- United States

- /

- Auto Components

- /

- NYSE:QS

QuantumScape (QS): Evaluating Valuation Following Recent Share Price Swings

Reviewed by Simply Wall St

QuantumScape (QS) shares have been on the move lately, catching the attention of investors interested in solid-state battery technology. The company’s stock performance this year suggests shifting market sentiment as QuantumScape continues to pursue its commercial goals.

See our latest analysis for QuantumScape.

QuantumScape’s share price has been anything but quiet this year. After surging more than 140% year-to-date, the past week and month have seen pullbacks of 19% and 25% respectively. The company’s one-year total shareholder return of 183% is still staggering. This rollercoaster in price momentum hints that investors are weighing long-term growth potential against the usual risks that come with breakthrough technologies.

If QuantumScape’s rapid swings have you looking for more opportunities, consider expanding your perspective and discover See the full list for free.

But with share prices swinging wildly and analysts’ targets lagging well behind the current price, the question remains: is QuantumScape now a bargain waiting for believers, or is all the future potential already baked in?

Most Popular Narrative: 46.3% Undervalued

According to davidlsander, QuantumScape's most followed narrative contends that the company's fair value sits far above its last close of $13.43, highlighting a gap that could be significant for investors watching its next move. The narrative backs up this bullish view with bold assumptions about the transformative impacts of QuantumScape’s proprietary technology and its competitive position in the industry.

QuantumScape (QS), a company that for years was often dismissed as a mere "science project" by skeptics, has definitively transformed into a formidable business on the verge of real-world impact. Having chosen the "Hard Path" to tackle fundamental battery challenges, QuantumScape's journey, spanning over a decade and fueled by approximately $1.5 billion in funding (with roughly $300 million strategically deployed to date), is now poised for commercial success.

Want to know the numbers driving this potential triple-digit upside? Dive into why this narrative places so much emphasis on commercial milestones, rapid scaling, and pivotal partnerships. See which future projections set these calculations apart and discover the missing link that could reshape how undervalued QuantumScape truly is.

Result: Fair Value of $25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent challenges in scaling up manufacturing and heightened competition from major automakers could quickly reshape QuantumScape’s perceived edge.

Find out about the key risks to this QuantumScape narrative.

Another View: What Does Our DCF Model Signal?

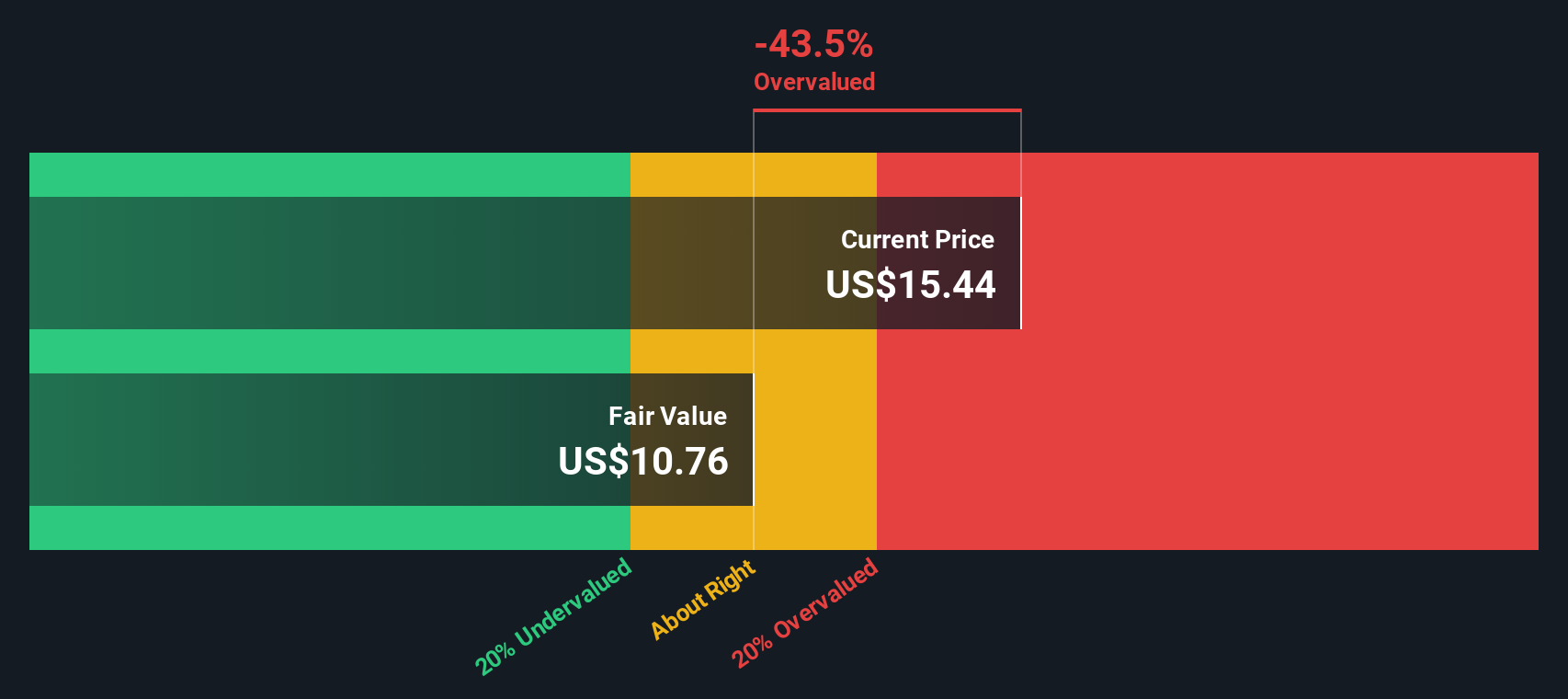

While the most popular narrative paints QuantumScape as significantly undervalued, our DCF model tells a different story. It estimates fair value at $10.86, which is below the current price of $13.43. This suggests there may be less upside than many bulls believe. Could this point to too much optimism already priced in?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out QuantumScape for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own QuantumScape Narrative

If you see things differently or value personal research, take charge and build your own view in under three minutes. Do it your way.

A great starting point for your QuantumScape research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Great opportunities never wait around. Open the door to your next winning pick by using the Simply Wall Street Screener and see where your curiosity could lead you. With so much rapid change in the market, now is the time to act and ensure you’re not left behind on tomorrow’s biggest success stories.

- Capitalize on under-the-radar growth by jumping into these 3593 penny stocks with strong financials that are making waves before the crowd catches on.

- Seize the edge in the booming world of artificial intelligence with these 25 AI penny stocks setting new standards for innovation and profitability.

- Secure your portfolio's future by targeting value opportunities from these 879 undervalued stocks based on cash flows that bring strong cash flows and compelling upside prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QuantumScape might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QS

QuantumScape

Focuses on the development and commercialization of solid-state lithium-metal batteries for electric vehicles and other applications in the United States.

Excellent balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives