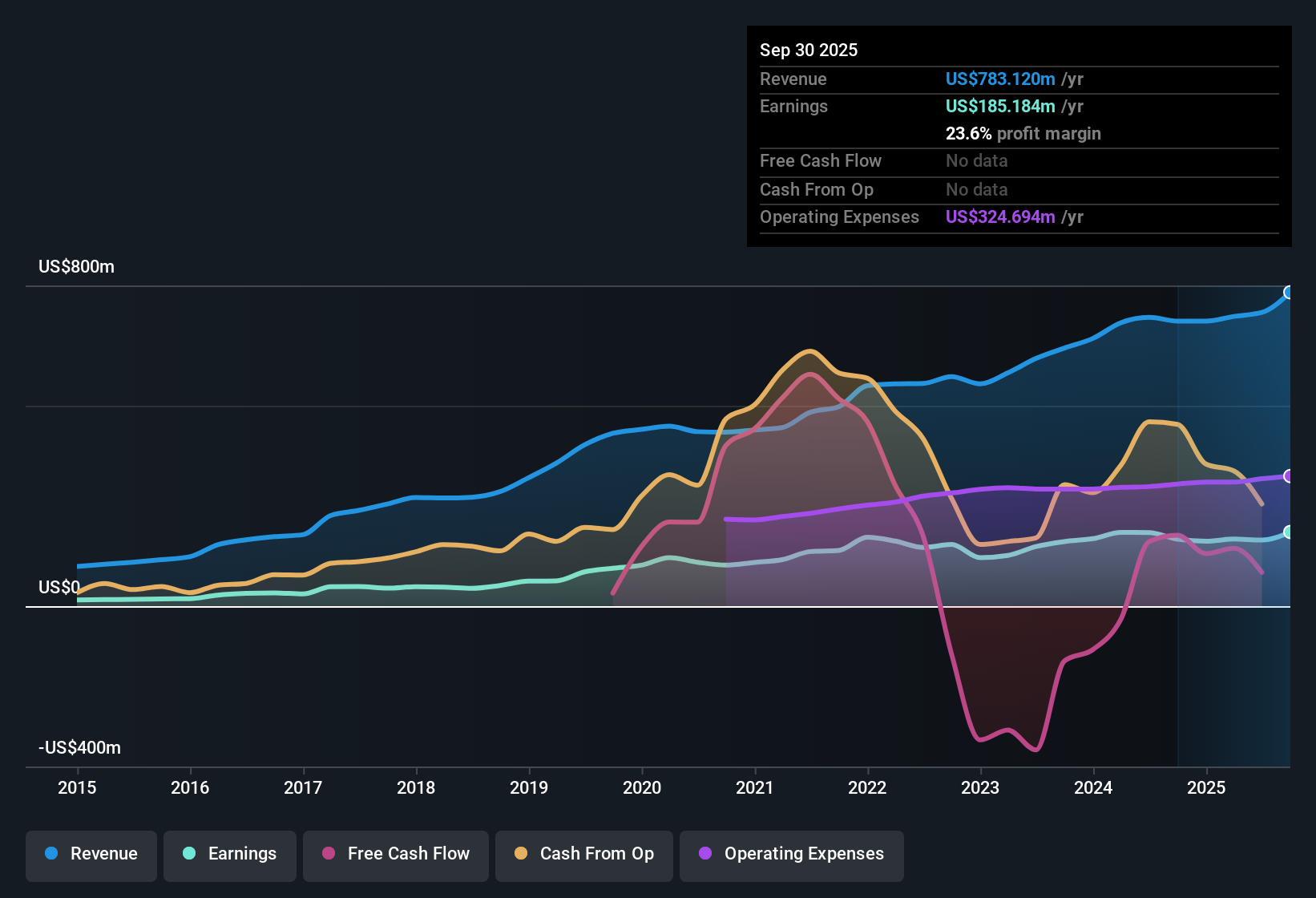

The Excess Returns valuation model measures how much profit Pathward Financial generates from its invested capital above the minimum required return for investors, known as the cost of equity. By focusing on the company’s ability to generate returns beyond this threshold, the model helps gauge sustainable value creation and long-term performance.

For Pathward Financial, the latest data shows a book value of $37.68 per share and a stable earnings per share (EPS) of $10.41, which is based on the median return on equity over the past five years. With a cost of equity at $3.21 per share, the resulting excess return is $7.20 per share. The company's average return on equity is a robust 22.58%, and the stable book value is projected to increase to $46.11 per share, using weighted future estimates from two analysts.

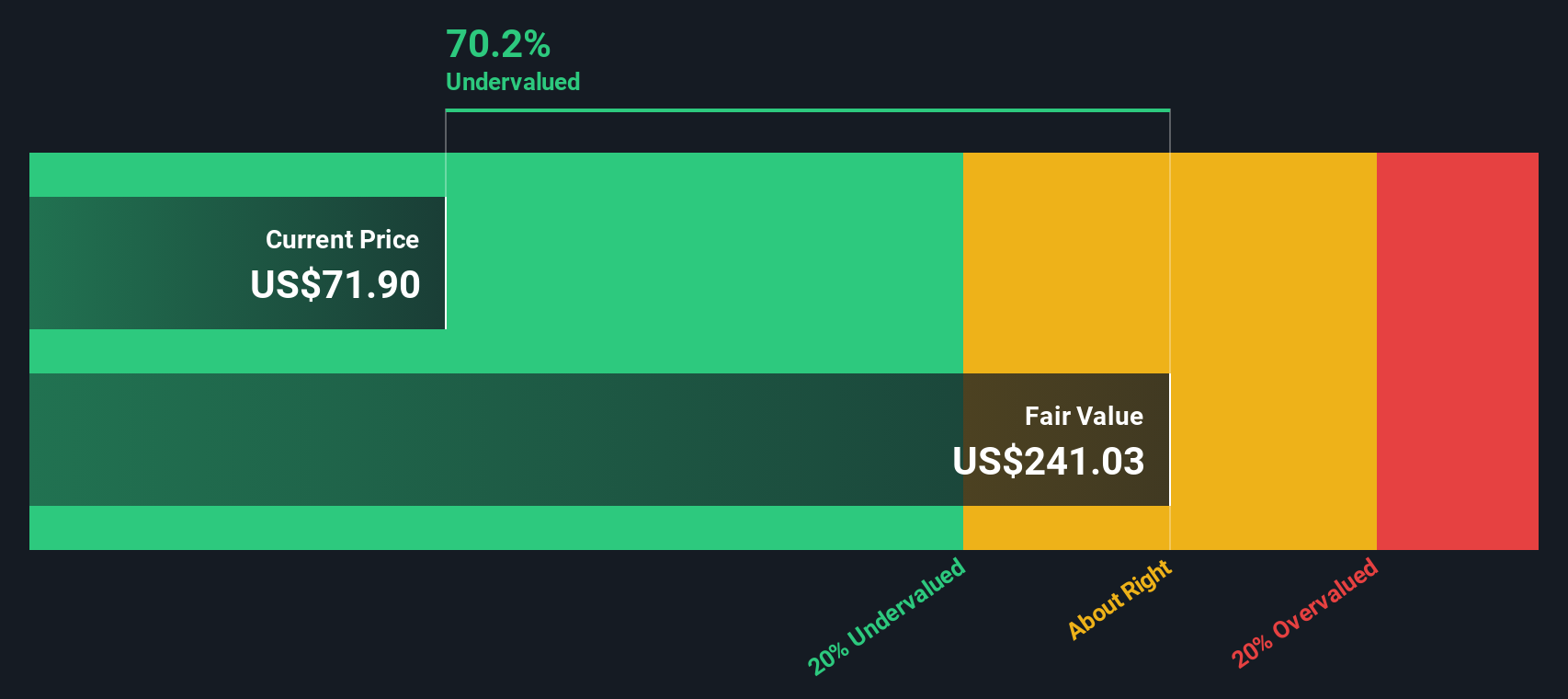

Applying the Excess Returns model, Pathward Financial’s intrinsic value is significantly higher than the current share price. The implied discount suggests the stock is 70.3% undervalued at present, indicating substantial upside compared to current market levels.

Result: UNDERVALUED

Our Excess Returns analysis suggests Pathward Financial is undervalued by 70.3%. Track this in your watchlist or portfolio, or discover 923 more undervalued stocks based on cash flows.

Approach 2: Pathward Financial Price vs Earnings

The price-to-earnings (PE) ratio is often the go-to multiple for evaluating profitable companies like Pathward Financial. This metric helps investors quickly gauge how much they are paying for each dollar of current earnings, making it especially useful for firms with steady profitability.

A company's "normal" or "fair" PE ratio is shaped by factors such as expected earnings growth, perceived risk, and how stable its profits are. In general, faster-growing and lower-risk businesses can justify higher PE ratios. Those facing uncertainty or slow growth tend to trade at lower multiples.

Pathward Financial currently trades at a PE ratio of 8.62x. For context, the industry average for banks is 11.40x and the average for its direct peers is 12.49x. Based purely on these benchmarks, Pathward Financial appears notably cheaper than most of its competitors.

Instead of just comparing ratios, Simply Wall St’s proprietary Fair Ratio takes into account not only industry and peer comparisons but also Pathward Financial's specific combination of growth prospects, profit margins, market capitalization, and risk profile. The Fair Ratio for Pathward Financial is calculated at 9.68x, which is considered a balanced valuation given what is known about its business.

Comparing the Fair Ratio of 9.68x with Pathward Financial's actual PE of 8.62x indicates the stock is somewhat undervalued on this basis. The current price leaves some room for upside relative to what could be considered a fair, justified multiple for the company given its earnings profile and risks.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1439 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Pathward Financial Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply the story behind the numbers—a personal perspective or thesis that ties together what you believe about a company’s future, including assumptions about fair value, future revenue, earnings, and profit margins.

Narratives go beyond static snapshots by linking a company’s business story to a financial forecast and ultimately to a fair value estimate. On Simply Wall St, Narratives are an accessible tool used by millions of investors, available on every company’s Community page. This feature lets you map out your own investment case or view other investors’ perspectives.

With Narratives, you can see at a glance how your fair value estimate compares to the current price and decide whether it is the right moment to buy, sell, or hold. Since Narratives update dynamically with every new earnings report or breaking news, your view always stays relevant.

For example, some investors believe Pathward Financial could reach $88 per share within three years if revenue grows 13% annually and margins stay above 20%. Others see headwinds from compliance costs and industry competition, which could limit fair value to nearer current prices.

Do you think there's more to the story for Pathward Financial? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CASH

Pathward Financial

Operates as the bank holding company for Pathward, National Association that provides various banking products and services in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.