- United States

- /

- Auto Components

- /

- NYSE:PHIN

PHINIA (PHIN): Evaluating the Stock’s Valuation Following Its Recent Share Price Pause

Reviewed by Kshitija Bhandaru

See our latest analysis for PHINIA.

After a strong run in the past year, PHINIA’s share price has recently taken a breather, even as its 1-year total shareholder return stands at nearly 27%. Short-term price returns have paused, but the longer-term momentum and outlook remain positive as investors look for signs of sustainable growth and value.

If you’re tracking momentum in the auto tech space, now is the perfect time to see what else is happening among automakers. Discover See the full list for free.

With shares pausing near their recent highs and future growth already strong, the question is whether PHINIA is flying under the radar or if its share price has already factored in all that upside. Could there still be room to buy in, or are markets a step ahead?

Most Popular Narrative: Fairly Valued

With PHINIA's last close of $56.47 aligning closely with the most followed narrative’s fair value target, the debate centers on whether current optimism is already reflected in the price or if further upside exists.

“Increased regulatory pressure for lower vehicle emissions globally is accelerating adoption of advanced fuel systems and after-treatment solutions. PHINIA is positioned to benefit from this structural tailwind, driving sustained revenue growth and margin expansion through premium product offerings.”

What powers the price? The narrative pins PHINIA’s worth on ambitious gains in operating margins and bold multi-year growth projections. Want to see exactly which big improvements and future multiples the valuation hinges on? The real story is in the numbers the consensus uses, so dive in for the details and surprises that shape this fair value.

Result: Fair Value of $56 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slow adoption in new markets or setbacks in electrification could challenge PHINIA’s growth narrative and put pressure on its earnings outlook going forward.

Find out about the key risks to this PHINIA narrative.

Another View: Deep Discount on SWS DCF Model

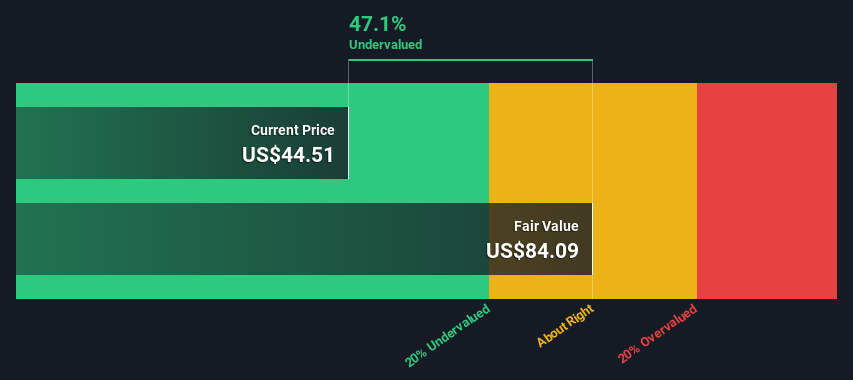

While the consensus price target suggests PHINIA is fairly valued today, our SWS DCF model offers a radically different perspective. According to this method, PHINIA is trading nearly 45% below its estimated fair value, which highlights a significant potential upside that the market may be missing. Which perspective will prove accurate as the company's fundamentals develop?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PHINIA for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PHINIA Narrative

If you see things differently or want to dig into the data yourself, you can shape your own PHINIA story in just a few minutes. Do it your way

A great starting point for your PHINIA research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors keep their edge by hunting for tomorrow’s standouts today, not just settling for what’s trending now. If you want to give your portfolio an extra lift, check out these unique opportunities before they’re gone:

- Tap into the next wave of automation by checking out these 24 AI penny stocks, which are at the forefront of artificial intelligence and machine learning advancements.

- Secure reliable returns and income streams as you review these 19 dividend stocks with yields > 3%, which offers attractive yields for investors prioritizing consistent payouts.

- Seize the chance to invest early in what could become the market’s next success stories with these 3569 penny stocks with strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PHIN

PHINIA

Engages in the development, design, and manufacture of integrated components and systems.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives