- United States

- /

- Banks

- /

- NasdaqGS:BUSE

First Busey (BUSE) Net Profit Margin Falls, Challenging Bullish Growth Narratives

Reviewed by Simply Wall St

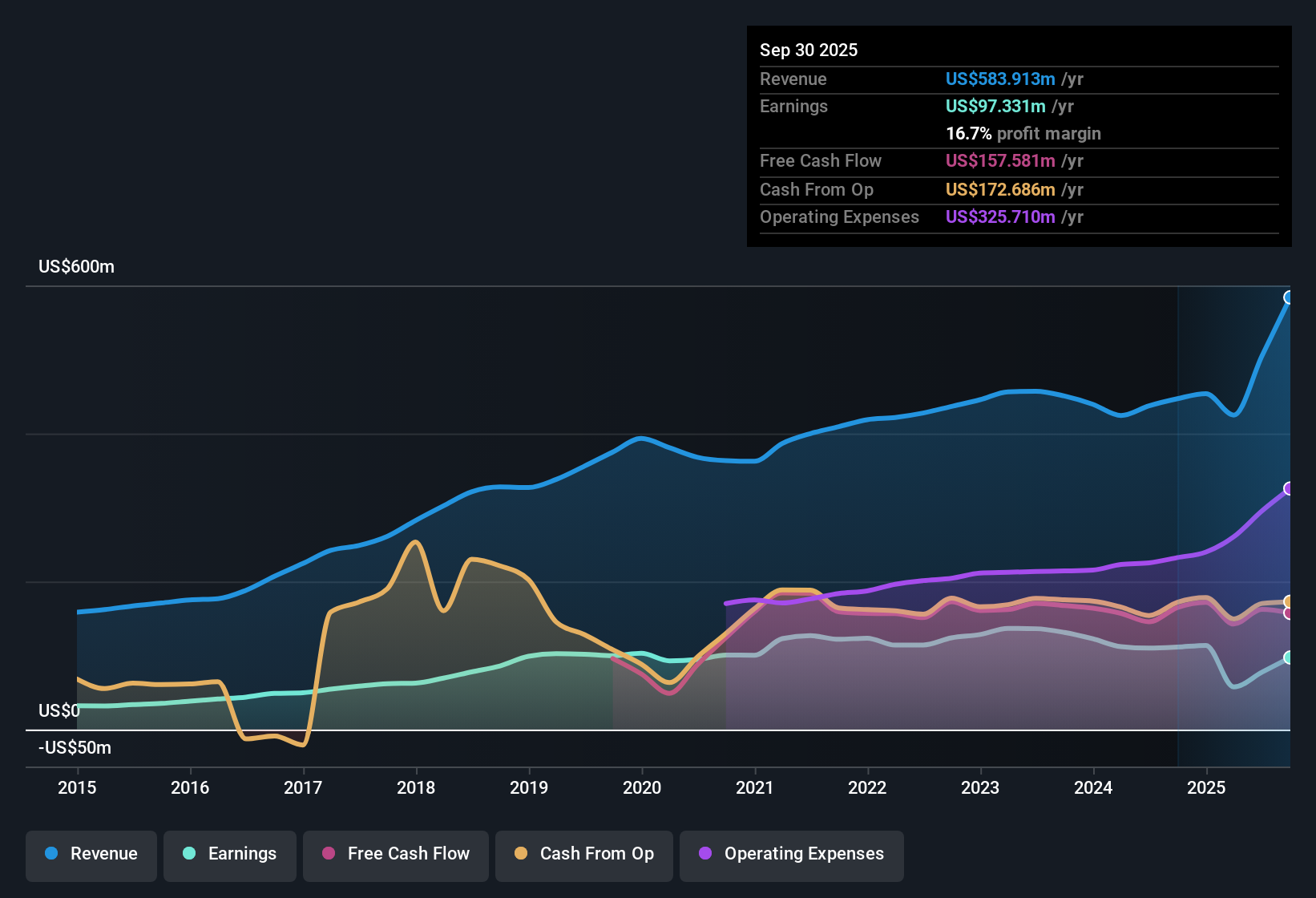

First Busey (BUSE) saw its net profit margin fall to 16.7% from last year's 25.5%, and over the past five years, the company posted an average annual earnings decline of 4.3%. Despite this recent softness, the market is watching closely, as the current share price of $22.53 sits well below the estimated fair value of $51.05. Future earnings are forecast to grow 43.1% per year, which is far above the US market average of 15.6%.

See our full analysis for First Busey.Next, we will see how these headline numbers compare to the market narratives that drive sentiment for BUSE, and where the stories may diverge or find new support.

Curious how numbers become stories that shape markets? Explore Community Narratives

P/E Multiple Stands Out Versus Peers

- First Busey's Price-to-Earnings ratio is 20.6x, which is significantly higher than both its peer average of 13.2x and the broader US banks industry average of 11.2x.

- What’s surprising is that despite this premium valuation, market discussion centers around a possible disconnect. Strong projected earnings growth and DCF fair value of $51.05 contrast with the company’s elevated P/E compared to industry standards.

- This tension keeps investors watching to see if future outperformance will justify the higher multiple.

- Bulls may seize on robust forecasts, while valuation-focused critics will question paying so far above industry norms.

Revenue Growth Forecast Tops Market Average

- BUSE is forecast to grow revenue 16.1% annually, outpacing the overall US market expectation of 10.2%.

- Market watchers point out that while this anticipated growth rate paints a compelling story, historical performance has lagged, with a 4.3% annual decline in earnings over five years.

- Investors are left balancing the strong revenue outlook with concerns raised by past negative earnings growth and softer recent margins.

- This growth versus profitability debate is central to how future earnings are viewed amid sector scrutiny.

DCF Fair Value Suggests Material Discount

- With shares trading at $22.53, BUSE sits well below its DCF fair value estimate of $51.05, indicating a perceived undervaluation despite a high P/E ratio.

- The prevailing market perspective notes that this wide gap between DCF valuation and current price keeps the stock in focus for value-oriented investors, but the lack of improvement in profit margins and prior earnings declines temper expectations for a quick rerating.

- This scenario often attracts patient investors looking for recovery potential, though ongoing margin pressure is flagged as a risk.

- The valuation debate is shaped as much by forward-looking growth as by recent softness in returns.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on First Busey's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Although First Busey offers a strong revenue growth outlook, its falling profit margins and persistent earnings declines highlight concerns about consistent performance.

If you want steadier returns through the cycle, use stable growth stocks screener (2121 results) to focus on companies that deliver reliability when others stumble.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BUSE

First Busey

Operates as the bank holding company for Busey Bank that engages in the provision of retail and commercial banking products and services to individual, corporate, institutional, and governmental customers in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives