- United States

- /

- Auto

- /

- NYSE:WGO

Winnebago Industries (WGO): Assessing Valuation Following Full-Year Earnings and 2026 Guidance

Reviewed by Simply Wall St

Winnebago Industries (WGO) has posted its full-year earnings, revealing higher net income and earnings per share compared to last year, even as sales slipped. The company also released guidance for fiscal 2026, outlining expected revenue and profit ranges.

See our latest analysis for Winnebago Industries.

Winnebago Industries' recent earnings release and fresh 2026 guidance brought a jolt of momentum, driving a remarkable 31% share price return over the past week and adding to an 18.8% gain in the last month. Still, the longer-term picture is more muted, with a one-year total shareholder return of -21.6% and a five-year return of -10.9%. This suggests that short-term optimism has yet to offset a generally downward trend.

If the latest earnings spark your curiosity about what else is out there, now’s a great moment to broaden your investment radar and discover See the full list for free.

With earnings and guidance now in focus, the key question for investors is whether Winnebago Industries offers hidden value at current levels or if the market has already accounted for its potential rebound in 2026.

Most Popular Narrative: 5% Undervalued

Winnebago Industries closed at $39.39, which is about 5% below the fair value estimated by the most widely followed narrative. This suggests analysts see modest upside potential based on new financial forecasts and strategic initiatives.

The successful launch and ramp-up of the Grand Design Motorhome Lineage lineup, including new models like the Series M Class C, Series F Super C Coach, and Series VT Class B, is expected to boost future revenues and market share in the motorized RV segment. The strategic transformation of Winnebago Towables under new leadership, with a focus on innovative pricing and product strategies, aims to increase market share and drive revenue growth in the competitive towables market.

Curious what financial leap powers this bullish outlook? The boldest moves in this narrative rely on rare growth targets and market-shifting profit assumptions. If you want to see exactly which aggressive forecasts underlie the latest fair value increase and how they tie to upcoming product launches, dive into the full narrative to uncover the projections fueling this view.

Result: Fair Value of $41.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macroeconomic uncertainty and softer consumer confidence could quickly challenge these upbeat assumptions. This could put both growth expectations and margins under pressure.

Find out about the key risks to this Winnebago Industries narrative.

Another View: High Earnings Multiple Signals Caution

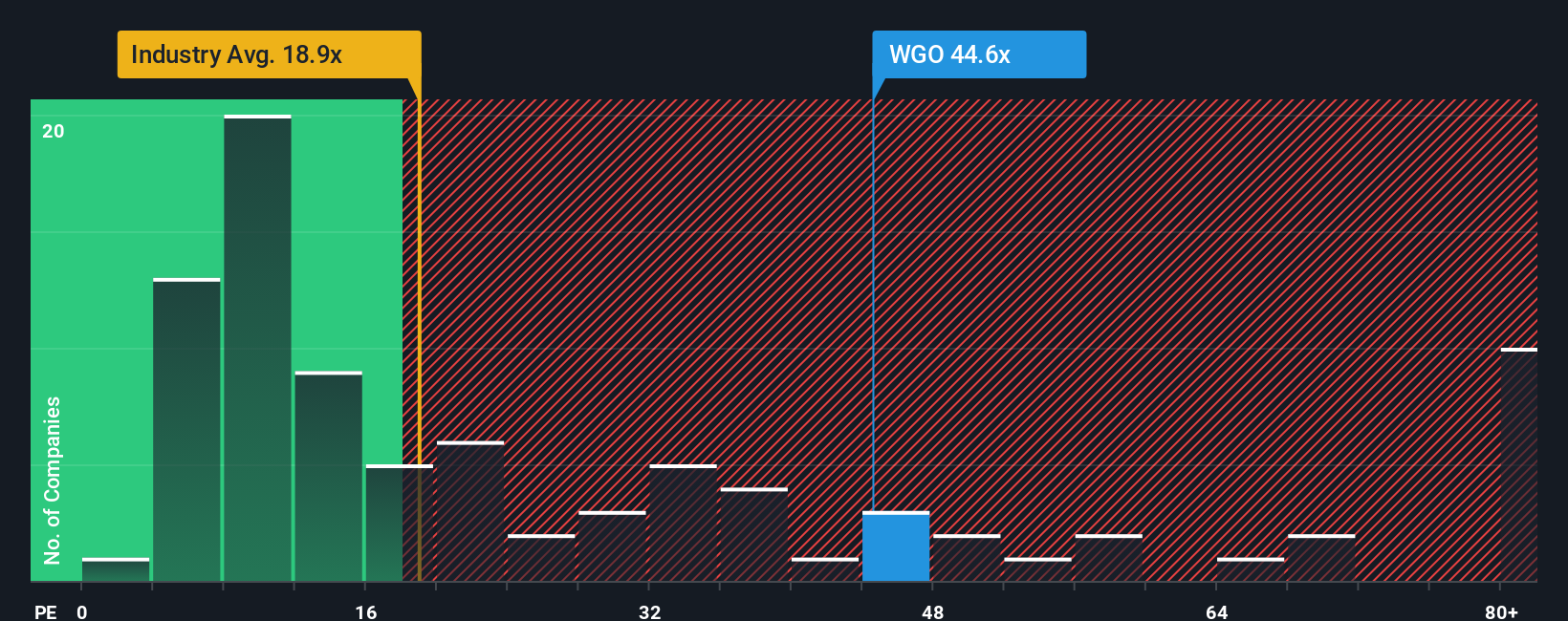

Looking from another perspective, Winnebago Industries is trading at a price-to-earnings ratio of 43.2x, which is much higher than both its industry peers (average 17.7x) and the overall auto sector (18.3x). Even when compared to the fair ratio of 29.8x, the stock appears expensive. This wide gap suggests investors are paying a premium, which increases the risk if profit growth falls short. Could this elevated price reflect expectations for future growth, or does it expose the stock to greater downside risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Winnebago Industries Narrative

If you see the story differently or are keen to run your own analysis, it’s easy to build your own view in just minutes. Do it your way

A great starting point for your Winnebago Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't limit yourself to just one opportunity. Open the door to smarter investing moves. There is a world of high-potential stocks waiting for you today.

- Grow your portfolio with steady income by checking out these 17 dividend stocks with yields > 3% featuring established companies offering attractive yields above 3%.

- Catch the AI surge early and uncover tomorrow’s leaders with these 27 AI penny stocks offering exposure to innovation in artificial intelligence across multiple industries.

- Capitalize on ground-floor opportunities by scanning these 3568 penny stocks with strong financials for fast-moving companies with solid fundamentals that the market may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Winnebago Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WGO

Winnebago Industries

Manufactures and sells recreation outdoor lifestyle products primarily for use in leisure travel and outdoor recreation activities.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives