- United States

- /

- Auto

- /

- NYSE:XPEV

Can XPeng's Record Deliveries and Tech Advancements Reshape Its Investment Thesis?

- XPeng's positive earnings report and improved delivery figures marked significant operational improvements, resulting in a noteworthy reduction in net loss.

- The announcement of surpassing vehicle delivery guidance and setting record gross margins highlighted strong market performance and future growth potential.

- The implications of XPeng's recent performance improvements on AI and automotive investments will shape their evolving investment narrative.

XPeng Investment Narrative Recap

As an XPeng shareholder, it's crucial to have confidence in their impressive strides in smart EV technology and global market penetration. While the recent positive earnings report reflects operational improvements, it doesn't necessarily alter the key short-term catalysts significantly. XPeng's ongoing commitment to expanding its AI and automotive footprint continues to challenge profit margins due to heightened R&D and expansion efforts. However, the company's record vehicle delivery figures and enriched product offerings signal a potential shift in the broader revenue narrative. Risks such as the sustainability of margin improvements and escalating international market competition remain critical elements that could impact XPeng’s trajectory.

Read the full narrative on XPeng (it's free!)

Exploring Other Perspectives

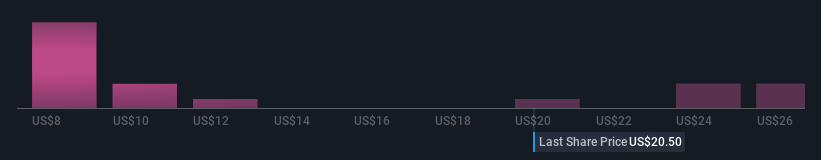

The Simply Wall St Community offers a broad range of XPeng fair value estimates, across 12 different perspectives, from as low as $5.44 to as high as $28. This range highlights diverse outlooks, indicating both potential undervaluation and overvaluation. With XPeng's recent news linking to its AI advancements, investors should weigh these differing viewpoints and consider how its strategic tech focus can impact future performance. Keep in mind that these opinions reflect different angles, urging you to explore various perspectives for a well-rounded understanding.

Explore 12 other fair value estimates on XPeng - why the stock might be worth as much as $28.00!

Build Your Own XPeng Narrative

Disagree with existing narratives? Create your own in under 3 minutes — extraordinary investment returns rarely come from following the herd.

- A great starting point for your XPeng research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free XPeng research report provides a comprehensive fundamental analysis summarized in a single visual — the Snowflake — making it easy to evaluate XPeng's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 23 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives