- United States

- /

- Banks

- /

- NasdaqGS:BOKF

BOK Financial (BOKF): Evaluating Valuation as Regional Credit Concerns Return

Reviewed by Kshitija Bhandaru

Investors kept a close eye on BOK Financial (BOKF) as heightened credit concerns rippled through the regional banking sector. Disclosures of loan issues at peer banks reignited industry-wide worries about deteriorating credit quality and possible loan losses.

See our latest analysis for BOK Financial.

BOK Financial's latest share price of $107.76 reflects how investor nerves over regional bank loan quality have been shaping momentum. After a brief rally, the 1-year total shareholder return stands at -3.2%, while the 3-year figure is a robust 21%. Performance has softened lately as sector-wide credit concerns resurface, but the longer-term trajectory still points to solid gains for committed shareholders.

If you’re searching for your next standout idea beyond banks, now could be the perfect moment to broaden your scope and discover fast growing stocks with high insider ownership

With BOK Financial trading below analyst targets and sector jitters weighing on sentiment, the real question is whether the stock’s current valuation offers an undervalued entry point or if the market has already accounted for future growth.

Most Popular Narrative: 8.4% Undervalued

BOK Financial's widely followed narrative sets its fair value at $117.60, which is about 8% above the latest closing price of $107.76. This suggests analyst assumptions are more optimistic than the market's current stance, and investors may be underestimating the company's momentum.

"BOK Financial's strategic expansion into fast-growing markets like Texas and Arizona, alongside talent acquisition in key markets, positions the company to capitalize on secular migration and economic trends, propelling above-peer loan and revenue growth."

Want to know what powers that valuation? The narrative rests on a future profit playbook, bold margin assumptions, and a growth rate that bucks the industry trend. Which variables tilt the math in favor of this price target? Dig in to uncover the full story behind the calculation.

Result: Fair Value of $117.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated exposure to commercial real estate and heavy reliance on growth in specific regions could challenge BOK Financial’s bullish outlook if local conditions shift.

Find out about the key risks to this BOK Financial narrative.

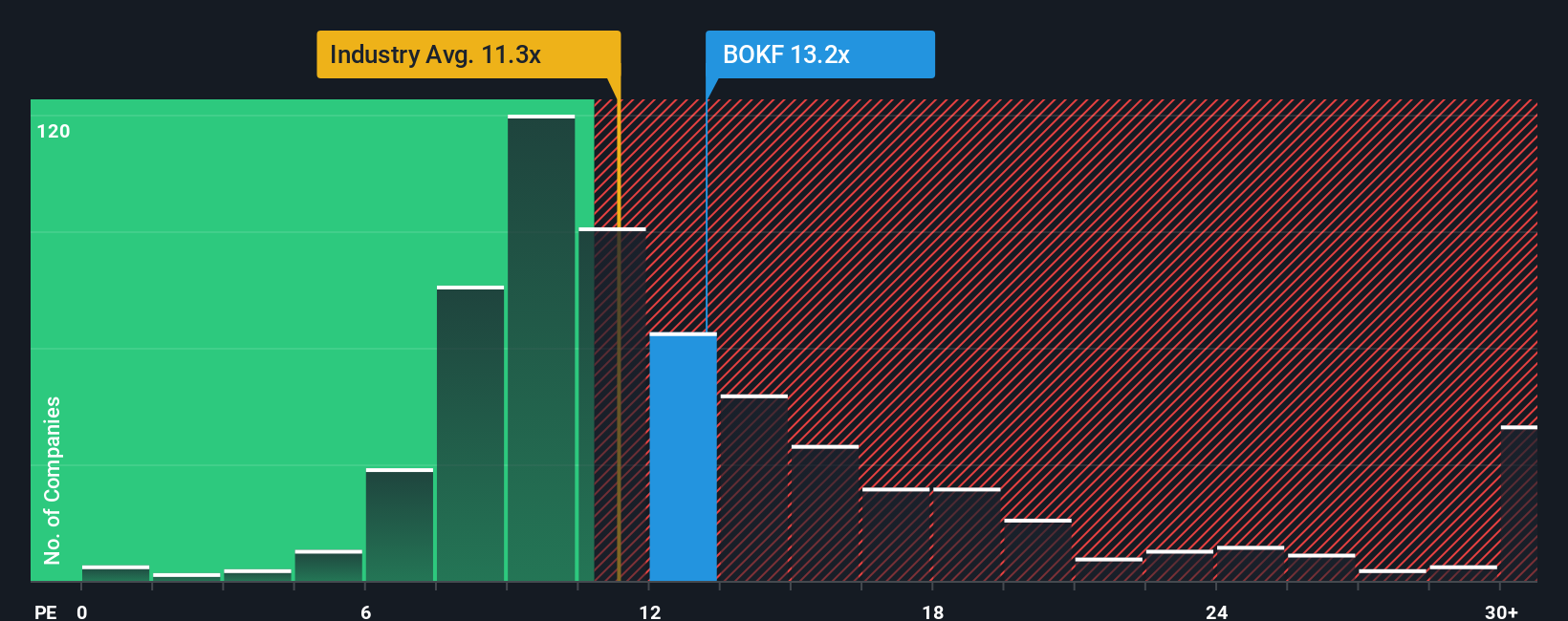

Another View: Market Ratios Tell a Different Story

Looking through the lens of price-to-earnings, BOK Financial appears expensive compared to both the US Banks industry and its direct peers. Its ratio is 12.5x, above the industry’s 11.6x and the peer average of 11.3x. It is also slightly over its calculated fair ratio of 12.2x. Does this suggest less upside than the fair value narrative implies?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BOK Financial Narrative

If you have your own perspective or want to dig deeper into the numbers, crafting a personalized view takes just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding BOK Financial.

Looking for More Smart Investment Opportunities?

Don't limit your gains to a single sector when there are countless innovative stocks just waiting to be put on your radar. Seize your edge and find the companies making big moves in tomorrow’s markets before everyone else.

- Capture growth momentum by scanning these 24 AI penny stocks, which are at the forefront of artificial intelligence breakthroughs.

- Secure steady income streams by reviewing these 20 dividend stocks with yields > 3% that boast yields above 3% for consistent returns.

- Stay ahead of market cycles and spot hidden gems among these 868 undervalued stocks based on cash flows that are primed for upward valuation re-rates based on solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BOK Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BOKF

BOK Financial

Operates as the financial holding company for BOKF, NA that provides various financial products and services in Oklahoma, Texas, New Mexico, Northwest Arkansas, Colorado, Arizona, and Kansas/Missouri.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives