- United States

- /

- Diversified Financial

- /

- NYSE:GHLD

Three US Growth Companies With High Insider Ownership And 56% Earnings Growth

Reviewed by Simply Wall St

As the U.S. market shows signs of recovery with major indices like the S&P 500 and Nasdaq posting gains, investors are keenly watching for opportunities that align with current economic dynamics. In this context, growth companies with high insider ownership can be particularly compelling, as they often signal strong confidence from those who know the company best—its leaders and founders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 25.2% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.4% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 34% |

| Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 39.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.5% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 94.7% |

We're going to check out a few of the best picks from our screener tool.

Burke & Herbert Financial Services (NasdaqCM:BHRB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Burke & Herbert Financial Services Corp., with a market cap of $873.21 million, serves as the holding company for Burke & Herbert Bank & Trust Company, offering a range of community banking products and services in Virginia and Maryland.

Operations: The company generates its revenue primarily from community banking, totaling $107.52 million.

Insider Ownership: 12.5%

Earnings Growth Forecast: 57.0% p.a.

Burke & Herbert Financial Services has seen substantial insider buying in the past three months, indicating strong confidence from those closest to the company. Despite this, shareholders have experienced significant dilution over the past year. The company's earnings are expected to grow by 57% annually, outpacing the US market forecast of 14.7%. However, its profit margins have decreased from 33% to 19% within a year. Recently, they announced an increase in authorized shares from 20 million to 40 million at their AGM, potentially preparing for future growth initiatives or capital needs.

- Delve into the full analysis future growth report here for a deeper understanding of Burke & Herbert Financial Services.

- Our expertly prepared valuation report Burke & Herbert Financial Services implies its share price may be too high.

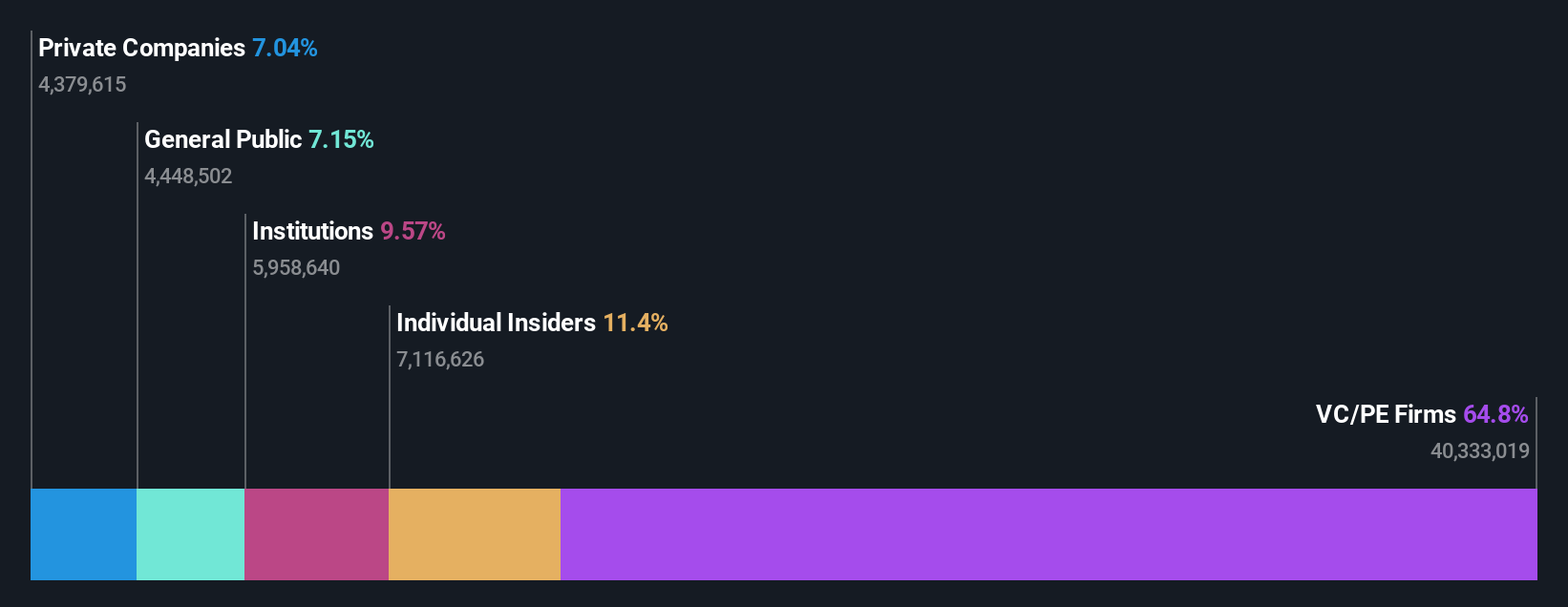

Capital Bancorp (NasdaqGS:CBNK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Capital Bancorp, Inc. serves as the bank holding company for Capital Bank, N.A., with a market capitalization of approximately $325.94 million.

Operations: Capital Bancorp, Inc.'s revenue is generated primarily through its segments: Opensky at $70.61 million, Corporate at $3.04 million, Commercial Bank at $77.43 million, and Capital Bank Home Loans (CBHL) at $5.18 million.

Insider Ownership: 35%

Earnings Growth Forecast: 27.5% p.a.

Capital Bancorp has demonstrated robust financial performance with a recent increase in quarterly dividends to US$0.10 per share, reflecting strong earnings and capital position. The company reported a 27.52% expected annual growth in earnings, outpacing the US market forecast of 14.7%. Additionally, revenue is projected to grow by 23% annually, significantly above the market average of 8.6%. These figures are complemented by strategic executive appointments aimed at enhancing operational efficiency and market reach, signaling a proactive approach to growth amidst high insider ownership.

- Click here to discover the nuances of Capital Bancorp with our detailed analytical future growth report.

- Our valuation report unveils the possibility Capital Bancorp's shares may be trading at a discount.

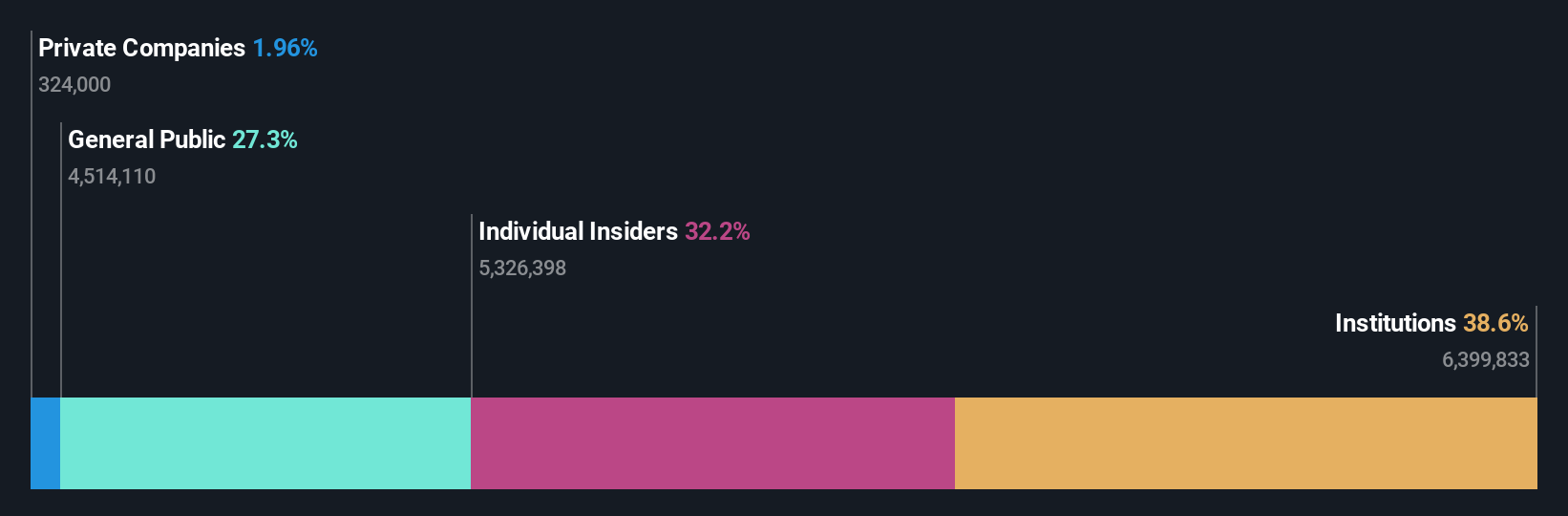

Guild Holdings (NYSE:GHLD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guild Holdings Company, operating in the United States, focuses on originating, selling, and servicing residential mortgage loans with a market capitalization of approximately $868.02 million.

Operations: The company generates revenue primarily through its loan origination and servicing segments, with $555.18 million from origination and $190.68 million from servicing.

Insider Ownership: 11.7%

Earnings Growth Forecast: 36.6% p.a.

Guild Holdings, with substantial insider buying in the past three months, reflects strong internal confidence despite a challenging environment marked by low profit margins and insufficient earnings coverage for interest payments. The company is trading at 86.1% below its estimated fair value, suggesting potential undervaluation. Recent innovations like the GuildGPT AI system demonstrate Guild's commitment to leveraging technology to enhance efficiency and service quality, potentially driving future revenue growth which is expected to outpace the US market significantly.

- Click to explore a detailed breakdown of our findings in Guild Holdings' earnings growth report.

- Our valuation report here indicates Guild Holdings may be overvalued.

Next Steps

- Navigate through the entire inventory of 185 Fast Growing US Companies With High Insider Ownership here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GHLD

Guild Holdings

Guild Holdings Company originates, sells, and services residential mortgage loans in the United States.

Very undervalued with high growth potential.