- United States

- /

- Auto

- /

- NYSE:RACE

Has Ferrari’s Stock Raced Ahead of Its Value After Electric Vehicle Push?

Reviewed by Bailey Pemberton

- Wondering if Ferrari is a hidden gem or already priced to perfection? This is your deep dive into what really drives the Prancing Horse’s stock value.

- In the past month, Ferrari's stock has climbed 7.1%, but looking back over the past year, it is down 2.5%. This hints that investor sentiment and expectations have been shifting recently.

- News around Ferrari has focused on the brand’s expansion into luxury lifestyle segments and its continued investments in hybrid and electric vehicles. These moves keep investors excited about its future direction. Market watchers are also discussing the impact of Ferrari’s recent partnerships and product launches on long-term brand strength.

- On Simply Wall St’s valuation scorecard, Ferrari scores 0 out of 6 for undervaluation, suggesting the stock is fully priced by most traditional checks. However, looking beyond the obvious is often where opportunity can be found, and we’ll get to that at the end of this article.

Ferrari scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ferrari Discounted Cash Flow (DCF) Analysis

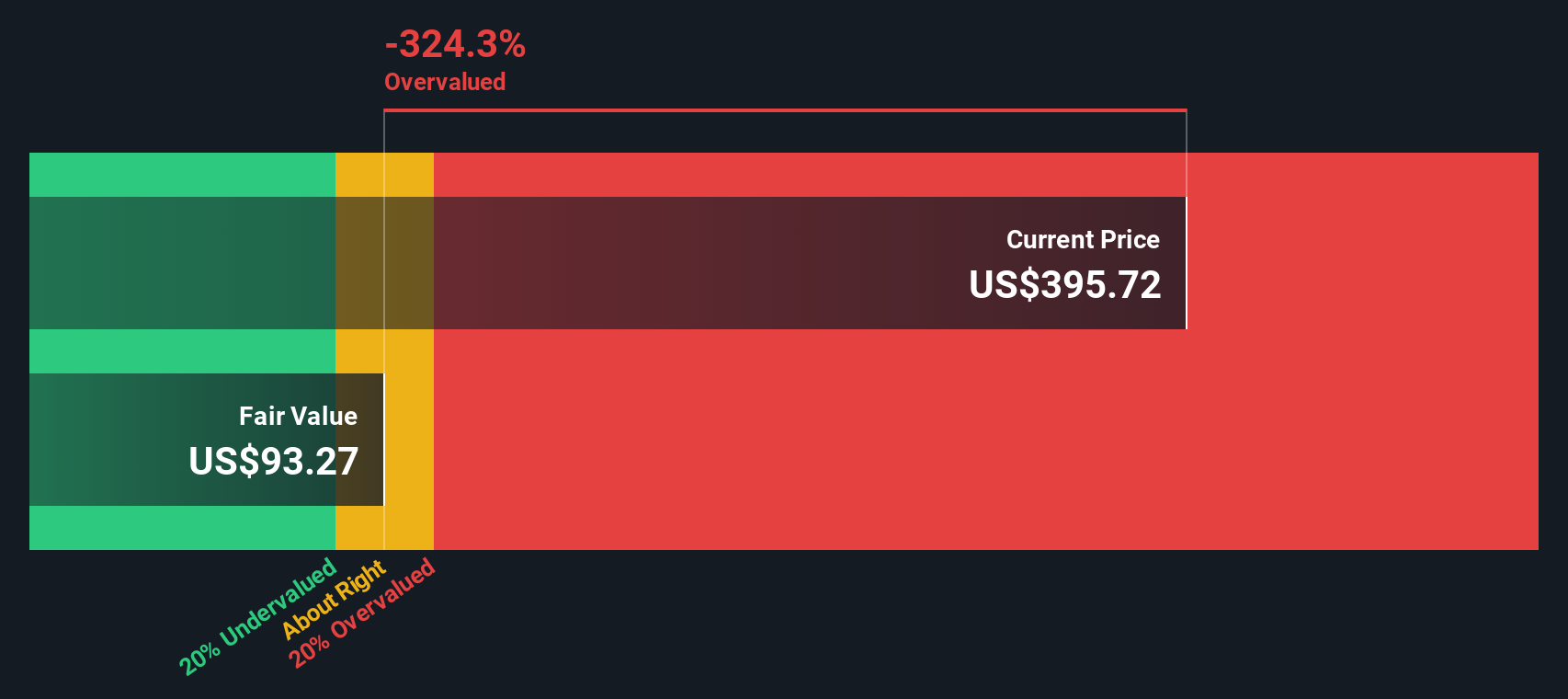

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by forecasting its future free cash flows and discounting them back to today’s worth. This approach helps investors judge what a business is fundamentally worth, rather than just relying on the market price.

For Ferrari, the most recent reported Free Cash Flow (FCF) is approximately €1.28 billion. Analyst projections suggest FCF will steadily grow over the coming years, reaching around €1.93 billion by 2029. While analysts provide estimates for up to five years, longer-term forecasts are extrapolated by Simply Wall St to extend the view up to a decade.

Based on these projections and cash flow assumptions, the DCF model calculates Ferrari’s fair value at around $104.57 per share. However, the stock currently trades about 299% above this estimated intrinsic value, which suggests it is significantly overvalued according to the DCF model.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ferrari may be overvalued by 298.9%. Discover 879 undervalued stocks or create your own screener to find better value opportunities.

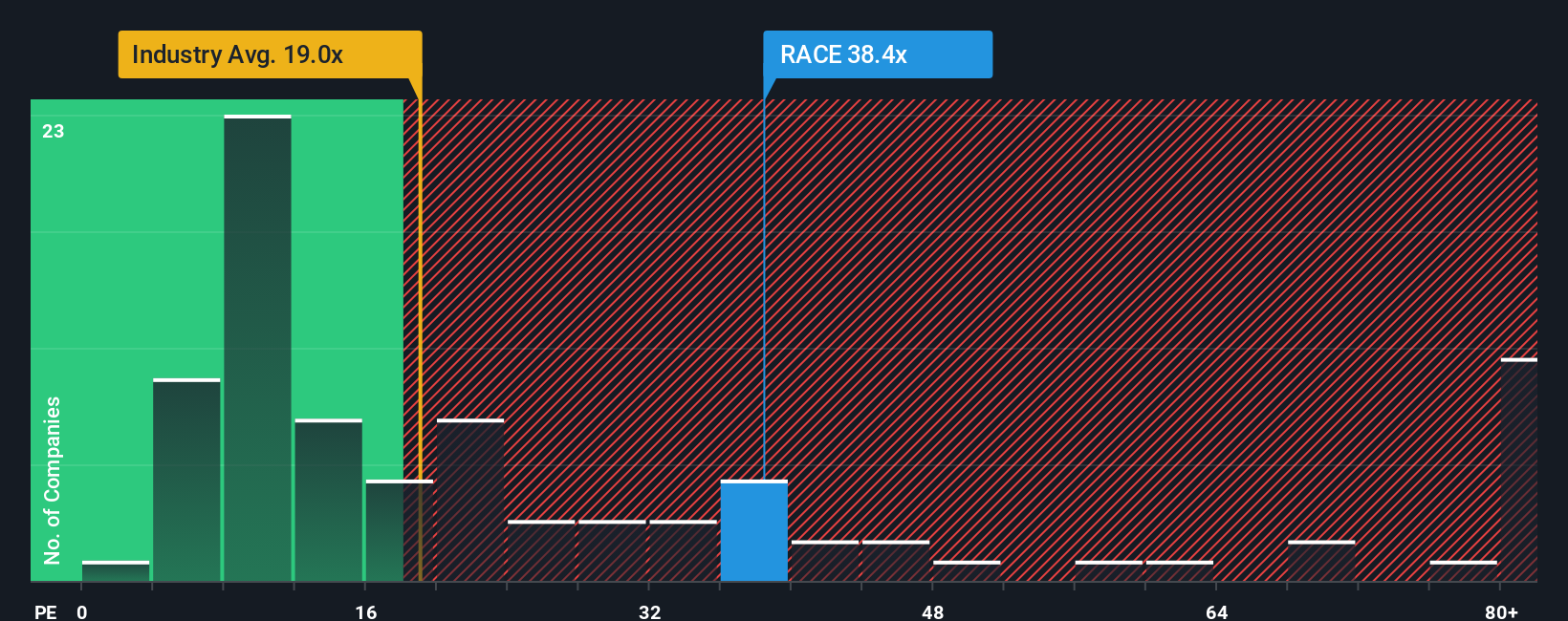

Approach 2: Ferrari Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a go-to metric for valuing profitable companies like Ferrari, as it relates the company’s stock price to its actual earnings. It is especially useful when a business is generating consistent profits, since it allows investors to quickly compare market expectations to the company’s underlying performance.

However, the “right” PE ratio can vary. Companies with higher expected earnings growth, strong operating margins, or lower risk typically command a higher multiple. Conversely, those with lower prospects or higher uncertainty often trade at a discount. These benchmarks help determine whether an investor is paying a premium or getting a bargain.

Ferrari’s current PE ratio stands at 39.92x, which is noticeably above both the Auto industry average of 18.42x and the peer group average of 15.65x. This premium suggests that the market is pricing in Ferrari’s unique brand strength, growth potential, and profitability.

To truly assess if Ferrari deserves this premium, Simply Wall St’s proprietary “Fair Ratio” can be particularly insightful. Unlike a plain comparison to peers or industry averages, the Fair Ratio takes into account the company’s specific growth outlook, profit margins, industry, market cap, and risk profile. For Ferrari, the Fair Ratio comes in at 14.45x.

Comparing the Fair Ratio of 14.45x to Ferrari’s current PE of 39.92x, the stock appears significantly overvalued based on this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

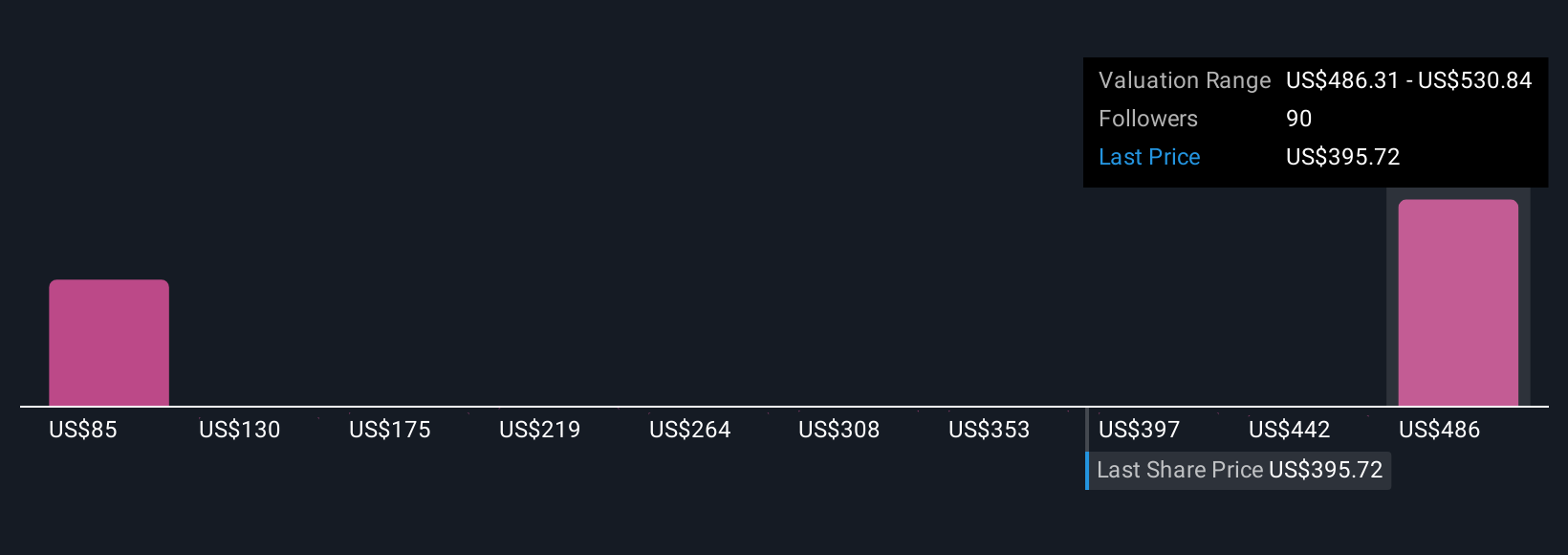

Upgrade Your Decision Making: Choose your Ferrari Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company, the perspective and expectations you have for Ferrari, brought to life through your own assumptions for future revenue, earnings, and margins, which then lead to your estimate of fair value.

Rather than looking only at numbers, Narratives let you tie together everything you know and believe about Ferrari, from business model changes and new model launches to global trends and risks, and connect your story directly to a real forecast and fair value calculation. This approach empowers you to make informed investment decisions that go beyond surface-level ratios, allowing you to see how your thinking stacks up against the market price.

Narratives are super accessible, available right now on the Simply Wall St Community page, and used by millions of investors worldwide. They help you track whether Ferrari is under- or overvalued at any point by instantly updating your fair value as new news and earnings come in, so you can decide when it’s the right time to buy, hold, or sell.

For example, some Ferrari Narratives predict a share price as high as $597, betting on luxury expansion and electrification, while more cautious views see fair value closer to $397 if costs and competition bite. This proves just how dynamic and personal your investing journey can be.

Do you think there's more to the story for Ferrari? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RACE

Ferrari

Through its subsidiaries, engages in design, engineering, production, and sale of luxury performance sports cars worldwide.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives