- United States

- /

- Banks

- /

- NasdaqGS:BOKF

BOK Financial (BOKF) Earnings Up 14.2%, Margin Strength Reinforces Bullish Narratives

Reviewed by Simply Wall St

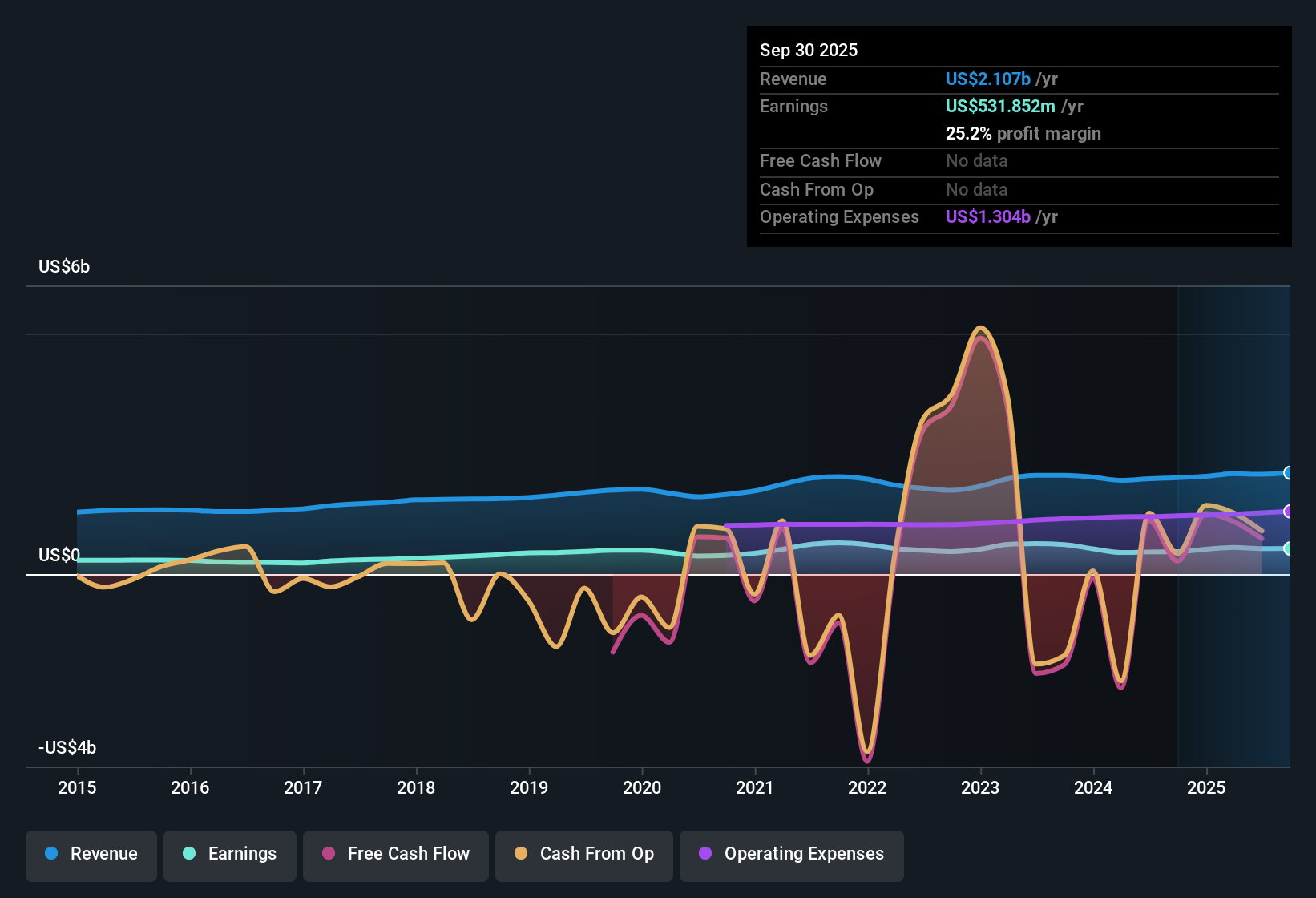

BOK Financial (BOKF) delivered robust results, with earnings climbing 14.2% over the past year, far surpassing its 5-year annual average growth rate of just 0.2%. Net profit margins reached 25.2%, an improvement over last year’s 23.2%, and the company is noted for high-quality earnings. While the current share price of $106.52 trails some fair value estimates, the high margin profile and steady operational performance set the tone for investor expectations as the market weighs slower forecasted growth and a richer valuation multiple.

See our full analysis for BOK Financial.Next up, we’ll dive into how these earnings stack up against the broader narratives that drive BOK Financial’s market story. Here we examine where expectations and reality might converge or diverge.

See what the community is saying about BOK Financial

Asset Mix Shapes Outlook at 25.2% Margins

- With net profit margins improving to 25.2%, BOK Financial continues to post higher quality earnings than many peer banks, showing a strong ability to generate profit from revenue even as growth moderates.

- Under the analysts' consensus view, earnings durability relies on diversified fee income and a broad wealth management platform. However, there is underlying tension because the company’s exposure to commercial real estate and regional economic shifts could squeeze margins and introduce volatility in future profit.

- Consensus narrative notes that while robust wealth management and fee income streams provide stability, dependence on the Midwest and Southwest makes results sensitive to regional slowdowns.

- Margin expansion supports optimism regarding operational efficiency. Still, the portfolio’s CRE concentration remains a key focus for longer-term earnings stability.

Curious how analysts see BOK Financial's position in the evolving regional banking landscape? 📊 Read the full BOK Financial Consensus Narrative.

Forecasted Growth Trails U.S. Market Pace

- Looking ahead, consensus estimates project annual earnings growth of 3.8% and revenue growth of 5.4% for BOK Financial. Both of these figures lag behind the average growth rates expected for the broader U.S. market, signaling more modest momentum ahead.

- The consensus narrative highlights that accelerated expansion into Sun Belt and Midwest markets and digital banking ambitions are intended to keep earnings resilient. These efforts may only partially offset industry pressure from slowing regional economies and increased competition.

- Analysts expect profit margins to drift lower from 25.6% to 23.5% over the next three years, reflecting anticipated cost pressures and normalization of growth.

- Broader adoption of technology is expected to produce efficiencies; however, margin compression and higher operating costs are identified as limiting factors despite growth-oriented investments.

Valuation Sits Above Peers Despite Discount to DCF Fair Value

- Shares currently trade at $106.52, putting BOK Financial at a price-to-earnings multiple of 12.7x, which is above both its peer group average (11.6x) and the broader U.S. Banks industry (11.3x). At the same time, the share price remains below the DCF fair value estimate of $153.36, creating a nuanced value proposition.

- The consensus narrative presents the view that a premium valuation could be justified if the company’s fee income and expansion strategy sustain outperformance. However, the modest 4.8% gap between share price and the analyst target of 120.2 shapes the upside, suggesting the market already prices in much of the expected growth.

- For the share price to reach consensus targets, BOK Financial would need to deliver on margin and revenue expectations, while also commanding a future PE of 15.3x, which is higher than current sector norms.

- The limited spread between trading price, DCF fair value, and analyst prices means investors may face limited near-term re-rating unless growth outpaces these projections.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for BOK Financial on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from another angle? Take a couple of minutes to craft and share your take on the BOK Financial narrative. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding BOK Financial.

See What Else Is Out There

BOK Financial’s below-market growth outlook and margin pressure highlight concerns about its ability to sustain expansion and deliver outsized returns in the future.

If steady growth is your priority, use stable growth stocks screener (2088 results) and focus your search on companies consistently delivering strong results regardless of market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BOK Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BOKF

BOK Financial

Operates as the financial holding company for BOKF, NA that provides various financial products and services in Oklahoma, Texas, New Mexico, Northwest Arkansas, Colorado, Arizona, and Kansas/Missouri.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives