- United States

- /

- Renewable Energy

- /

- NYSE:SPRU

Time To Worry? Analysts Are Downgrading Their XL Fleet Corp. (NYSE:XL) Outlook

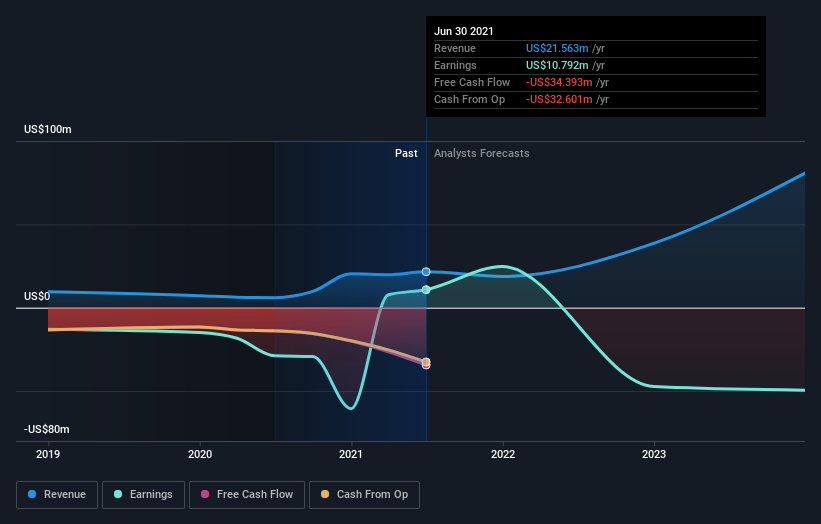

Today is shaping up negative for XL Fleet Corp. (NYSE:XL) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. Both revenue and earnings per share (EPS) estimates were cut sharply as analysts factored in the latest outlook for the business, concluding that they were too optimistic previously.

Following the latest downgrade, the two analysts covering XL Fleet provided consensus estimates of US$19m revenue in 2021, which would reflect a definite 13% decline on its sales over the past 12 months. Statutory earnings per share are presumed to leap 76% to US$0.17. Before this latest update, the analysts had been forecasting revenues of US$27m and earnings per share (EPS) of US$0.26 in 2021. It looks like analyst sentiment has declined substantially, with a pretty serious reduction to revenue estimates and a large cut to earnings per share numbers as well.

Check out our latest analysis for XL Fleet

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 25% by the end of 2021. This indicates a significant reduction from annual growth of 258% over the last year. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 13% per year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - XL Fleet is expected to lag the wider industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for XL Fleet. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that XL Fleet's revenues are expected to grow slower than the wider market. After a cut like that, investors could be forgiven for thinking analysts are a lot more bearish on XL Fleet, and a few readers might choose to steer clear of the stock.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At least one analyst has provided forecasts out to 2023, which can be seen for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you decide to trade XL Fleet, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:SPRU

Spruce Power Holding

Owns and operates distributed solar energy assets in the United States.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion