- United States

- /

- Banks

- /

- NasdaqCM:BFC

Will Higher Net Interest Income Redefine Bank First's (BFC) Path to Sustained Profitability?

Reviewed by Sasha Jovanovic

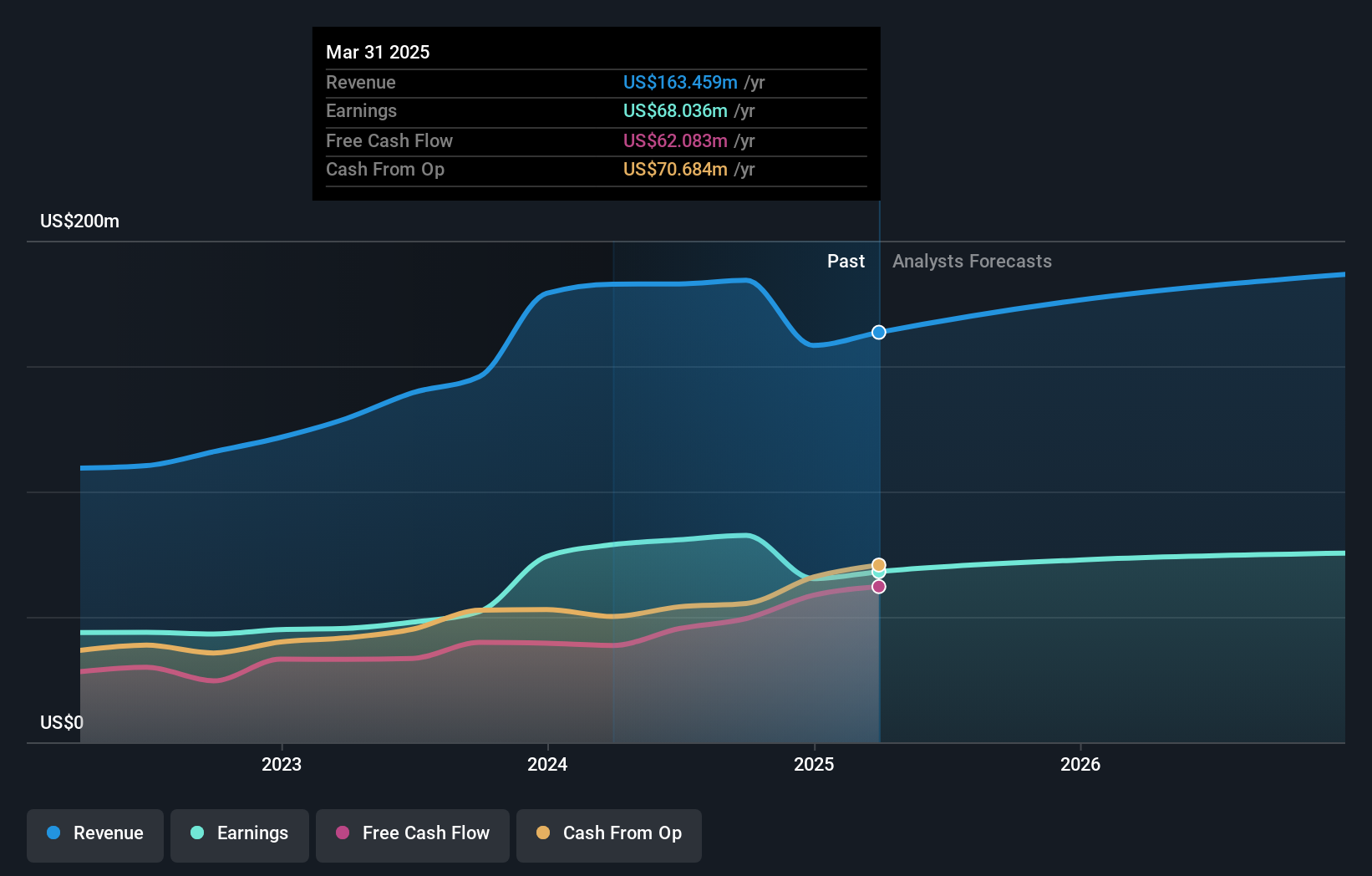

- Bank First Corporation announced its third quarter and nine-month earnings for the period ended September 30, 2025, reporting increases in both net interest income and net income versus the previous year.

- The company’s financial results indicate continued improvement in profitability with higher basic and diluted earnings per share from continuing operations for both the quarter and year-to-date figures.

- We’ll explore how rising net interest income may shape Bank First’s overall investment narrative moving forward.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Bank First's Investment Narrative?

For anyone interested in Bank First, the investment thesis hinges on whether the company can sustain its pattern of rising net interest income and profit, as highlighted in the latest third quarter earnings release. The new results show another period of earnings growth, supporting earlier expectations of strong revenue and profit expansion. These numbers could ease near-term concerns about the negative earnings growth seen in previous periods and confirm that the most important catalyst, a rebound in core banking profitability, remains intact. At the same time, risks tied to a relatively high price-to-earnings ratio and a modest return on equity have not disappeared, warranting attention as the share price response to positive news was muted. The latest earnings help clarify the direction, but key financial and valuation risks are still part of the picture.

But that high price-to-earnings ratio remains an important risk investors should keep in mind. Despite retreating, Bank First's shares might still be trading 11% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on Bank First - why the stock might be worth over 3x more than the current price!

Build Your Own Bank First Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bank First research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Bank First research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bank First's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank First might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BFC

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives