- United States

- /

- Auto

- /

- NYSE:XPEV

XPeng (NYSE:XPEV): Assessing Valuation Perspectives Following Recent Share Price Decline

Reviewed by Simply Wall St

XPeng (NYSE:XPEV) shares have been trending lower this week, slipping nearly 4% in the latest session. Investors are parsing the recent moves after the stock rallied sharply over the past year, gaining more than 77% during that period.

See our latest analysis for XPeng.

XPeng’s recent share price slide comes after an impressive period of momentum, with a year-to-date gain nearing 89% and a 77% total shareholder return over the past year. Short-term pullbacks like this often reflect shifting sentiment or profit-taking following major rallies. However, the longer-term performance indicates that investor enthusiasm around growth prospects has not entirely faded.

If XPeng’s surge has piqued your curiosity, this could be a perfect time to uncover what’s happening with other electric vehicle makers. Discover See the full list for free.

But with shares now trading around $21.79 and a price target suggesting modest upside, the question emerges: is XPeng stock undervalued at this point or has the market already priced in much of its future growth?

Most Popular Narrative: 17.7% Undervalued

XPeng’s recent share price of $21.79 sits nearly 18% below the narrative fair value of $26.49. This considerable gap comes as analysts weigh expansion abroad and the company’s rapidly evolving product lineup.

XPeng's rapid in-house development and deployment of proprietary AI hardware (Turing AI SoC) and vision-based ADAS are expected to significantly advance its vehicle autonomy and smart cockpit solutions. This aligns with surging consumer demand for intelligent, software-centric vehicles and sets the stage for higher-margin software revenue along with enhanced gross and net margins.

Want a peek at the formula powering this lofty valuation? One bold growth assumption is hidden at the core. Find out which pivotal forecasts and aggressive targets stand behind this narrative's fair value. The full story reveals the unexpected projections reshaping expectations for XPeng’s future.

Result: Fair Value of $26.49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent net losses and fierce competition in China’s EV market could still act as significant hurdles for XPeng’s future growth narrative.

Find out about the key risks to this XPeng narrative.

Another View: Price Ratios Tell a Different Story

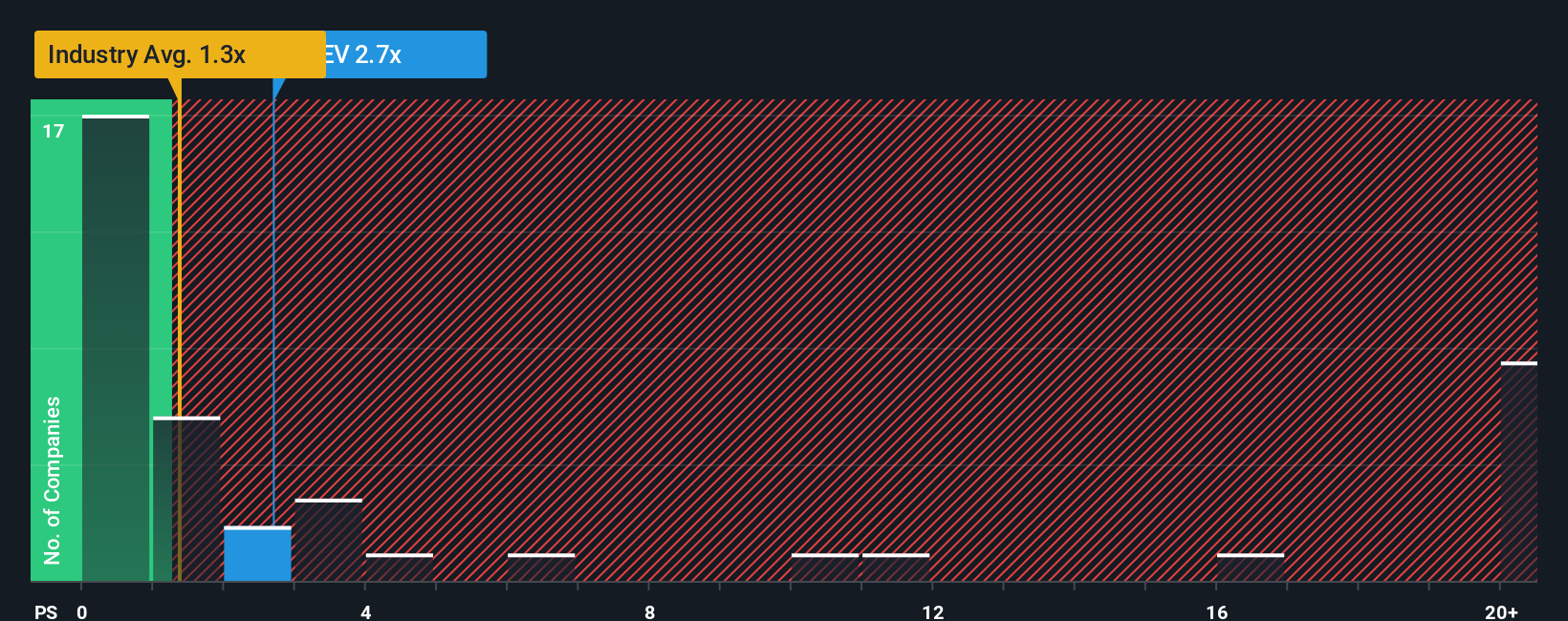

While the narrative valuation highlights XPeng as undervalued, a look at sales-based ratios suggests a different angle. XPeng trades at a price-to-sales ratio of 2.5x, which is significantly higher than its peer average of 1.8x and the US auto industry average of just 1.1x. Even compared to its estimated fair ratio of 2x, the stock appears expensive. Could the market be overestimating XPeng’s growth, or is there more value to uncover?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own XPeng Narrative

If the analysis above does not fully fit your perspective or you enjoy digging into the numbers yourself, you can craft a unique XPeng story in just a few minutes and see where your research leads. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding XPeng.

Ready for More Smart Investment Moves?

Don’t miss your chance to act on the hottest stock opportunities right now. Be the first to spot tomorrow’s winners with Simply Wall Street’s advanced screener tools.

- Uncover hidden potential by targeting these 836 undervalued stocks based on cash flows based on robust cash flow metrics often overlooked by the crowd.

- Accelerate your portfolio’s edge by tapping into the explosive growth of artificial intelligence through these 25 AI penny stocks poised for next-level expansion.

- Secure consistent income with these 20 dividend stocks with yields > 3% offering yields above 3 percent, handpicked for financial strength and reliability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives