- United States

- /

- Banks

- /

- NasdaqCM:AFBI

Affinity Bancshares (AFBI) Margin Expansion Reinforces Bullish Narrative Despite Stretched Valuation

Reviewed by Simply Wall St

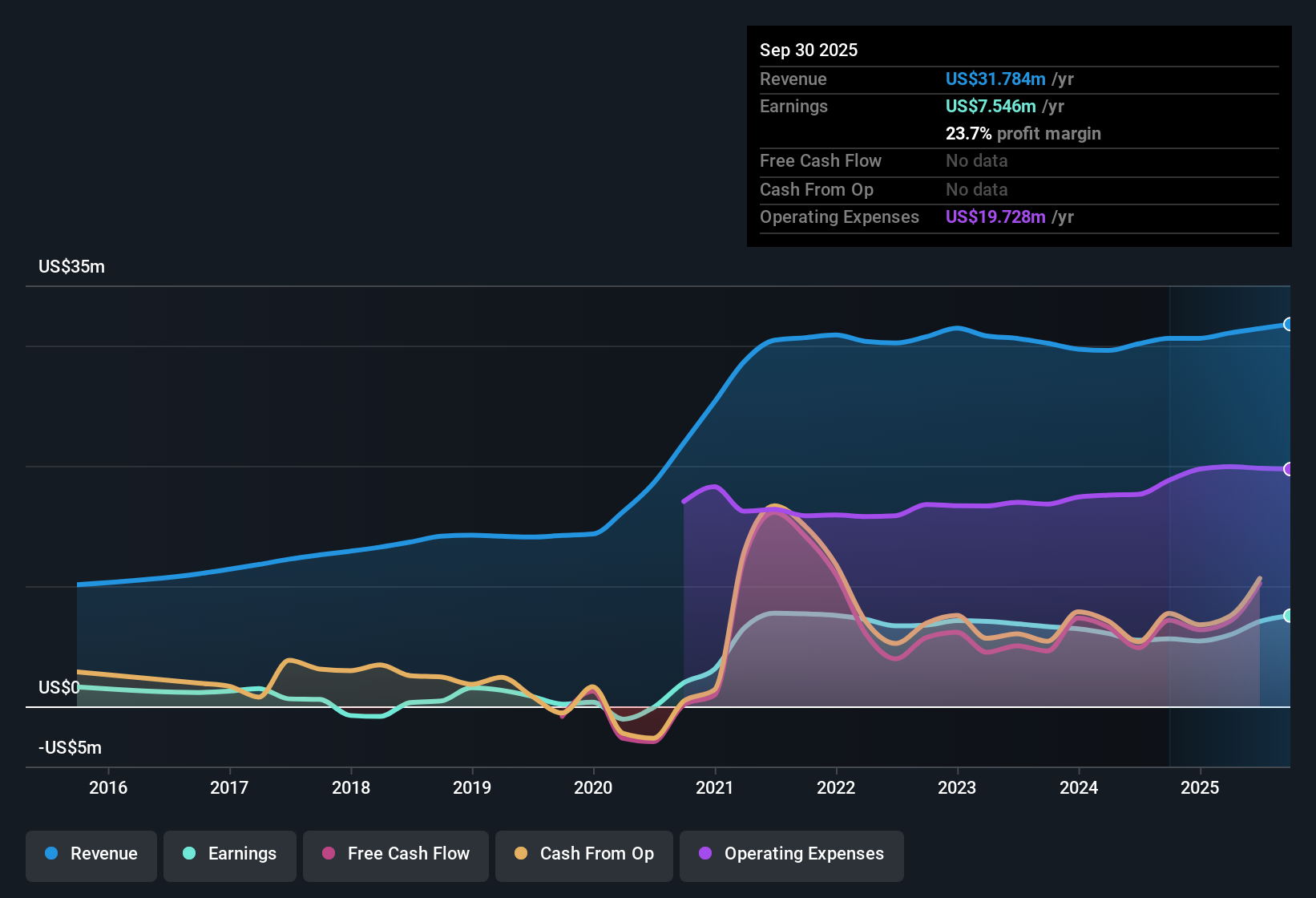

Affinity Bancshares (AFBI) reported a net profit margin of 23.7%, up from 18.3% a year ago, underscoring higher profitability relative to revenue. Earnings growth surged 34.5% year over year, materially above the company’s 5-year average of 3.4% per year and further highlighted by management as high quality. With margins improving and consistent profit gains, investors are likely to take note of both the stronger bottom line and the context of higher valuation multiples compared to industry peers.

See our full analysis for Affinity Bancshares.Next, we’ll see how these results compare with the most widely discussed narratives for Affinity Bancshares, highlighting where investor consensus is reinforced or put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Maintain Upside Momentum

- Net profit margin expanded to 23.7%, rising from 18.3% the prior year. This confirms stronger conversion of revenue into profits beyond peer averages in this period.

- What's surprising is that, even without explicit guidance or special items, the improved margin profile aligns with the view that disciplined loan growth and cost control set Affinity apart from other small banks in a volatile sector.

- When compared to a steady 3.4% annualized earnings increase over five years, the recent acceleration to 34.5% yearly profit growth highlights management’s ability to lift returns at a pace some see as a durable advantage.

- Narrative analysis emphasizes that in a market wary of margin pressure and regulatory shifts, a jump in profitability is especially noteworthy for those supporting the bullish case.

Valuation Stretch Widens Above Peers

- Affinity Bancshares’ price-to-earnings ratio registered 15.7x, above both the US banks’ industry average of 11.2x and direct peers’ 12.7x. This illustrates the growing valuation premium attached to recent profit gains.

- Challenging the assertion that the stock is an undiscovered bargain, the prevailing investment analysis points directly to the $18.78 share price outpacing the DCF fair value of $11.77. This introduces tension for investors weighing strong operating results against premium multiples.

- Bulls might cite ongoing margin expansion and lack of insider selling as justification for the premium, but the quantified gap to fair value compels careful re-examination of upside potential.

- Bears, meanwhile, often warn that valuation premiums for small banks can reverse quickly if sector optimism cools or competitive pressures mount.

Sustained Growth, Low Insider Risk

- Earnings have advanced by 3.4% per year over the last five years, indicating ongoing profitability improvements without significant interruptions or adverse financial signals during the period.

- Standing out, the latest disclosures point out that no substantial insider selling occurred in the past quarter. This adds support to the idea that management is confident in future performance, and removes a common bearish talking point about executive caution.

- For comparison, companies in this sector sometimes face leadership turnover or insider divestiture during times of operational stress. Affinity Bancshares offers a clean slate on these risk flags.

- Management’s own stake and lack of selling can act as a stabilizing signal for retail investors evaluating whether current trends are sustainable.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Affinity Bancshares's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Affinity Bancshares’ profits are surging, its valuation looks stretched. The share price noticeably exceeds estimated fair value and peer multiples.

If you want to focus on stocks trading below their intrinsic value and avoid paying a premium, check out these 877 undervalued stocks based on cash flows to uncover options where the numbers may be more in your favor.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:AFBI

Affinity Bancshares

Operates as the holding company for Affinity Bank that provides various banking products and services in Georgia.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)