- United States

- /

- Banks

- /

- NasdaqGS:BANF

BancFirst (BANF): Assessing Valuation After Reporting Higher Net Income and EPS Growth

Reviewed by Simply Wall St

BancFirst (BANF) just released its third quarter numbers, showing an increase in both net income and earnings per share for the recent quarter and nine-month period. This uptick in profitability is likely to catch investor attention.

See our latest analysis for BancFirst.

BancFirst’s improved profitability in the latest quarter has caught investor attention, but the stock’s momentum has cooled recently with a 1-month share price return of -13.9%. Still, long-term investors have been rewarded, as the total shareholder return over the past five years stands at an impressive 178%.

If this kind of banking resilience has you thinking bigger, it might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership.

With shares pulling back despite strong profit growth, is BancFirst now trading at a discount, or has the market already factored in the company’s future prospects? Is there a real buying opportunity here?

Price-to-Earnings of 15.8x: Is it justified?

BancFirst currently trades at a price-to-earnings (P/E) ratio of 15.8x, notably higher than peers in the US banks sector as well as its own fair P/E.

The P/E ratio measures how much investors are willing to pay for each dollar of a company's earnings. For banks, it reflects market expectations for profit growth, risk, and relative quality.

BancFirst's premium P/E signals the market is paying up for current earnings. However, this is well above both the US Banks industry average of 11.2x and the estimated fair value ratio of 11.3x. This suggests the stock may be priced for outperformance, unless future profit growth or quality distinguishes it further from peers.

Explore the SWS fair ratio for BancFirst

Result: Price-to-Earnings of 15.8x (OVERVALUED)

However, ongoing weak annual net income growth and recent underperformance in the share price could present challenges to the company’s strong valuation in the coming quarters.

Find out about the key risks to this BancFirst narrative.

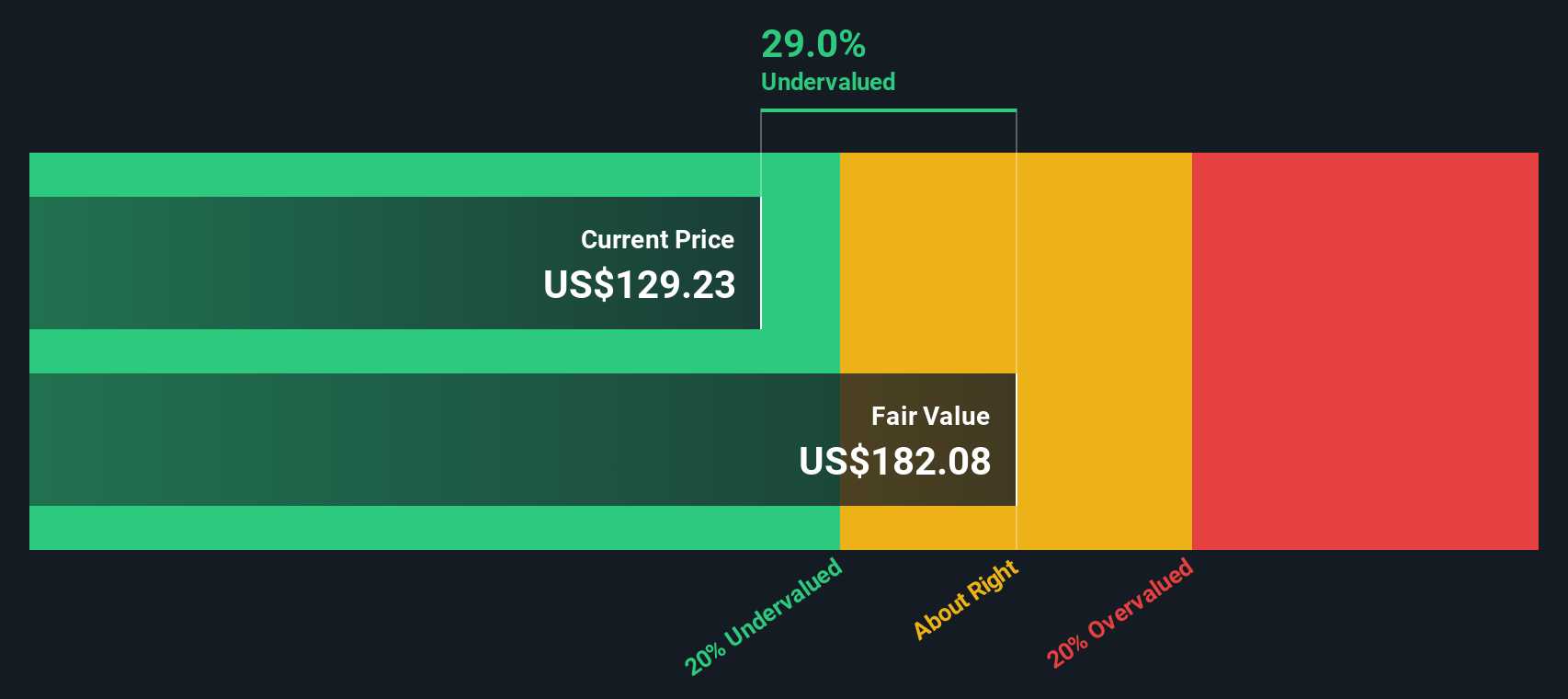

Another View: Discounted Cash Flow Suggests Undervaluation

While BancFirst appears overvalued when looking at its current P/E ratio, our SWS DCF model tells a very different story. According to this approach, shares are trading about 38% below their estimated fair value. This suggests the market may be underestimating BancFirst’s potential. Should investors trust the lower multiple, or is the DCF pointing to a hidden bargain?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BancFirst for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BancFirst Narrative

If you have a different perspective or want to dig deeper into the numbers yourself, shaping your own view takes less than three minutes, so why not Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding BancFirst.

Looking for more investment ideas?

The strongest portfolios are built on smart choices. Don’t miss your chance to get ahead and expand your search for winning stocks with these unique opportunities:

- Tap into high recurring yield by targeting stable companies offering attractive payouts with these 17 dividend stocks with yields > 3%.

- Catch the next wave of disruptive innovation by targeting market leaders in artificial intelligence through these 27 AI penny stocks.

- Secure solid foundations for your portfolio with established businesses trading below their intrinsic value via these 877 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BancFirst might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BANF

BancFirst

Operates as the bank holding company for BancFirst that provides a range of commercial banking services to retail customers, and small to medium-sized businesses in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives