- United States

- /

- Auto

- /

- NYSE:RACE

Ferrari (NYSE:RACE): Examining Valuation as Shares Cool After Recent Rally

Reviewed by Simply Wall St

See our latest analysis for Ferrari.

Ferrari’s share price has cooled off after rallying earlier this year, with a recent 30-day pullback of 14.3% and a total shareholder return of minus 16.3% over the last 12 months. Still, the company’s impressive 111.5% total return over three years highlights its enduring strength. However, momentum now seems to be fading for the moment.

If you’re watching trends unfold in the auto industry, you might want to expand your search and check out See the full list for free.

With Ferrari’s recent pullback and a current share price sitting below analysts' targets, investors are left to consider if this signals an undervaluation, or if the market has already factored in the company’s growth potential. Is now the moment to buy?

Most Popular Narrative: 14.7% Undervalued

Ferrari's strongest-followed narrative assigns a fair value of $477.93, which is higher than the most recent close of $407.46. This perspective weighs updated profit forecasts, new model momentum, and ongoing industry changes as key drivers behind the stock's potential re-rating.

The launch of six new models in 2025, including the anticipation of the Ferrari full electric, is likely to drive revenue growth, capturing both existing and new customers while expanding Ferrari's electrification journey. Continued focus on personalization, expected to remain around 20% of car and spare parts revenues, enhances the revenue stream due to the higher profit margins associated with bespoke options.

Want to understand what’s really driving that premium valuation? The narrative hinges on bold financial targets for revenue growth and profit margins, as well as unprecedented ambitions for electrification and personalized luxury. The story behind these projections might surprise you. Explore the full details for the inside scoop on Ferrari’s future value.

Result: Fair Value of $477.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including concerns that launching six new models in 2025 could dilute Ferrari's brand exclusivity and reduce its pricing power.

Find out about the key risks to this Ferrari narrative.

Another View: What Do Market Valuations Signal?

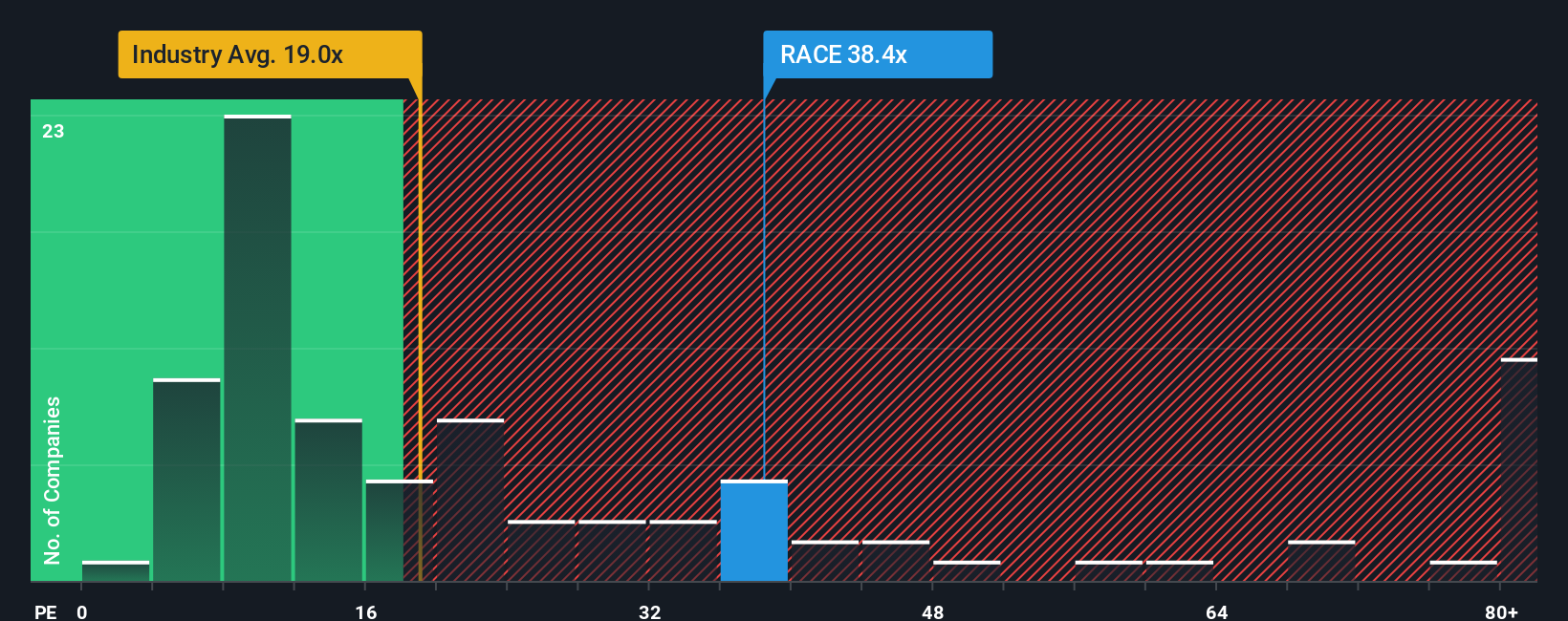

While analyst targets suggest Ferrari might be undervalued, the current price-to-earnings ratio of 39.2x tells a different story. That is more than double the global auto industry average of 18.4x, and well above its closest peers at 16.5x. The fair ratio for Ferrari is estimated at 14.2x, suggesting the market is pricing in hefty performance expectations. Does this premium reflect true opportunity, or is it a setup for disappointment if growth stalls?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ferrari Narrative

If you have a different perspective or want to dig deeper into the numbers yourself, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your Ferrari research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

If you want fresh opportunities, you owe it to yourself to check out other standout stocks ready to spark your portfolio’s next chapter on Simply Wall Street.

- Start chasing unbeatable yields and resilient cash flow with these 19 dividend stocks with yields > 3%, offering impressive payouts and the financial strength you want on your side.

- Fuel your strategy with these 27 AI penny stocks and be in front of the smartest advances that could power tomorrow’s biggest market winners.

- Snap up value plays while others are distracted by hype using these 871 undervalued stocks based on cash flows, where hidden gems catch sharp investors before the crowd notices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RACE

Ferrari

Through its subsidiaries, engages in design, engineering, production, and sale of luxury performance sports cars worldwide.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives