- United States

- /

- Auto

- /

- NYSE:WGO

Can Winnebago Industries (WGO) Sustain Profit Gains Amid Softer Sales Guidance and Changing Market Trends?

Reviewed by Sasha Jovanovic

- Winnebago Industries recently reported financial results for the year ended August 30, 2025, with sales of US$2.80 billion and net income of US$25.7 million, while also providing fiscal year 2026 guidance anticipating consolidated net revenues between US$2.75 billion and US$2.95 billion and diluted earnings per share of US$1.25 to US$1.95.

- Despite a decrease in annual sales compared to the previous year, Winnebago more than doubled its net income and improved its earnings per share, reflecting operational and profitability gains even in a softer market.

- We will explore how Winnebago's updated revenue and earnings guidance influences its investment narrative and outlook on future profitability.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Winnebago Industries Investment Narrative Recap

To be a Winnebago shareholder, you need conviction in the company's ability to drive long-term profitability through innovation and operational efficiency, even in a softening recreational vehicle market. The latest guidance, signaling stable revenues but a wide earnings outlook for 2026, does little to change the central catalyst, execution on new product launches, while ongoing dealer caution and macroeconomic headwinds remain the biggest risks. The recent financial update essentially confirms these underlying themes rather than shifting the risk-reward profile.

Among recent announcements, Winnebago's debut of several new RV models and smart technology at the September 2025 Hershey RV Show stands out. This aligns directly with the company's near-term catalyst: boosting revenues and refreshing market share through successful product innovation and rollout, especially across its Grand Design and Newmar lines, in a competitive environment.

However, it is important for investors to recognize that, despite these efforts, heightened dealer caution and inventory constraints could...

Read the full narrative on Winnebago Industries (it's free!)

Winnebago Industries' outlook anticipates $3.4 billion in revenue and $217.6 million in earnings by 2028. This projection relies on a 7.2% annual revenue growth rate and a $234.7 million increase in earnings from the current level of -$17.1 million.

Uncover how Winnebago Industries' forecasts yield a $41.45 fair value, a 10% upside to its current price.

Exploring Other Perspectives

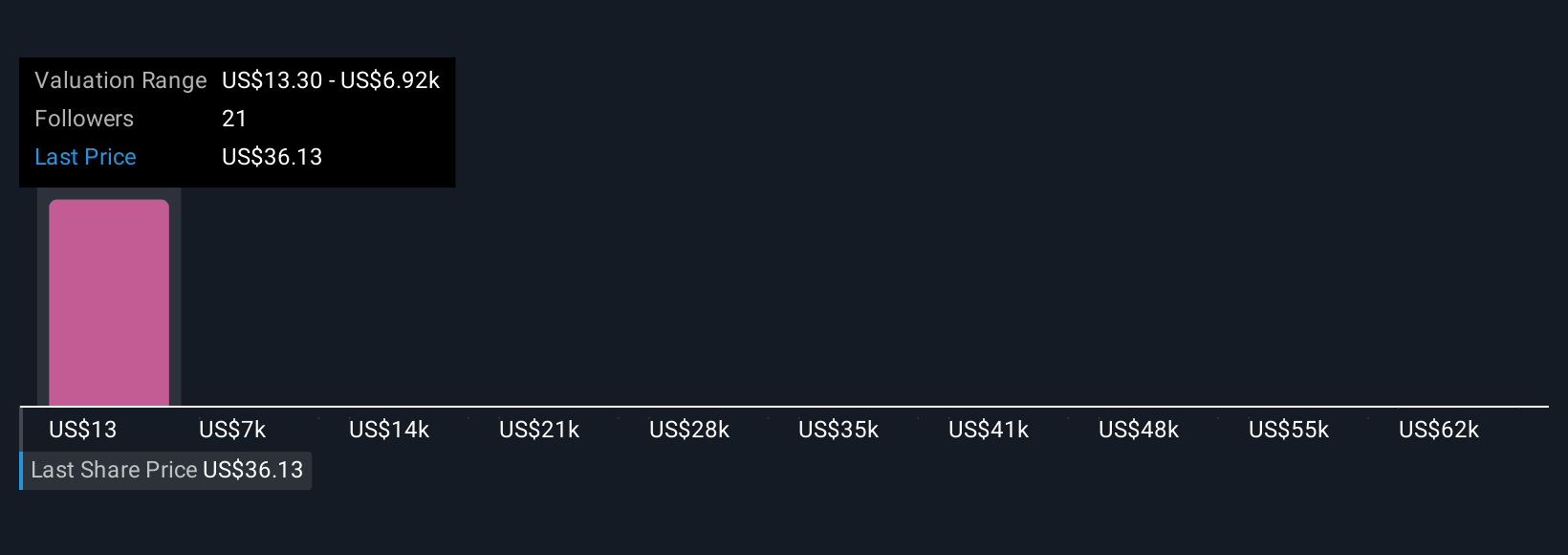

Six community members from Simply Wall St provided fair value estimates for Winnebago Industries, ranging from as low as US$13 to above US$69,000. While opinions vary this widely, dealer inventory trends and soft retail demand continue to weigh on near-term performance, so exploring multiple viewpoints can help inform your expectations.

Explore 6 other fair value estimates on Winnebago Industries - why the stock might be a potential multi-bagger!

Build Your Own Winnebago Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Winnebago Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Winnebago Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Winnebago Industries' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Winnebago Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WGO

Winnebago Industries

Manufactures and sells recreation outdoor lifestyle products primarily for use in leisure travel and outdoor recreation activities.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives