- United States

- /

- Banks

- /

- NasdaqGS:BANF

Should You Be Adding BancFirst (NASDAQ:BANF) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like BancFirst (NASDAQ:BANF), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for BancFirst

How Fast Is BancFirst Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. BancFirst managed to grow EPS by 12% per year, over three years. That's a good rate of growth, if it can be sustained.

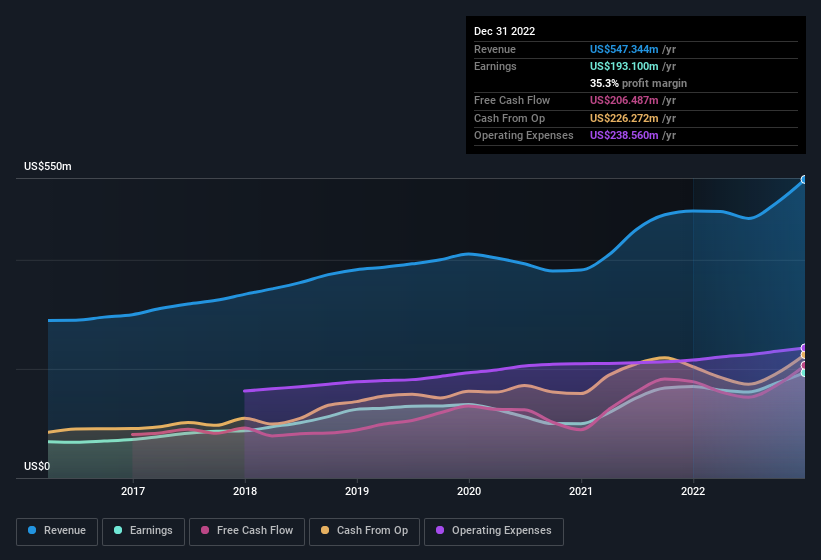

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Our analysis has highlighted that BancFirst's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. EBIT margins for BancFirst remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 12% to US$547m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of BancFirst's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are BancFirst Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So as you can imagine, the fact that BancFirst insiders own a significant number of shares certainly is appealing. In fact, they own 35% of the shares, making insiders a very influential shareholder group. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. At the current share price, that insider holding is worth a staggering US$1.0b. That means they have plenty of their own capital riding on the performance of the business!

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. A brief analysis of the CEO compensation suggests they are. Our analysis has discovered that the median total compensation for the CEOs of companies like BancFirst with market caps between US$2.0b and US$6.4b is about US$6.5m.

BancFirst's CEO took home a total compensation package of US$797k in the year prior to December 2021. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add BancFirst To Your Watchlist?

One positive for BancFirst is that it is growing EPS. That's nice to see. Earnings growth might be the main attraction for BancFirst, but the fun does not stop there. With company insiders aligning themselves considerably with the company's success and modest CEO compensation, there's no arguments that this is a stock worth looking into. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if BancFirst is trading on a high P/E or a low P/E, relative to its industry.

Although BancFirst certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if BancFirst might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BANF

BancFirst

Operates as the bank holding company for BancFirst that provides a range of commercial banking services to retail customers, and small to medium-sized businesses in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives