- United States

- /

- Banks

- /

- NasdaqCM:ATLO

Ames National (ATLO): Profit Margin Rises to 23.7%, Challenging Weak Earnings Narrative

Reviewed by Simply Wall St

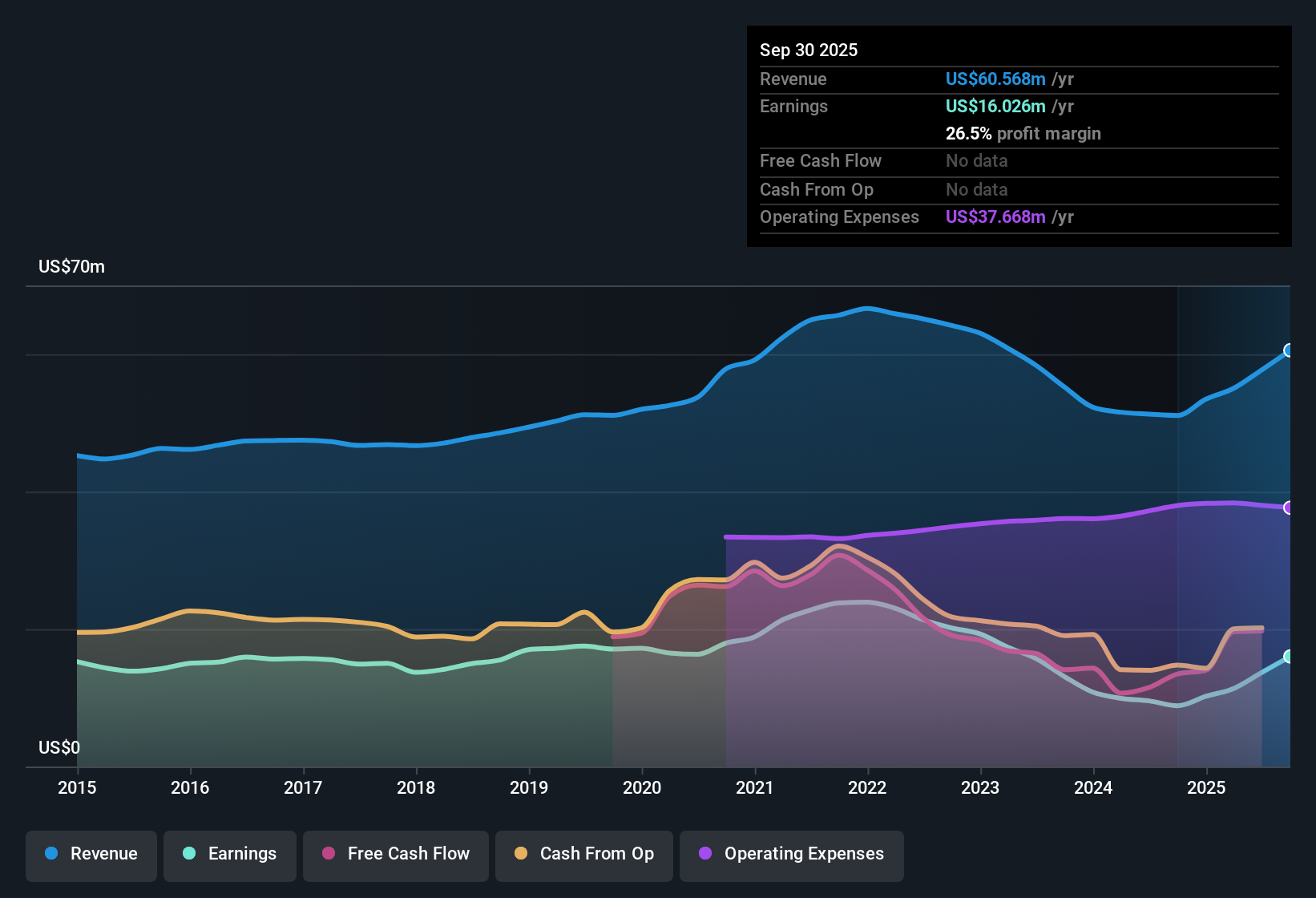

Ames National (ATLO) posted a net profit margin of 23.7%, up from 18.6% a year earlier, and delivered 43.3% earnings growth over the past year. This sharply contrasts its five-year average decline of 15.2% per year. Despite the recent jump in earnings quality and profitability, the stock is trading at $19.61, which remains below its estimated fair value. However, its Price-To-Earnings ratio is notably higher than both peers and the broader US Banks industry. Investors will likely welcome the margin expansion and strong profitability, but ongoing questions around growth expectations and dividend sustainability could shape sentiment going forward.

See our full analysis for Ames National.Next, we’ll see how these headline results compare to the narratives and expectations that surround Ames National. Some assumptions may be confirmed, while others could be up for debate.

Curious how numbers become stories that shape markets? Explore Community Narratives

DCF Fair Value Suggests Upside

- The stock trades at $19.61, which is below its DCF fair value of $23.88. This indicates a market discount of nearly $4.30 per share compared to estimated intrinsic worth.

- The prevailing view judges this discount positively for valuation-focused investors, but tempers enthusiasm by noting that revenue and earnings are not projected to grow in the near term.

- While the 23.7% net profit margin is well above last year's 18.6%, expectations for future performance remain muted. Some may see the discount as justified.

- This dynamic leaves value seekers intrigued by the upside, but wary of the lack of new growth catalysts.

Premium Price-To-Earnings Ratio Stands Out

- Ames National currently trades at a Price-To-Earnings ratio of 12.8x, higher than both its peer average of 10.8x and the wider US Banks sector at 11.2x.

- The narrative underscores that margin expansion and high-quality earnings help explain the premium, but this comes at a time when broader industry earnings are not expected to grow.

- Investors must weigh the company’s recent improvement in profitability against the reality that multiples have already moved ahead of industry norms.

- This premium may persist if Ames National continues to operate with above-average profit margins. However, any slip in quality could put the stock under pressure relative to peers.

Dividend and Growth Sustainability Concerns

- Despite strong recent profit growth and a high net margin, there are explicit concerns about dividend sustainability and the outlook for ongoing revenue and earnings expansion.

- Narrative analysis points out that, although high-quality earnings are appealing for income-focused holders, questions about whether these gains can be maintained may raise caution.

- Prior five-year earnings trends show an average decline of 15.2% annually before the latest rebound, casting doubt on the durability of recent improvements.

- Ongoing apprehension over the company’s ability to maintain or grow its dividend persists, especially if growth stalls or reverses in future periods.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Ames National's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Ames National’s rebound in profitability is promising. However, uncertain growth prospects and ongoing doubts about dividend sustainability remain major concerns.

If consistent earnings and reliable dividends matter to you, use stable growth stocks screener (2084 results) to zero in on companies that have demonstrated steady performance and less volatility across economic cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ATLO

Ames National

Operates as a multi-bank holding company that provides banking products and services primarily in Boone, Clarke, Hancock, Marshall, Polk, Story, Taylor, and Union Counties in central, north-central, and south-central Iowa.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives