- United States

- /

- Auto Components

- /

- NYSE:PHIN

How PHINIA’s (PHIN) Legal Settlement and Tax Clarity Could Reshape Its Investment Outlook

Reviewed by Sasha Jovanovic

- PHINIA Inc. recently resolved longstanding legal disputes with BorgWarner by entering into a settlement agreement, resulting in an anticipated one-time loss of approximately US$39 million for the third quarter of 2025, primarily related to tax matters from prior to their 2023 spin-off.

- This agreement not only clarifies PHINIA's future tax positions and financial obligations but also unlocks potential cash inflow of up to US$29 million from research and development credits by the end of 2026.

- We'll explore how the settlement's financial clarity and tax benefits may reshape PHINIA's investment narrative going forward.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

PHINIA Investment Narrative Recap

To be a confident PHINIA shareholder today, you need to believe the firm can successfully transition and diversify beyond its reliance on internal combustion engine technologies, leveraging cash flows from legacy businesses to grow in alternative fuels and new end-markets. The recent BorgWarner settlement, while resulting in a one-off US$39 million charge, brings tax clarity and potential future credits, but does not alter PHINIA’s most important near-term catalyst: execution on revenue diversification; nor does it materially impact the largest risk, exposure to ICE market contraction. PHINIA’s recent 2025/2026 Global Emission Standards Booklet, supporting industry adaptation to new regulations, reinforces how regulatory pressure can remain a catalyst for advanced fuel system adoption and aftermarket demand, key elements tied to the longer-term success signaled in the investment narrative. However, it’s important to remember that, unlike one-time legal events, the secular risk from a shrinking ICE market is an ongoing challenge investors should be aware of...

Read the full narrative on PHINIA (it's free!)

PHINIA's narrative projects $3.6 billion revenue and $246.8 million earnings by 2028. This requires 2.3% yearly revenue growth and a $138.8 million increase in earnings from $108.0 million today.

Uncover how PHINIA's forecasts yield a $58.20 fair value, a 7% upside to its current price.

Exploring Other Perspectives

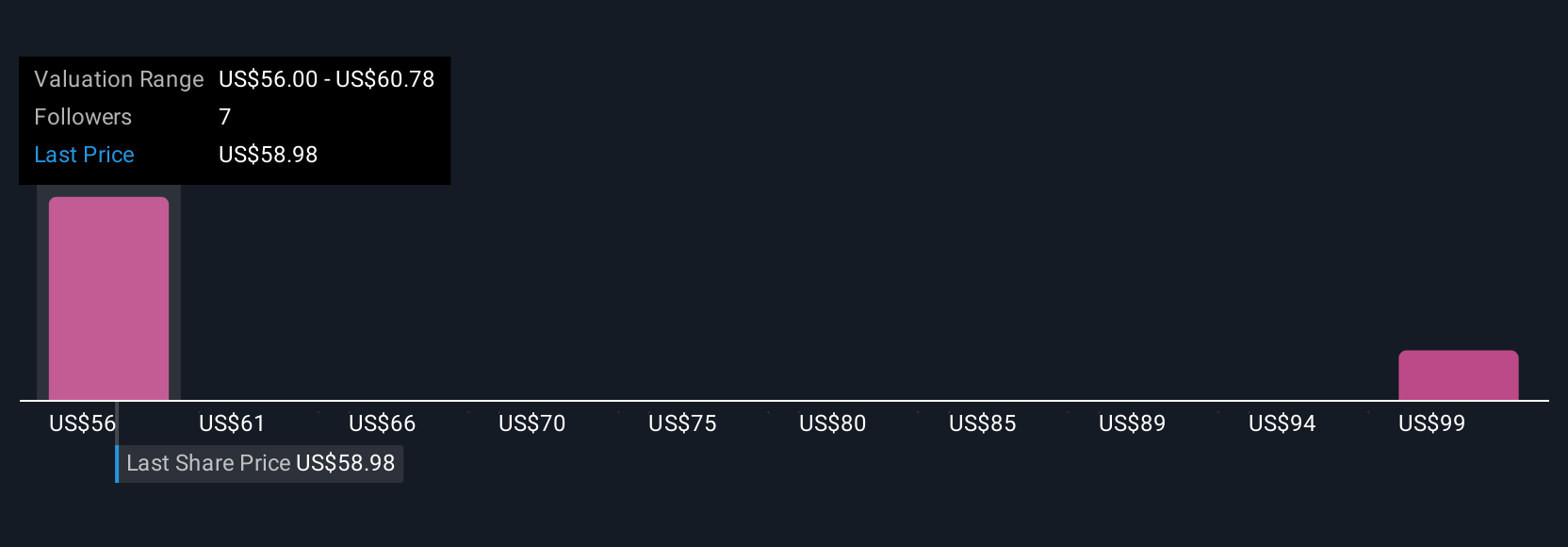

Simply Wall St Community members have placed PHINIA’s estimated fair value between US$58.20 and US$101.27 based on two analyses. Yet, with the company's top risk tied to the future of combustion engines, these contrasting projections reflect just how much investor outlooks can differ, consider exploring several viewpoints to get the full picture.

Explore 2 other fair value estimates on PHINIA - why the stock might be worth as much as 86% more than the current price!

Build Your Own PHINIA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PHINIA research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PHINIA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PHINIA's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PHIN

PHINIA

Engages in the development, design, and manufacture of integrated components and systems.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives