- United States

- /

- Auto Components

- /

- NYSE:LEA

Does Lear’s 2025 Momentum and EV Program Wins Justify Its Current $117 Share Price?

Reviewed by Bailey Pemberton

- Many investors are asking whether Lear, at around $117, is quietly trading below its intrinsic value. This breakdown is designed to unpack that question.

- After gaining 3.2% over the last week, 14.1% over the past month, and 26.4% year to date, Lear is starting to look more like a momentum name than the sleepy auto supplier its 5 year return of -18.0% might suggest.

- Recent headlines have focused on Lear winning new seating and E systems programs with major automakers and continuing to position itself in EV related content, reinforcing the idea that it can grow content per vehicle even in a choppy auto cycle. At the same time, industry news around automakers retooling for electric platforms and software defined vehicles has pushed investors to re evaluate which suppliers have the balance of resilience and upside.

- Right now, Lear scores a 4 out of 6 on our valuation checks, which suggests it screens as undervalued on most, but not all, of the usual metrics. Next we will walk through those methods before finishing with a more powerful way to think about what the stock is really worth.

Approach 1: Lear Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and then discounting them back to today in $ terms. For Lear, the latest twelve month Free Cash Flow is about $715 million, and analysts expect it to remain in the mid to high $500 million range over the coming years, with Simply Wall St extrapolating cash flows out to 2035 as analyst visibility drops off.

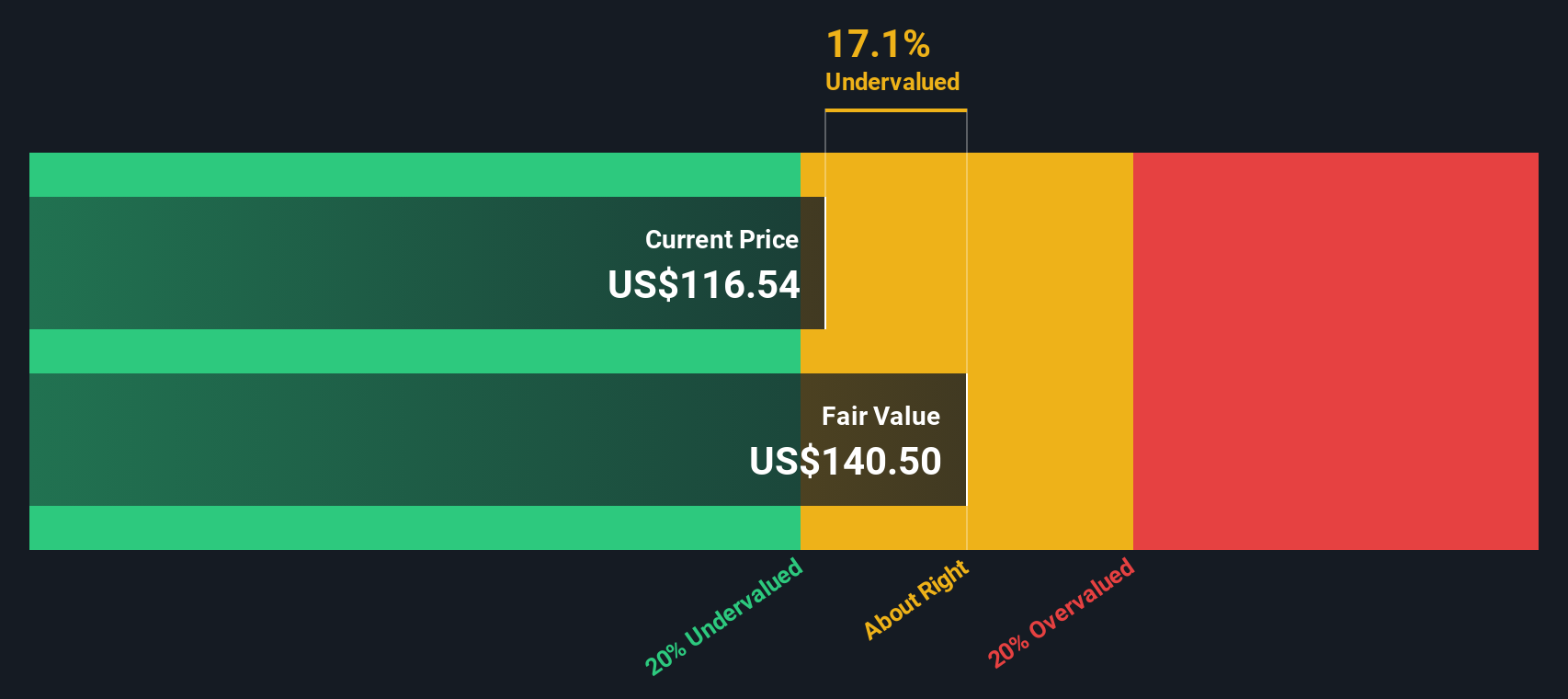

Under this 2 Stage Free Cash Flow to Equity model, Lear’s projected cash flows gradually moderate but stay solidly positive. This supports a DCF fair value estimate of roughly $141 per share. Compared with the current share price around $117, this output implies the stock is about 16.6% undervalued on a cash flow basis and indicates that the market may not be fully pricing in the durability of Lear’s future cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lear is undervalued by 16.6%. Track this in your watchlist or portfolio, or discover 916 more undervalued stocks based on cash flows.

Approach 2: Lear Price vs Earnings

For a profitable, established manufacturer like Lear, the Price to Earnings ratio is a useful reality check on valuation because it links what investors pay today directly to the company’s current earnings power.

In general, companies with higher, more reliable growth and lower perceived risk tend to trade on a higher normal PE multiple. Slower growth and higher cyclicality usually mean a lower one. With Lear trading on about 13.7x earnings, the stock sits well below both the Auto Components industry average of roughly 19.8x and a broader peer group closer to 28.2x.

Simply Wall St’s Fair Ratio framework refines this comparison by estimating what multiple Lear could trade on, given its earnings growth profile, margins, industry positioning, market cap and risk factors. For Lear, that Fair Ratio comes out at around 19.8x, which implies a valuation more in line with quality sector names rather than a deep discount. Comparing the current 13.7x to the 19.8x Fair Ratio highlights a notable gap on an earnings multiple basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1458 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lear Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your story about a company turned into numbers like future revenue, earnings, margins and a fair value estimate. A Narrative links what you believe about Lear’s business, such as EV program wins, automation benefits and buybacks, to a clear financial forecast and then to a single fair value number you can compare with today’s share price to decide whether it is a buy, hold or sell. On Simply Wall St, millions of investors build and share these Narratives on the Community page, and the platform keeps them dynamic by updating the data when new earnings, guidance or news hits. For Lear, one investor might build a bullish Narrative that leans on stronger 2026 margins and a fair value near $136, while a more cautious investor might focus on E Systems risks and cyclical headwinds to reach a fair value closer to $95, and Narratives make those different views transparent, comparable and easy to track over time.

Do you think there's more to the story for Lear? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LEA

Lear

Designs, develops, engineers, manufactures, assembles, and supplies automotive seating, and electrical distribution systems and related components for automotive original equipment manufacturers in North America, Europe, Africa, Asia, and South America.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion