This article will reflect on the compensation paid to Ignacio Alvarez who has served as CEO of Popular, Inc. (NASDAQ:BPOP) since 2017. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Popular

Comparing Popular, Inc.'s CEO Compensation With the industry

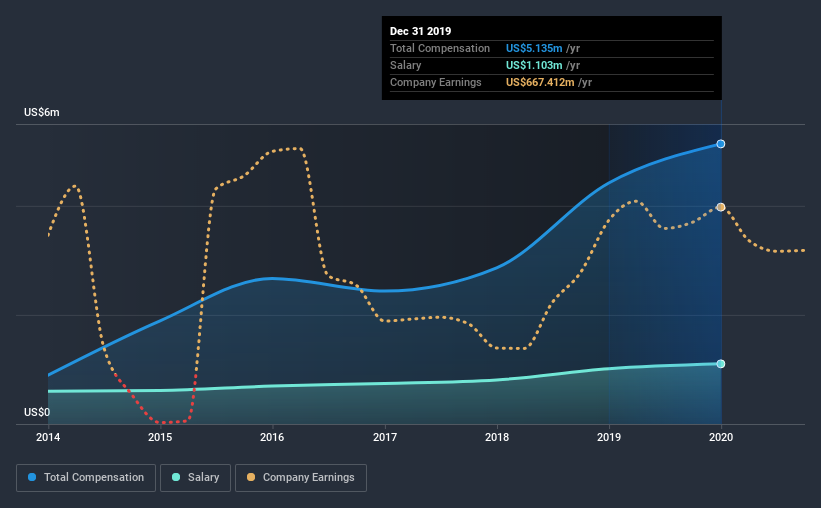

According to our data, Popular, Inc. has a market capitalization of US$4.7b, and paid its CEO total annual compensation worth US$5.1m over the year to December 2019. That's a notable increase of 16% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$1.1m.

On examining similar-sized companies in the industry with market capitalizations between US$2.0b and US$6.4b, we discovered that the median CEO total compensation of that group was US$4.4m. From this we gather that Ignacio Alvarez is paid around the median for CEOs in the industry. Furthermore, Ignacio Alvarez directly owns US$9.6m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | US$1.1m | US$1.0m | 21% |

| Other | US$4.0m | US$3.4m | 79% |

| Total Compensation | US$5.1m | US$4.4m | 100% |

Speaking on an industry level, nearly 43% of total compensation represents salary, while the remainder of 57% is other remuneration. Popular sets aside a smaller share of compensation for salary, in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Popular, Inc.'s Growth

Popular, Inc.'s earnings per share (EPS) grew 42% per year over the last three years. It saw its revenue drop 11% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. While it would be good to see revenue growth, profits matter more in the end. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Popular, Inc. Been A Good Investment?

Boasting a total shareholder return of 74% over three years, Popular, Inc. has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

As we touched on above, Popular, Inc. is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Few would be critical of the leadership, since returns have been juicy and EPS are moving in the right direction. So one could argue that CEO compensation is quite modest, if you consider company performance! In fact, shareholders might even think the CEO deserves a raise as a reward due to the fantastic returns generated.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We did our research and spotted 2 warning signs for Popular that investors should look into moving forward.

Important note: Popular is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade Popular, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:BPOP

Popular

Through its subsidiaries, provides various retail, mortgage, and commercial banking products and services in Puerto Rico, the United States, and the British Virgin Islands.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.