- United States

- /

- Banks

- /

- NasdaqCM:BMRC

Bank of Marin (BMRC) Profitability Turnaround Reinforces Bullish Growth Narratives Despite Premium Valuation

Reviewed by Simply Wall St

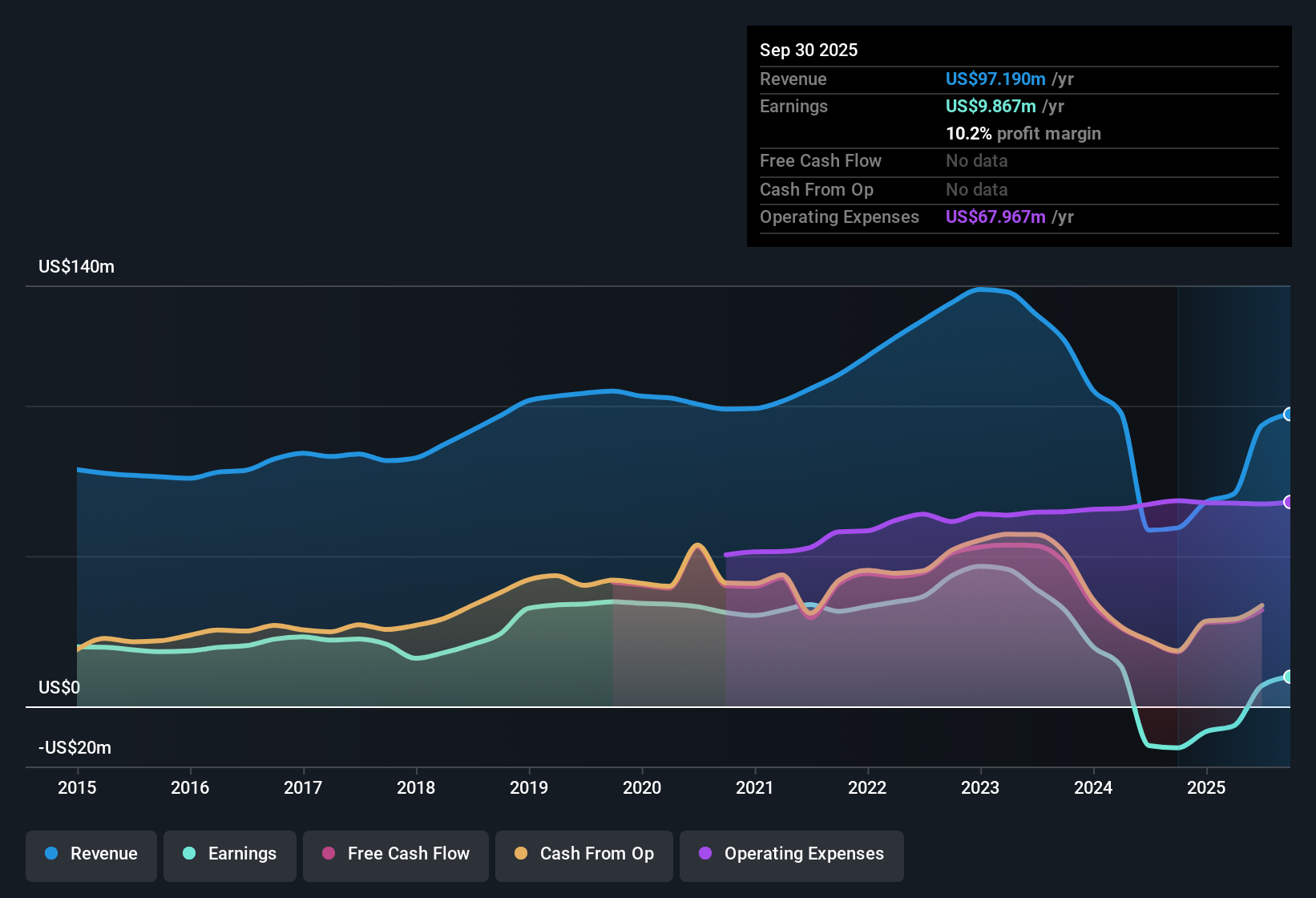

Bank of Marin Bancorp (BMRC) has swung to profitability, reporting high-quality earnings and forecasting EPS growth of 60.57% per year. This projection not only outpaces the company's own five-year average, which saw a 34% annual decline, but also surpasses the broader US market's expected 15.5% annual earnings growth. With profits newly established, BMRC’s stock now trades at $25.66, commanding a price-to-earnings ratio of 59.3x, notably higher than both industry and peer averages. Investors are focused on whether this rapid forecasted growth can continue, and if the premium valuation is justified.

See our full analysis for Bank of Marin Bancorp.Now, we will see how these latest numbers measure up against the most widely followed narratives and expectations in the market. Some long-held views might stand validated, while others could face new questions.

See what the community is saying about Bank of Marin Bancorp

Margin Expansion Targets: Profit Margins Forecast to Reach 45.8%

- Analysts expect profit margins to grow from 7.4% today up to 45.8% over the next three years, reflecting significant operational efficiency gains anticipated through investments in digital banking and technology upgrades.

- According to the analysts' consensus view, these margin gains are anchored to targeted expansion in growth markets like Sacramento and continued digital transformation.

- Consensus narrative highlights that modernization is expected to drive lower long-term costs, while capital management supports steady earnings.

- However, the margin outlook assumes successful execution of these strategies in the face of industry competition and rising compliance costs.

- Curious how margins might impact longer-term upside? See what other investors expect in our full consensus deep-dive. 📊 Read the full Bank of Marin Bancorp Consensus Narrative.

Revenue Growth Outlook: 25.6% Annual Increase Projected

- Analysts forecast revenue will grow by 25.6% each year for the next three years, based on increased loan origination capacity and investments in client engagement technologies.

- Consensus narrative calls out that expanding into new markets and tapping digital services should both support higher revenue and reduce reliance on the core Bay Area banking footprint.

- This growth rate is notably above the broader US market forecast for earnings growth and relies on robust demand, successful technology implementation, and disciplined expense management.

- Analysts also caution that this top-line surge depends on maintaining asset quality and competitive position as new fintech entrants challenge traditional banks.

Premium Valuation: Shares Trading 46% Above DCF Fair Value

- Bank of Marin Bancorp's share price sits at $25.66, which is around 46% above its DCF fair value of $17.59, and means it trades at a high PE multiple of 59.3x versus the industry’s 11.2x.

- Consensus narrative suggests investors are paying up for the forecasted growth, but warns this leaves limited margin for error if targets are missed.

- The price-to-earnings premium reflects optimism about rapid margin and revenue gains, yet also amplifies exposure to risks like credit concentration and slower digital adoption.

- This valuation gap sets a high bar for outperformance and underscores the importance of monitoring execution versus ambitious growth assumptions.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bank of Marin Bancorp on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you have a unique take on the numbers? Share your interpretation and shape your own perspective in just a few minutes. Do it your way

A great starting point for your Bank of Marin Bancorp research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While Bank of Marin Bancorp’s rapid growth outlook is impressive, the shares trade at a substantial premium and leave little room for disappointment if targets are missed.

If you want stocks priced more reasonably based on their fundamentals, check out these 875 undervalued stocks based on cash flows so you don’t pay top dollar for growth that may not materialize.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Marin Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BMRC

Bank of Marin Bancorp

Operates as the holding company for Bank of Marin that provides a range of financial services to small to medium-sized businesses, not-for-profit organizations, and commercial real estate investors in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives