- United States

- /

- Auto

- /

- NYSE:LVWR

A Look at LiveWire Group’s Valuation Following Major Leadership Transition Announcement

Reviewed by Simply Wall St

Leadership Change Sparks Fresh Questions for LiveWire Group (NYSE:LVWR) Investors

Big leadership changes always get Wall Street talking, and the latest from LiveWire Group (NYSE:LVWR) is no exception. The company has announced that Jochen Zeitz, its founding Chairman and former CEO, will step down from the Board at the end of September 2025. Not only is Zeitz a pivotal figure in LiveWire’s short history, but his simultaneous departure from both LiveWire and parent company Harley-Davidson signals a clean break from the company’s origins. The Board has already tapped Jonathan Root, a senior Harley-Davidson executive and current LiveWire director, as the incoming Chairman. This move underscores both change and continuity.

If you have been tracking LiveWire's rollercoaster of a year, you know this isn't just another boardroom shuffle. The stock has shed 31% over the past year while showing some recent signs of life, with a nearly 30% gain this month and a 37% jump over the past week. Despite these short-term spikes, long-term performance remains negative, and the market is clearly responding with caution as much as optimism. Prior updates had centered on electric motorcycle model launches and synergy with Harley-Davidson, but this leadership shift brings the spotlight firmly onto governance and strategy.

With momentum suddenly swinging but the company still deep in transition, the key question is whether LiveWire Group can capitalize on its new leadership structure or if the market has already factored the next chapter into the share price.

Price-to-Sales of 41.4x: Is it justified?

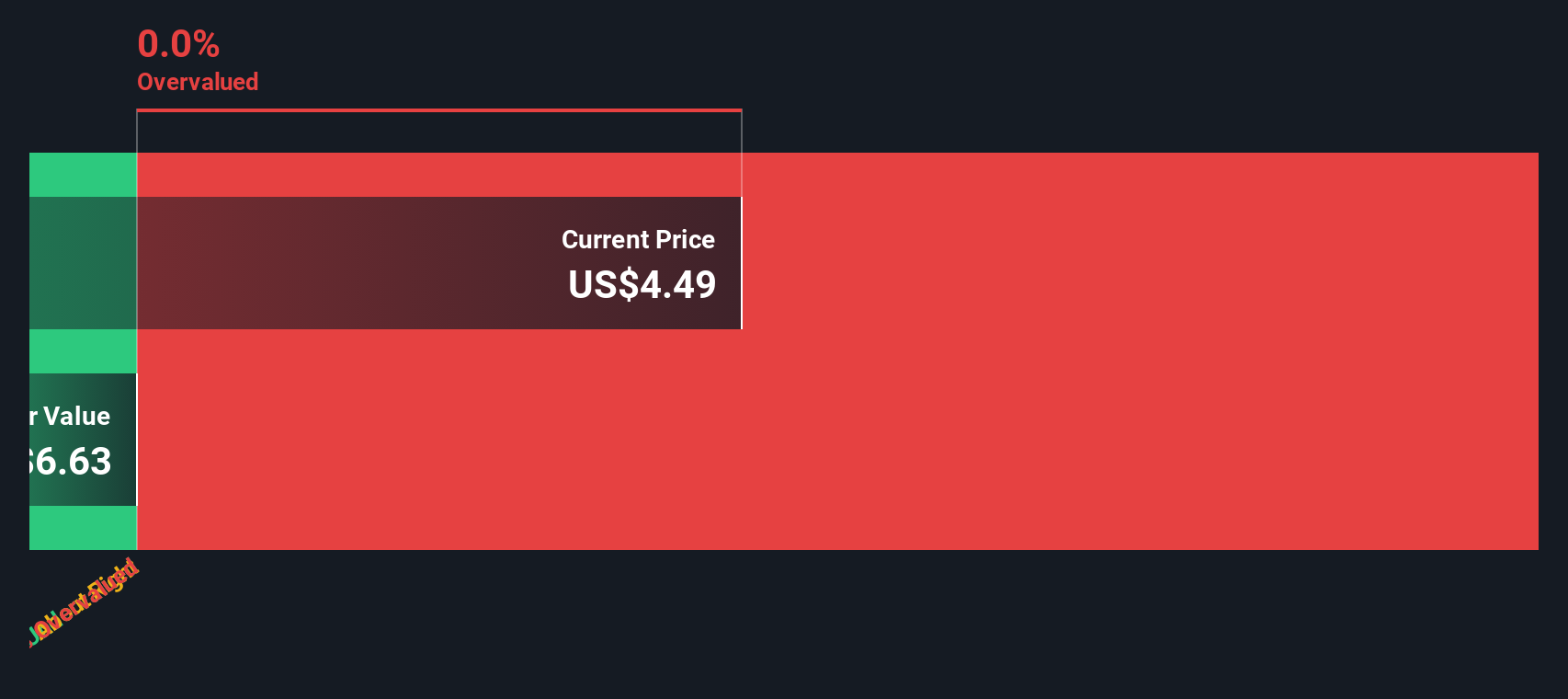

By the numbers, LiveWire Group trades at a Price-to-Sales (P/S) ratio of 41.4 times, which is sharply higher than both the US Auto industry average (1.3x) and the average among its listed peers (0.8x). This suggests the stock is currently overvalued on this metric.

The Price-to-Sales ratio measures how much investors are willing to pay for each dollar of a company's sales. In capital-intensive industries such as automotive manufacturing, a lower P/S ratio is typically favored because margins are thin and earnings volatility is common. For a growth story to warrant such a premium, markets generally expect very rapid revenue expansion, improving profit margins, or the emergence of a significant competitive moat.

With valuation this far above the sector, the implication is that the market anticipates exceptional future growth or a dramatic shift in business prospects. However, given LiveWire's recent financial performance and lack of profitability, these expectations reflect optimism rather than demonstrated results. At current levels, investors should be mindful of the gap between future projections and present fundamentals.

Result: Fair Value of $4.84 (OVERVALUED)

See our latest analysis for LiveWire Group.However, limited revenue growth and ongoing net losses remain key risks that could derail bullish expectations for LiveWire in the months ahead.

Find out about the key risks to this LiveWire Group narrative.Another View: Discounted Cash Flow

A different lens, our SWS DCF model, also suggests the stock may be overvalued based on future cash flows. This adds weight to concerns raised by the high sales multiple. Could this alignment mean the market is missing something, or are expectations really that stretched?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own LiveWire Group Narrative

If you see things differently, or want to dig deeper before taking a view, our platform lets you build your own perspective in just a few minutes. Do it your way

A great starting point for your LiveWire Group research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Staying ahead means knowing where the next winners could be. Don’t limit yourself to one opportunity. Supercharge your strategy with more hand-picked stocks today.

- Target high-yield opportunities and boost your income with a lineup of companies offering attractive returns via dividend stocks with yields > 3%.

- Tap into the artificial intelligence boom by tracking companies at the forefront of machine learning innovation with AI penny stocks.

- Uncover hidden gems trading below their intrinsic value and sharpen your edge by reviewing undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LVWR

LiveWire Group

Manufactures and sells electric motorcycles in the United States, Austria, and internationally.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives