- United States

- /

- Auto Components

- /

- NYSE:QS

QuantumScape (NYSE:QS) Sees 10% Decline Over Last Month Amid Global Trade Tensions

Reviewed by Simply Wall St

QuantumScape (NYSE:QS) experienced a price move of 10% over the last month, during which stocks worldwide tumbled due to escalating trade tensions as significant tariffs were imposed by major economies. The broader market downturn saw the 5.6% decline in overall market indices, propelled by fears of a recession and inflationary pressures, impacting tech-heavy sectors like QuantumScape. As a pioneer in solid-state battery technology, QuantumScape's shares were affected amid investor uncertainty and the broader sell-off in technology stocks, reflecting concerns about reduced economic growth and heightened market volatility.

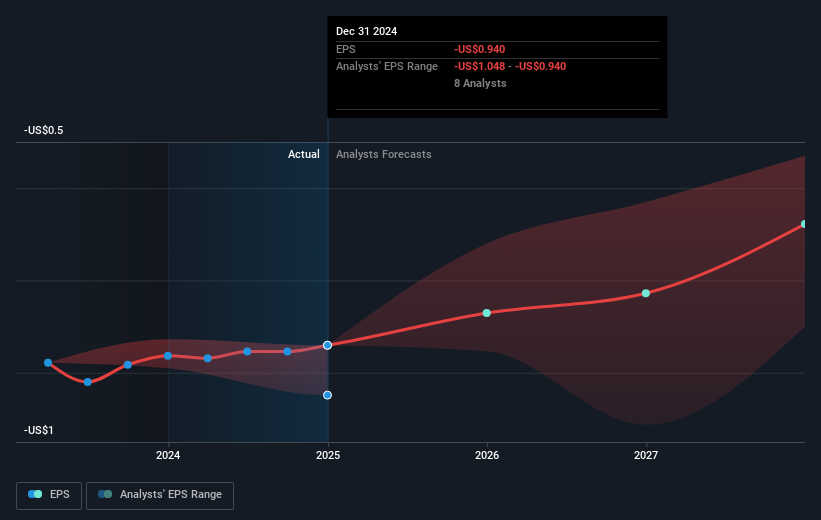

Over the past year, QuantumScape's total shareholder return declined by 32.37%, aligning closely with the US Auto Components industry's 32.7% decline. This performance lagged behind the broader US market, which rose by 3.3% during the same period. Investors have been cautious as the company reported ongoing net losses in 2024, with a Q4 net loss of US$114.66 million. The substantial insider selling over the past three months has also contributed to investor unease.

Despite these challenges, QuantumScape is advancing collaborations to improve its market position. The company's agreement with PowerCo to industrialize its solid-state battery technology represents a significant step, with plans to produce up to 40 GWh annually and expand further. Concurrently, leadership changes, including the appointment of Dennis Segers as Chairman, aim to steer QuantumScape through these transformative initiatives as it seeks to strengthen its foothold in the electric vehicle battery market.

Assess QuantumScape's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QuantumScape might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QS

QuantumScape

Focuses on the development and commercialization of solid-state lithium-metal batteries for electric vehicles and other applications in the United States.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives