- United States

- /

- Banks

- /

- NasdaqCM:BFC

Bank First (BFC): Forecast Earnings Growth Outpaces Market, Margin Dip Brings Narrative Shift

Reviewed by Simply Wall St

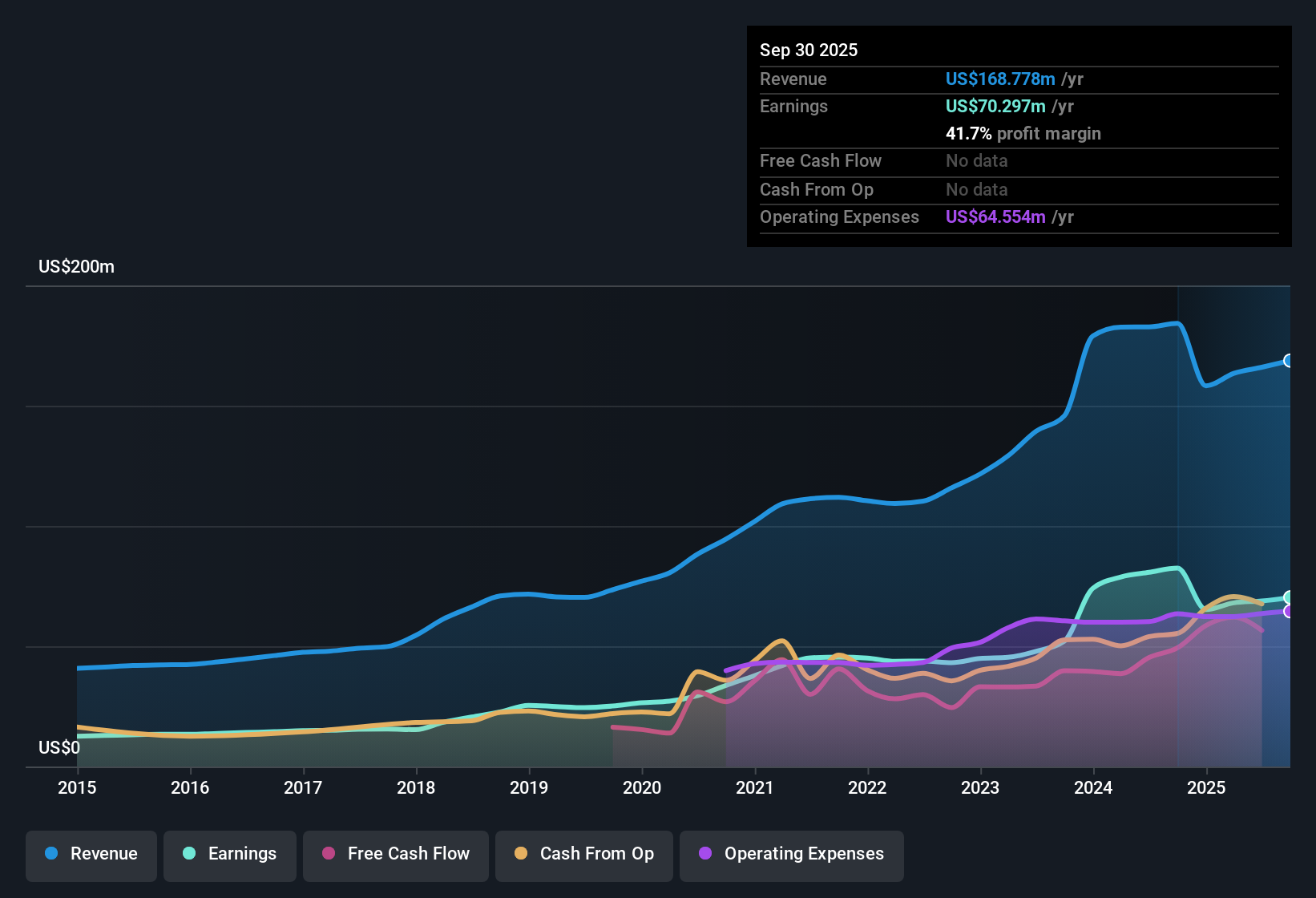

Bank First (BFC) reported that earnings are set to grow at an annual rate of nearly 24% over the next three years, with revenue expected to expand by 23.6% per year. Both figures are well ahead of broad US market trends. While the net profit margin stands at 41.5%, slightly down from last year’s 44.2%, the company continues to be recognized for high quality earnings, having achieved 16.4% annual earnings growth over the past five years. Investors are weighing these robust growth projections against a share price of $132.19, which currently trades below the estimated fair value but at a premium price-to-earnings ratio relative to peers.

See our full analysis for Bank First.The next step is to see how these results compare against prevailing narratives, considering where the numbers confirm expectations and where the stories might shift.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Eases, Still High Quality

- Bank First’s net profit margin of 41.5% remains exceptionally strong by industry standards, though it has dipped from last year’s 44.2%.

- Management’s focus on preserving high quality earnings has delivered a five-year annual earnings growth rate of 16.4%, which stands out against peers.

- That margin slippage adds nuance to the growth story, as it signals even top-performing banks must manage pressures on profitability alongside expansion.

- Strong earnings quality, demonstrated by consistent multi-year growth, supports investors who prioritize stability, but watching for continued margin changes will be key.

P/E Ratio Far Above Peers

- The company’s price-to-earnings ratio is 18.9x, sitting well above both the US banks industry average of 11.2x and its peer group average of 11.4x.

- Even with that premium valuation, the growth outlook may support bullish hopes for future return potential.

- This elevated multiple is only justified if Bank First maintains its growth lead, so bulls will want to see continued outperformance versus the market’s lower expectations for the banking sector.

- Trading at a steeper P/E means market confidence is already priced in. This raises the stakes for each results period to confirm strong delivery and not disappoint.

Share Price Below DCF Fair Value

- Bank First shares trade at $132.19, which is currently below its DCF fair value estimate of $155.78, despite being at a valuation premium to peers.

- This discount to fair value, combined with rapid growth forecasts, could attract investors seeking upside, yet premium multiples versus the industry underline the importance of monitoring future performance.

- Investors may weigh the appeal of a below-DCF fair value entry point against peer-relative caution signaled by the higher P/E ratio.

- Continued delivery on projected growth remains crucial for the stock to close the gap to fair value and justify its valuation premium.

Here's what long-term focused investors should consider as Bank First continues to balance quality growth and valuation: See our latest analysis for Bank First.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Bank First's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Bank First’s rapid growth justifies a premium, shrinking margins and reliance on continued outperformance make its valuation riskier than many peers.

If you want to focus on companies that currently trade at more reasonable prices, our these 875 undervalued stocks based on cash flows is the fastest way to spot opportunities where upside is more strongly supported by valuation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank First might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BFC

Flawless balance sheet with high growth potential and pays a dividend.

Market Insights

Community Narratives