- United States

- /

- Banks

- /

- NasdaqCM:BFC

Share Buyback and Q2 Results Could Be a Game Changer for Bank First (BFC)

Reviewed by Simply Wall St

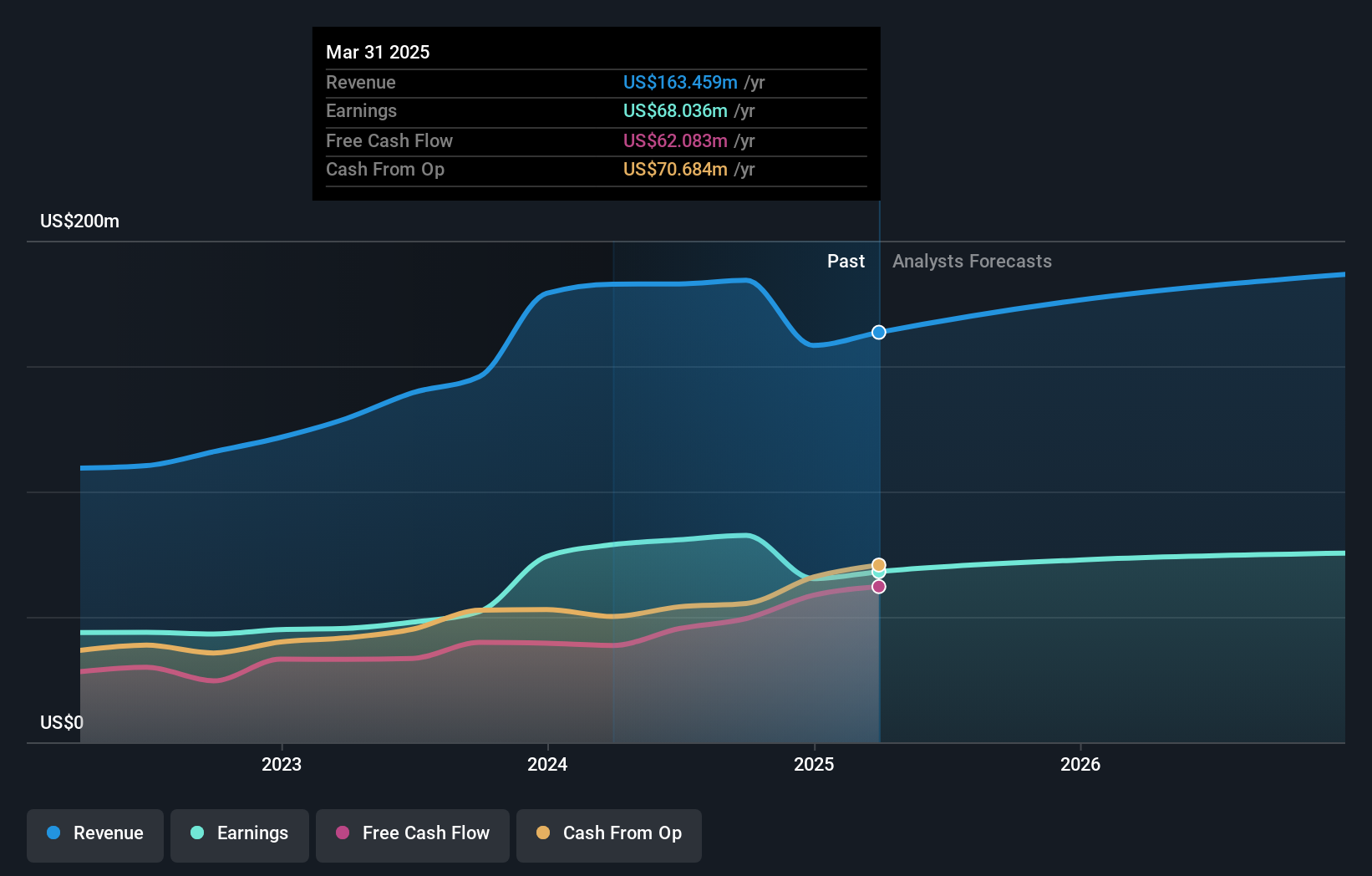

- Bank First Corporation recently announced its second quarter 2025 results, reporting year-over-year increases in net interest income, net income, and earnings per share, while completing a buyback of 191,753 shares for US$20.6 million.

- Although the results missed analyst estimates, the company’s ongoing share repurchase program and forecasts for future revenue growth appeared to bolster investor confidence.

- We'll explore how Bank First's continued share buybacks influence the company’s investment narrative in light of recent earnings results.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Bank First's Investment Narrative?

To genuinely believe in Bank First as a shareholder right now, I think you need to back its ability to grow steadily despite a pace that trails broader market peers. The company’s consistent profit growth and recent string of dividends and buybacks have underpinned a track record of rewarding shareholders, but there’s no escaping that the latest quarterly results missed analyst forecasts. Even so, shares ticked higher after the announcement, signaling that ongoing share repurchases and guidance on future revenue are more influential short-term catalysts than one soft quarter. For now, the buyback seems to have blunted most immediate downside risk, and with shares still trading below the consensus fair value, the bull case rests on management’s capital allocation. The muted revenue growth outlook and a relatively high valuation, though, remain potential headwinds if growth expectations reset lower.

But there are some concerns about how sustainable that growth path really is. Bank First's shares have been on the rise but are still potentially undervalued by 17%. Find out what it's worth.Exploring Other Perspectives

Build Your Own Bank First Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bank First research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Bank First research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bank First's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank First might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BFC

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives