- United States

- /

- Banks

- /

- NasdaqGS:BPOP

Popular (BPOP): Evaluating Valuation After Board Approves New Quarterly Dividend

Reviewed by Simply Wall St

Popular (BPOP) just gave its shareholders a reason to pay attention. The Board of Directors has approved a quarterly cash dividend of $0.75 per share, payable this October. While dividend hikes might seem like routine fare for some companies, these moves often signal management's confidence in the business and its underlying earnings power. For investors wondering about Popular’s momentum, this dividend decision is a clear indication that the bank is focused on rewarding shareholders and sustaining its value proposition in a competitive industry.

This announcement comes at an interesting moment. Over the past year, Popular’s stock has climbed 26%, with a 17% increase in the past three months alone. Long-term holders have also been rewarded, with returns more than doubling over three years and tripling in five. Recent news has highlighted a pattern of calculated growth, and with steady annual gains in both revenue and net income, it appears the company has a solid foundation supporting these dividend payments.

However, there is a question that gives many investors pause: is Popular still trading at an attractive price after this climb, or is the market already factoring in future growth and stability from moves such as this latest dividend increase?

Most Popular Narrative: 9.9% Undervalued

According to community narrative, Popular is currently trading nearly 10% below what analysts consider its fair value. This reflects optimism about future growth drivers that may not be fully captured in the current share price.

Ongoing investments in digital infrastructure, such as the launch of a new digital platform for commercial cash management and branch modernization, are expected to enhance customer acquisition, retention, and operational efficiency. These efforts are seen as supporting long-term revenue and margin expansion.

Curious about what powers this bullish outlook? Discover which future growth levers analysts think could set Popular apart from its peers. The numbers behind this undervaluation might surprise even experienced bank investors. The core story begins with calculated investments in technology and ambitious goals for profit and efficiency. Interested in the metrics everyone is discussing?

Result: Fair Value of $135.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing reliance on Puerto Rico’s local economy and delays in digital banking adoption could present challenges to Popular’s earnings stability in the years ahead.

Find out about the key risks to this Popular narrative.Another View: Discounted Cash Flow Perspective

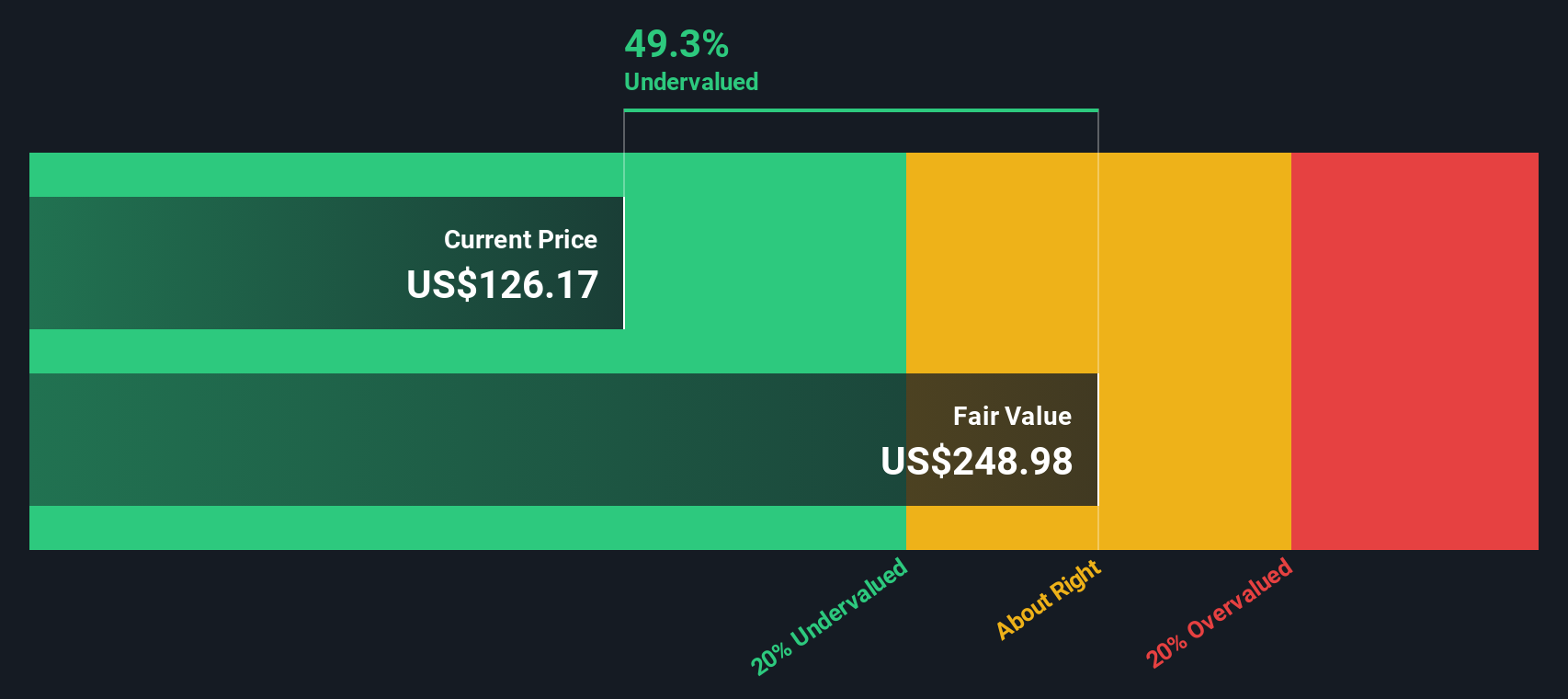

While analyst targets suggest Popular is undervalued, our DCF model offers an even more optimistic scenario and indicates the share price is well below its intrinsic value. Is the market overlooking deeper value, or is there reason to remain cautious?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Popular Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can build your own analysis and perspective in just a few minutes. do it your way.

A great starting point for your Popular research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop searching for their next great opportunity. Keep momentum on your side by zeroing in on winning stocks you might have overlooked. The Simply Wall Street screener gives you an advantage, allowing you to target the types of investments other investors want to find first. Here are three powerful ways to get ahead:

- Spot high-yield companies by uncovering dividend stocks with yields > 3% that could boost your portfolio with reliable income and steady growth potential.

- Jump on tech’s hottest trends and browse AI penny stocks making waves in artificial intelligence, automation, and the next era of digital innovation.

- Zero in on exceptional value by filtering for undervalued stocks based on cash flows and position yourself to capitalize on tomorrow’s winners at the right price today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BPOP

Popular

Through its subsidiaries, provides various retail, mortgage, and commercial banking products and services in Puerto Rico, the United States, and the British Virgin Islands.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives