- United States

- /

- Auto Components

- /

- NYSE:QS

QuantumScape (QS) Valuation in Focus After Milestone Q3 Billings, QSE-5 Shipments, and Strengthened Outlook

Reviewed by Simply Wall St

QuantumScape, a leading solid-state battery developer, reported a narrower net loss and announced its first-ever customer billings in the third quarter. Investors took note as the company emphasized stronger revenue visibility and an improved cost structure.

See our latest analysis for QuantumScape.

Thanks to a double dose of good news: improved earnings and the shipment of cutting-edge QSE-5 cells, QuantumScape’s share price momentum has accelerated, up an impressive 23% over the past month and soaring 181% year-to-date. For investors focused on the bigger picture, the 1-year total shareholder return of 186% reflects renewed optimism about solid-state battery breakthroughs and QuantumScape’s potential role in powering the next wave of electric vehicles.

If this kind of innovation has you curious about what else is on the move, now’s the moment to uncover promising companies in the sector. See the full list for free.

But after such dramatic gains and a wave of positive developments, the question lingers: are QuantumScape shares undervalued on future potential, or has the recent run-up already priced in what lies ahead?

Most Popular Narrative: 37.6% Undervalued

QuantumScape’s most-watched narrative calculates a fair value of $25 per share, well above the last closing price of $15.59. This suggests that, according to the narrative by davidlsander, there is still significant upside in the stock for believers in next-generation battery tech.

At the heart of QuantumScape’s innovation is its proprietary ceramic separator, a unique component that enables an anode-free lithium metal battery architecture. This design allows them to solve the elusive "and problem", simultaneously achieving multiple critical performance metrics that have long eluded the battery industry.

Ever wondered what turbocharges this bold valuation target? There is a financial forecast intertwined with breakthrough battery tech, strong growth ambitions, and surprising manufacturing twists. The narrative teases a future where today’s challenges become tomorrow’s windfalls. Curious which big number changed the game? Dive in to see what assumptions drive such a premium target.

Result: Fair Value of $25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, scaling up production and potential delays in vehicle integration remain real challenges that could test QuantumScape’s ambitious outlook.

Find out about the key risks to this QuantumScape narrative.

Another View: Looking at Book Value

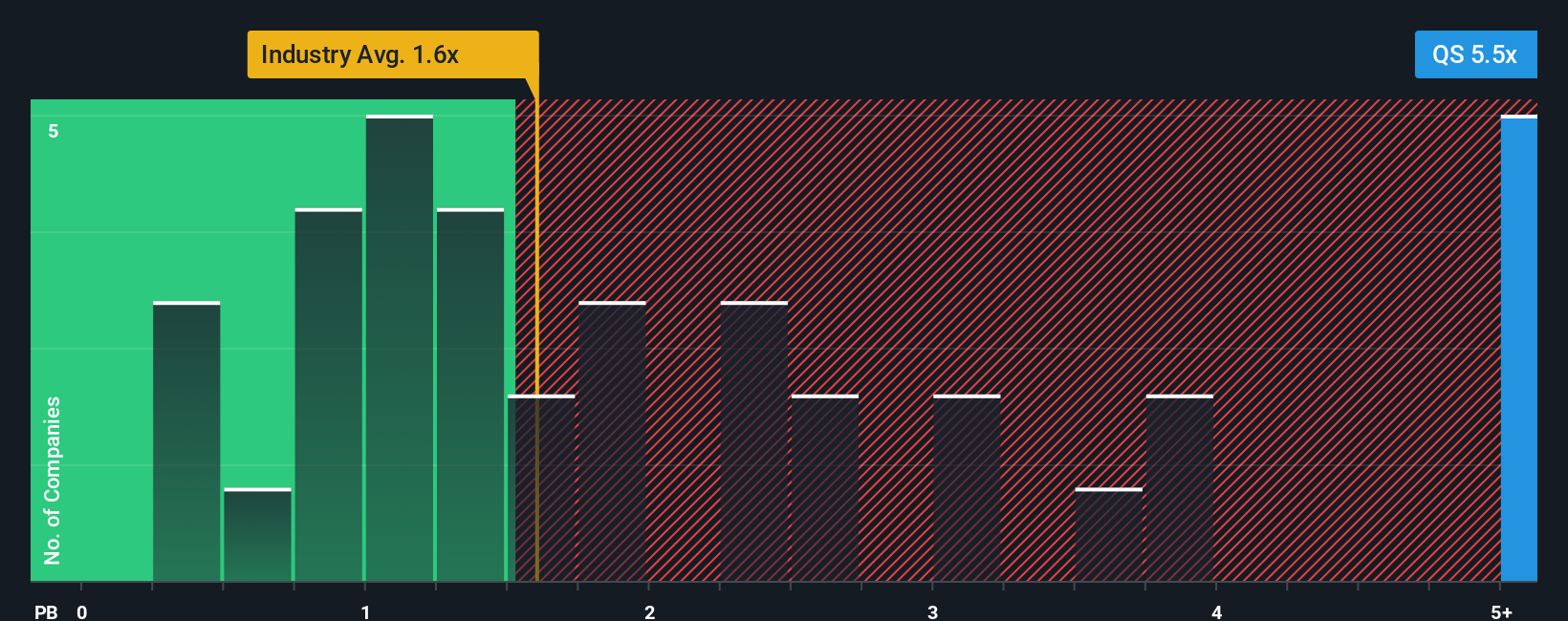

While narrative-driven forecasts point to significant upside, a look at QuantumScape’s price-to-book ratio tells a different story. At 7.7x, QuantumScape trades at more than double its peer average of 3.6x and far above the US Auto Components industry average of 1.6x. This premium suggests investors are already baking in a lot of future optimism, raising the question: can fundamentals catch up to support such a rich valuation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own QuantumScape Narrative

If you think a different storyline fits the numbers or want to chart your own perspective, you can easily craft your own narrative in just minutes. Do it your way

A great starting point for your QuantumScape research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Great companies aren’t found by chance, and your next smart move could be just a click away. Don’t let game-changing opportunities in emerging or overlooked sectors slip by.

- Accelerate your portfolio with momentum by seizing these 868 undervalued stocks based on cash flows, packed with stocks trading below their true worth before the crowd catches on.

- Capitalize on innovation in healthcare breakthroughs by browsing these 34 healthcare AI stocks, featuring companies harnessing artificial intelligence to transform patient outcomes and medical diagnostics.

- Unearth early-stage growth stories through these 3575 penny stocks with strong financials, where nimble businesses with strong foundations are ready for their next big leap.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QuantumScape might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QS

QuantumScape

Focuses on the development and commercialization of solid-state lithium-metal batteries for electric vehicles and other applications in the United States.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives