- United States

- /

- Diversified Financial

- /

- NYSE:GHLD

3 US Growth Companies With High Insider Ownership And Up To 76% Revenue Growth

Reviewed by Simply Wall St

As the S&P 500 and Nasdaq Composite recently snapped their winning streaks, investors are closely monitoring market movements and economic indicators. In this environment, growth companies with high insider ownership can offer unique insights into potential revenue expansion, particularly those demonstrating up to 76% revenue growth.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.6% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.6% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.7% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.1% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 32.3% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.9% |

| On Holding (NYSE:ONON) | 28.4% | 24.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.9% |

| BBB Foods (NYSE:TBBB) | 22.9% | 70.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Burke & Herbert Financial Services (NasdaqCM:BHRB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Burke & Herbert Financial Services Corp. is the bank holding company for Burke & Herbert Bank & Trust Company, offering community banking products and services in Virginia and Maryland, with a market cap of $946.02 million.

Operations: Burke & Herbert Financial Services Corp. generates $124.67 million in revenue from its community banking products and services in Virginia and Maryland.

Insider Ownership: 12.4%

Revenue Growth Forecast: 57.0% p.a.

Burke & Herbert Financial Services has seen substantial insider buying over the past three months, indicating confidence in its growth potential. Despite significant shareholder dilution in the past year, BHRB is forecasted to achieve high revenue growth of 57% per year and earnings growth of 166.3% per year, outpacing market averages. However, recent financial results show a net loss and an unsustainable dividend payout, raising concerns about short-term profitability despite long-term growth prospects.

- Dive into the specifics of Burke & Herbert Financial Services here with our thorough growth forecast report.

- Our valuation report unveils the possibility Burke & Herbert Financial Services' shares may be trading at a premium.

Contango Ore (NYSEAM:CTGO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Contango Ore, Inc. is an exploration stage company focused on the exploration and development of mineral properties in Alaska, with a market cap of $256.39 million.

Operations: Contango Ore, Inc. does not currently report any revenue segments as it is still in the exploration stage.

Insider Ownership: 30.7%

Revenue Growth Forecast: 76.2% p.a.

Contango Ore is poised for significant growth, with earnings forecasted to increase by 119.68% per year and revenue expected to rise by 76.2% annually, surpassing US market averages. Despite recent financial losses and shareholder dilution, the company’s high insider ownership aligns with its promising outlook. Recent successful gold production from the Manh Choh project exceeded expectations, reinforcing confidence in future profitability as Contango aims to produce up to 40,000 ounces of gold in 2024.

- Click here and access our complete growth analysis report to understand the dynamics of Contango Ore.

- Insights from our recent valuation report point to the potential undervaluation of Contango Ore shares in the market.

Guild Holdings (NYSE:GHLD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guild Holdings Company originates, sells, and services residential mortgage loans in the United States with a market cap of approximately $990.16 million.

Operations: The company's revenue segments include $623.64 million from origination and $173.23 million from servicing residential mortgage loans in the United States.

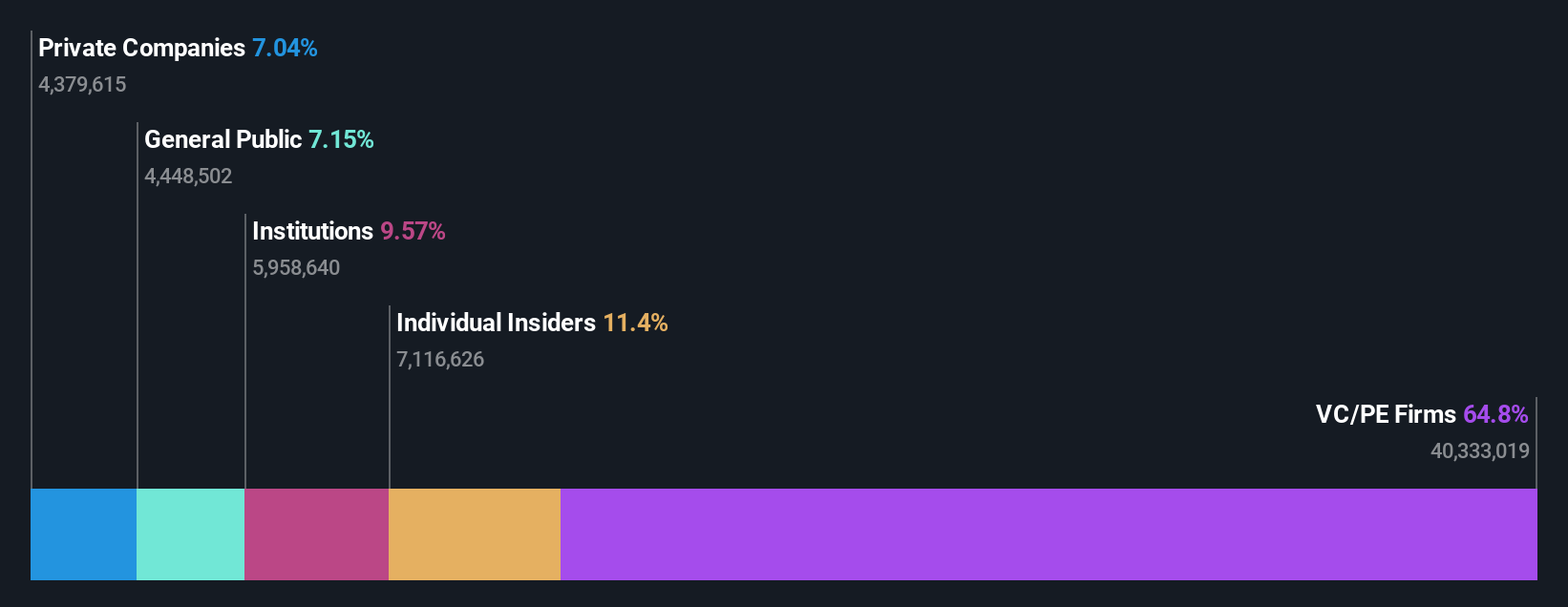

Insider Ownership: 11.5%

Revenue Growth Forecast: 17.8% p.a.

Guild Holdings demonstrates strong potential as a growth company with high insider ownership. Recent earnings reports show revenue of US$285.69 million for Q2 2024, up from US$236.81 million the previous year, and net income of US$37.58 million, slightly higher than last year's US$36.94 million. The introduction of GuildGPT, an AI tool enhancing employee efficiency, marks a significant technological advancement. Forecasted annual profit growth at 32.8% and substantial insider buying bolster investor confidence despite lower profit margins and interest coverage concerns.

- Click to explore a detailed breakdown of our findings in Guild Holdings' earnings growth report.

- Our expertly prepared valuation report Guild Holdings implies its share price may be too high.

Turning Ideas Into Actions

- Discover the full array of 176 Fast Growing US Companies With High Insider Ownership right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GHLD

Guild Holdings

Guild Holdings Company originates, sells, and services residential mortgage loans in the United States.

Very undervalued with high growth potential.