- United States

- /

- Auto Components

- /

- NYSE:QS

Reassessing QuantumScape (QS) Valuation After New OEM Partnership and Expanded Volkswagen PowerCo Ties

Reviewed by Simply Wall St

QuantumScape (QS) is back in the spotlight after signing a joint development agreement with a top-10 global automaker and deepening ties with Volkswagen’s PowerCo, moves that signal real progress toward commercial solid-state batteries.

See our latest analysis for QuantumScape.

The flurry of new OEM deals, PowerCo support and progress on the Eagle Line has arrived after a choppy few weeks, with a 30 day share price return of negative 8.27 percent but a powerful year to date share price return of 106.32 percent and a 1 year total shareholder return of 127.69 percent. This suggests momentum is shifting from speculative hype toward early execution.

If this kind of shift from promise to proof interests you, it is worth exploring other auto focused opportunities via our screen of auto manufacturers.

Yet with QuantumScape still pre revenue, burning cash and now trading above consensus price targets after a triple digit year, are investors being handed an early stage bargain, or is the market already pricing in tomorrow’s growth?

Most Popular Narrative Narrative: 54.3% Undervalued

According to davidlsander, the narrative fair value of $25 sits well above QuantumScape’s last close at $11.43, framing a bold upside case.

Key Breakthroughs and Validated Performance:

• Ultra-Fast Charging: QuantumScape batteries can charge from 0% to 80% in less than 15 minutes3. Their ceramic separator can withstand current densities equivalent to a 2-minute charge (25C rate) without failure, a "remarkable leap" that "blows away any previous demonstration"3. This capability is "astonishing" and "reimagines what fast charging even means"89.

Want to see why this narrative backs such a steep upside? It leans on rapid revenue acceleration, ambitious margins and a future earnings multiple usually reserved for elite innovators.

Result: Fair Value of $25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, solid state scale up challenges and competitive advances from rivals like Toyota could delay commercialization and undermine the current upside narrative.

Find out about the key risks to this QuantumScape narrative.

Another Lens on Valuation

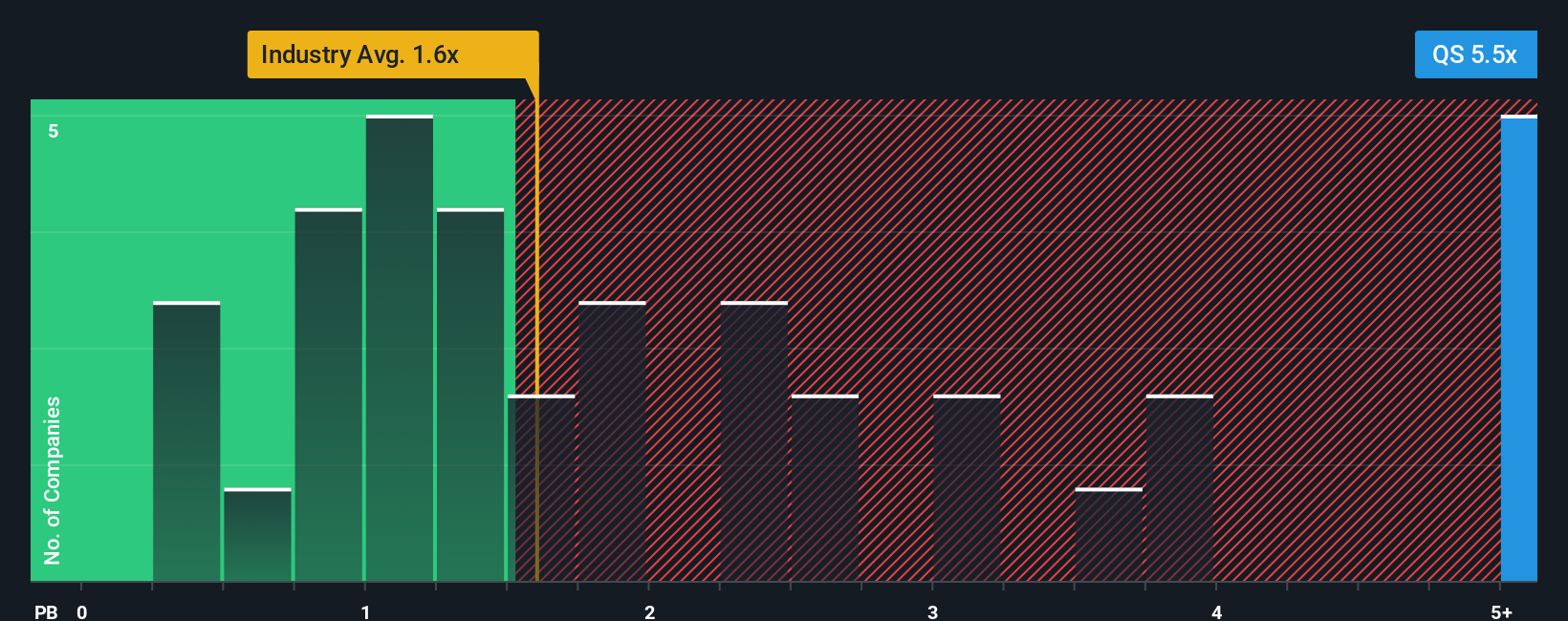

Market based signals paint a very different picture from the $25 narrative fair value. With no meaningful revenue yet, QuantumScape trades at roughly 5.7 times book value, versus about 1.6 times for the US auto components industry and 1.8 times for peers, implying a steep optimism premium.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own QuantumScape Narrative

If you see the story differently or want to stress test the assumptions yourself, you can build a fresh narrative in minutes: Do it your way.

A great starting point for your QuantumScape research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next edge by scanning fresh opportunities in minutes, so you are not relying on a single high risk bet.

- Target high potential bargains by screening these 914 undervalued stocks based on cash flows that already look cheap on cash flow expectations.

- Ride powerful technology trends by checking out these 25 AI penny stocks shaping the next wave of intelligent automation.

- Strengthen your income stream by finding these 13 dividend stocks with yields > 3% that can help keep cash coming in while markets fluctuate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if QuantumScape might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QS

QuantumScape

Focuses on the development and commercialization of solid-state lithium-metal batteries for electric vehicles and other applications in the United States.

Excellent balance sheet with moderate risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion