Stock Analysis

- United States

- /

- Auto

- /

- NYSE:XPEV

What Does The Future Hold For XPeng Inc. (NYSE:XPEV)? These Analysts Have Been Cutting Their Estimates

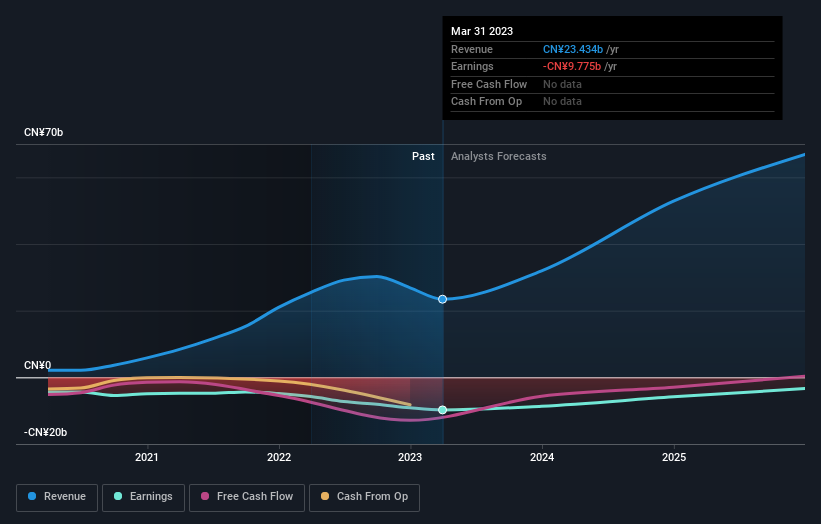

The latest analyst coverage could presage a bad day for XPeng Inc. (NYSE:XPEV), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

Following the downgrade, the most recent consensus for XPeng from its 33 analysts is for revenues of CN¥32b in 2023 which, if met, would be a sizeable 36% increase on its sales over the past 12 months. Losses are predicted to fall substantially, shrinking 25% to CN¥8.47. Yet prior to the latest estimates, the analysts had been forecasting revenues of CN¥36b and losses of CN¥7.80 per share in 2023. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a serious cut to their revenue forecasts while also expecting losses per share to increase.

Check out our latest analysis for XPeng

The consensus price target fell 17% to CN¥70.82, implicitly signalling that lower earnings per share are a leading indicator for XPeng's valuation. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. The most optimistic XPeng analyst has a price target of CN¥14.46 per share, while the most pessimistic values it at CN¥5.00. Still, with such a tight range of estimates, it suggests the analysts have a pretty good idea of what they think the company is worth.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It's pretty clear that there is an expectation that XPeng's revenue growth will slow down substantially, with revenues to the end of 2023 expected to display 51% growth on an annualised basis. This is compared to a historical growth rate of 66% over the past three years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 18% per year. So it's pretty clear that, while XPeng's revenue growth is expected to slow, it's still expected to grow faster than the industry itself.

The Bottom Line

The most important thing to take away is that analysts increased their loss per share estimates for this year. While analysts did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. The consensus price target fell measurably, with analysts seemingly not reassured by recent business developments, leading to a lower estimate of XPeng's future valuation. Overall, given the drastic downgrade to this year's forecasts, we'd be feeling a little more wary of XPeng going forwards.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. We have estimates - from multiple XPeng analysts - going out to 2025, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Valuation is complex, but we're helping make it simple.

Find out whether XPeng is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:XPEV

XPeng

XPeng Inc. designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

Adequate balance sheet with limited growth.