- United States

- /

- Auto Components

- /

- NYSE:MOD

Modine Manufacturing (MOD) Sees 56% Price Surge Over Last Quarter

Reviewed by Simply Wall St

Modine Manufacturing (MOD) recently introduced advanced cooling solutions and inaugurated a large facility in India, strengthening its position in high-demand markets. These developments align with a 56% share price increase over the last quarter. In parallel, broader market trends showed significant gains, with major indexes like the Dow and S&P 500 reaching record highs due to anticipated Federal Reserve rate cuts. Modine's strategic enhancements likely helped it capitalize on these favorable market conditions, supporting its robust share price appreciation. This synergy of company-specific progress and overall market optimism underscores Modine's competitive positioning.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

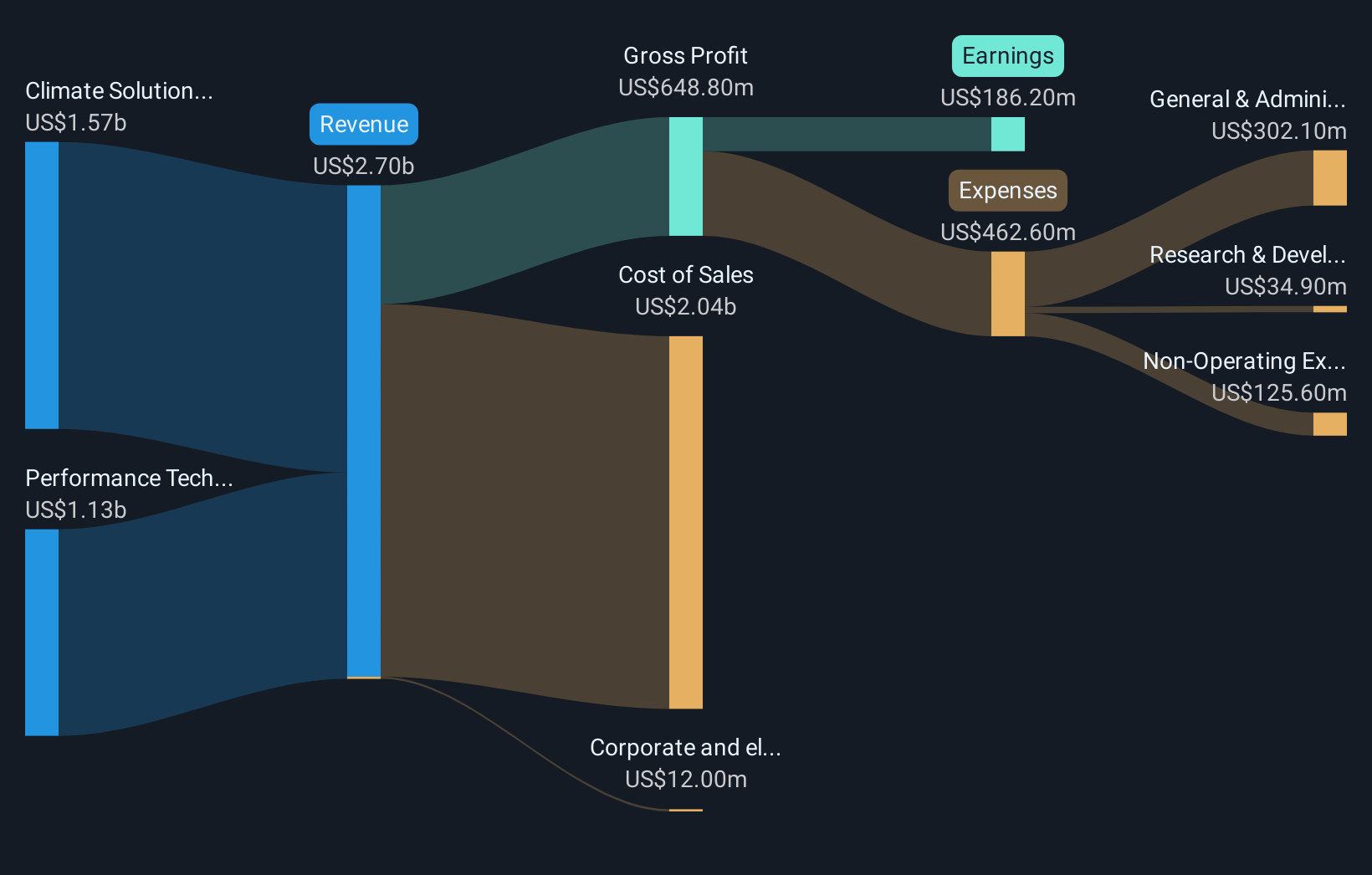

The recent advancements by Modine Manufacturing, such as the introduction of advanced cooling solutions and the opening of a new facility in India, align with strategic goals focused on expanding the company's reach in high-demand markets. This expansion could potentially enhance Modine's revenue and earnings prospects as it taps into the burgeoning data center and HVAC markets. With management estimating that data center revenues could double by fiscal 2028, these developments may support the company's ambitious growth forecasts.

Over the past five years, Modine's total shareholder return was extraordinarily high, reaching very large values, illustrating a sustained period of significant return on investment for shareholders. In the shorter term, over the past year, Modine's performance outpaced both the US Auto Components industry and the broader US market, with the company's returns exceeding industry and market averages of 30.7% and 20%, respectively.

Despite the recent share price rally, the current price of $151.50 remains slightly below the consensus price target of $160.0, indicating potential upward movement if forecasted revenue of $4 billion and earnings of $453 million by 2028 are realized. However, the current share price already suggests a substantial recognition of Modine's growth potential and strategic execution, and investors will keenly watch how the company manages execution risks and market dynamics to achieve projected outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MOD

Modine Manufacturing

Designs, engineers, tests, manufactures, and sells mission-critical thermal solutions in the United States, Canada, Italy, Hungary, the United Kingdom, China, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.