- United States

- /

- Auto

- /

- NYSE:RACE

Evaluating Ferrari’s Share Value Amid Brand Expansion and 2.7% Price Jump

Reviewed by Bailey Pemberton

- Curious whether Ferrari is a sleek collector’s item or just an expensive ride at current prices? Let’s break down what is under the hood when it comes to its value.

- Ferrari’s shares have zipped higher by 2.7% over the last week, though they are still down 5.9% year-to-date and 9.7% for the past year. Over five years, the shares have recorded a 92.2% gain.

- Recent headlines have highlighted Ferrari’s continued brand strength and expansion into luxury lifestyle ventures, fueling speculation about how these moves might support long-term growth. At the same time, concerns about the broader auto market and shifting demand trends have kept some investors on the sidelines.

- According to Simply Wall St’s valuation checks, Ferrari currently scores 0 out of 6 for being undervalued. We will walk through the usual valuation approaches and hint at another way to spot value, so keep reading for the full picture.

Ferrari scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ferrari Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by forecasting future cash flows and then discounting them back to today’s value. This approach helps investors assess what a business is truly worth, beyond just current market prices.

For Ferrari, the DCF model uses its most recent Free Cash Flow, which stands at approximately €1.28 Billion. Analysts expect this to steadily grow, reaching a projected €1.93 Billion by 2029, with longer-term projections extrapolated beyond the five-year analyst estimates and extending even higher in future years. These cash flows are assessed using a two-stage approach that factors in both near-term analyst forecasts and longer-term estimates.

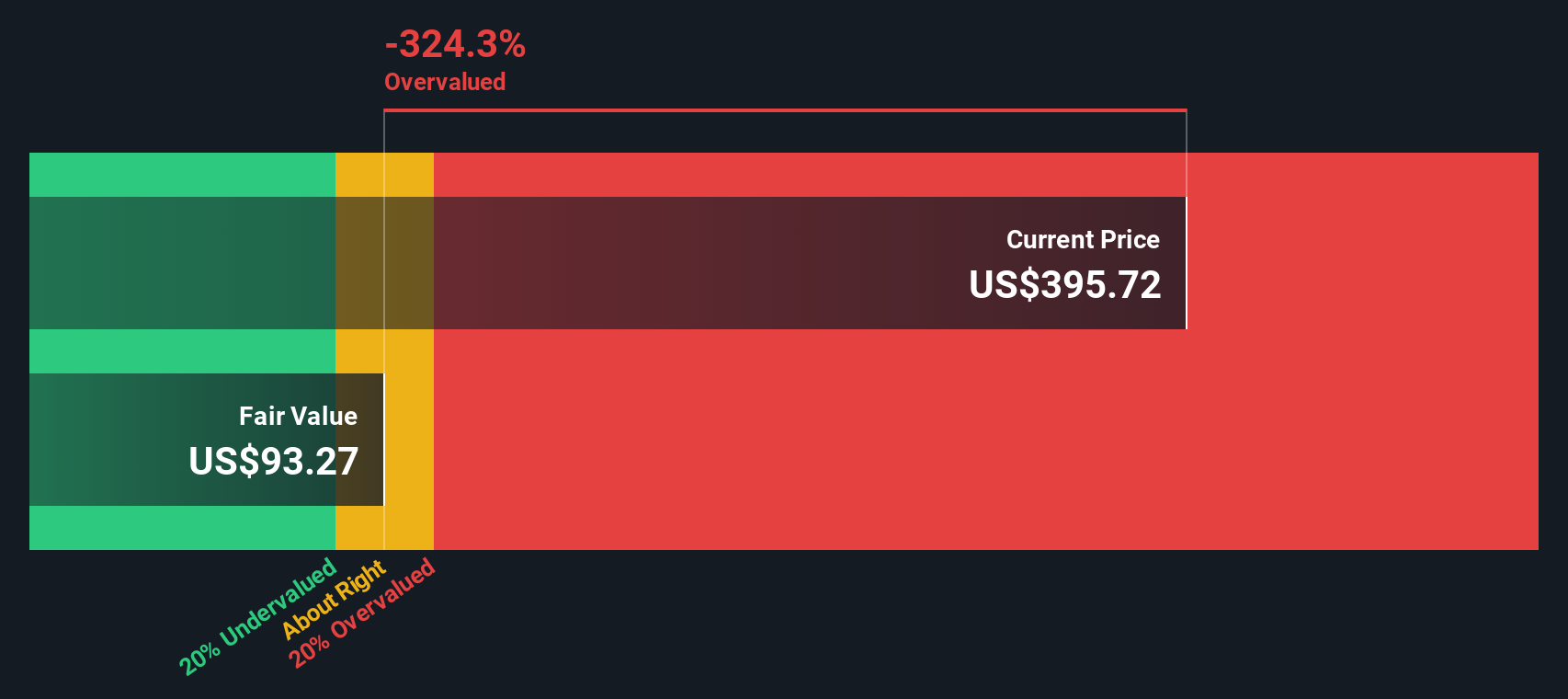

According to these calculations, the intrinsic value per share for Ferrari is €104. When compared to the current share price, this results in an implied discount of -276.9%. In other words, Ferrari stock is trading at a price significantly above what its future cash flows would justify based on this DCF analysis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ferrari may be overvalued by 276.9%. Discover 915 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Ferrari Price vs Earnings

For consistently profitable companies like Ferrari, the Price-to-Earnings (PE) ratio is a widely used valuation metric. It gives investors a quick view of how much they are paying for each dollar of earnings generated by the company. Higher growth expectations or lower risk can justify a higher PE ratio. In contrast, lower growth or more risk usually leads to lower "normal" valuations.

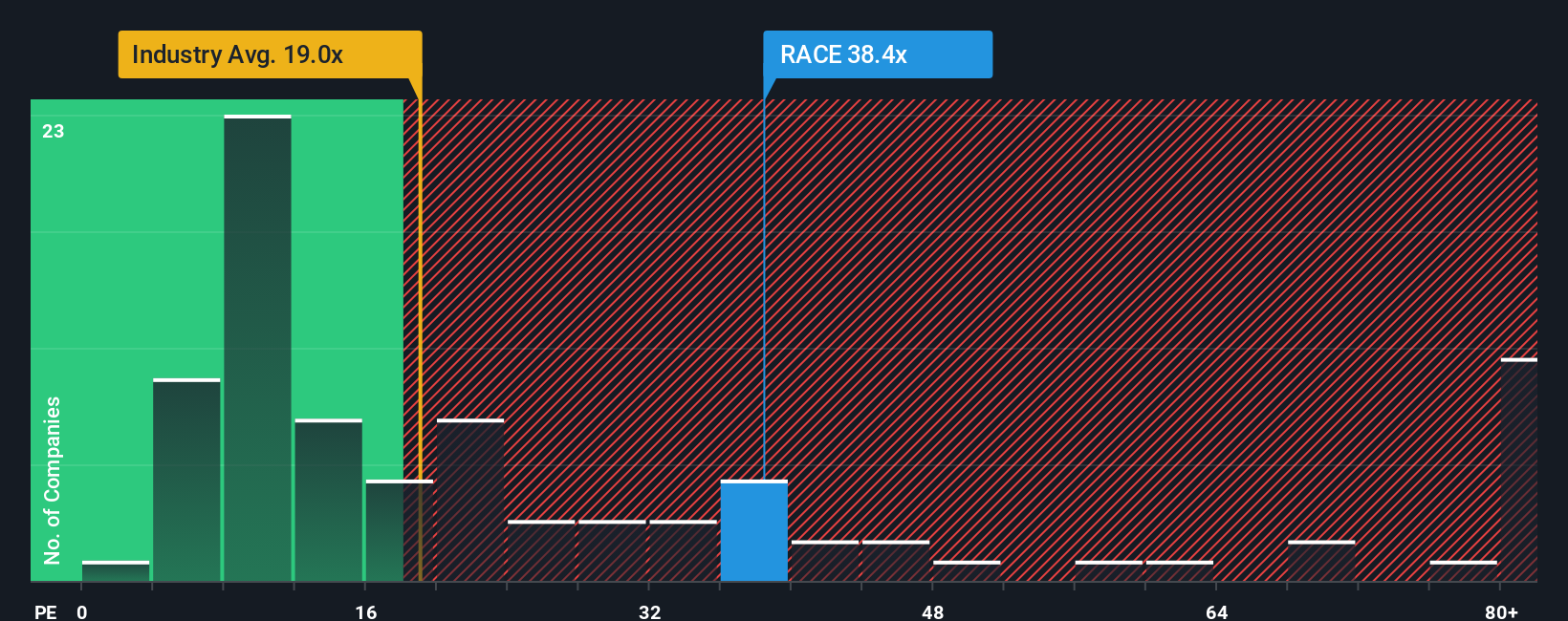

Currently, Ferrari trades at a PE ratio of 37.4x. This stands well above the auto industry average of 18.2x and the average of its peers, which is 18.9x. On the surface, this premium might seem excessive, but raw comparisons do not always capture the full story, especially when a business has standout strengths or challenges.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. For Ferrari, the Fair PE ratio is calculated at 17.1x. Unlike a plain-vanilla industry or peer average, the Fair Ratio weighs factors like Ferrari’s growth potential, profit margins, industry dynamics, market capitalization, and specific risks. In this way, it reflects what is reasonable for Ferrari’s unique position rather than a one-size-fits-all approach.

Comparing Ferrari’s current 37.4x to its Fair Ratio of 17.1x, the stock looks significantly overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ferrari Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are easy-to-use tools on Simply Wall St that empower investors to connect a company’s story, including their own views on future revenue, earnings, and profit margins, to a financial forecast and ultimately an estimate of fair value. Rather than relying solely on ratios or analyst targets, you craft your perspective by linking real business developments to the numbers underpinning a fair price for Ferrari.

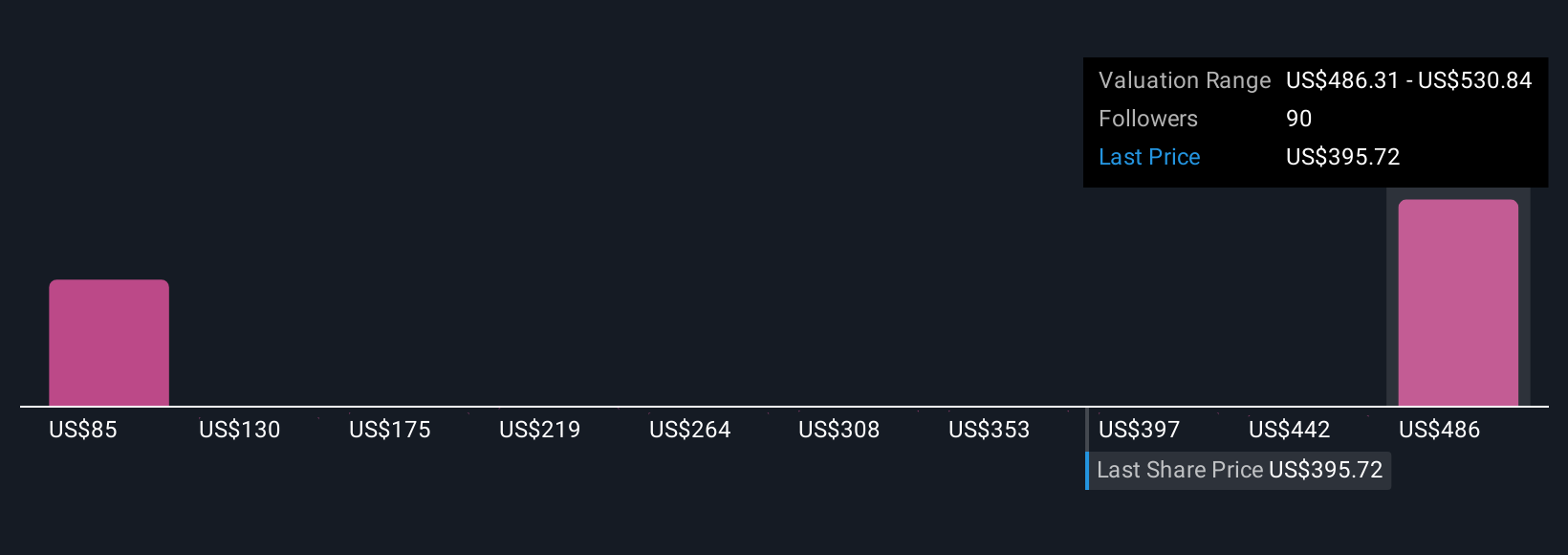

Millions of investors are already using Narratives in the Simply Wall St Community page to track, update, and discuss their investment stories. As new information such as news, earnings, or strategic changes comes in, Narratives refresh automatically to reflect the latest outlook. This helps you make smarter decisions on when to buy or sell by comparing your Fair Value to the current share price. For example, one investor may believe that Ferrari’s innovative new models and premium branding will drive future earnings and set their fair value above $590, while another may worry about market saturation and assign a much lower fair value, nearer to $397. Each Narrative helps you see both the data and the story behind the stock, putting you in control of your investment decisions.

Do you think there's more to the story for Ferrari? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RACE

Ferrari

Through its subsidiaries, engages in design, engineering, production, and sale of luxury performance sports cars worldwide.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026