- United States

- /

- Auto

- /

- NYSE:GM

Is GM a Hidden Value Play After 30% Rally and New Battery Investments?

Reviewed by Bailey Pemberton

- Ever wondered if General Motors is actually good value right now, or if you're just jumping in after the crowds? You're not alone, and the answer might surprise you.

- GM's stock has had quite a ride recently, up 11.2% over the past month and a strong 30.2% so far this year, but with a dip of 4.3% last week that could signal changing momentum.

- Excitement over GM's electric vehicle strategy and continued advancements in autonomous driving technology have been driving interest, with recent headlines highlighting major partnerships and big investments in battery innovation. These kinds of moves keep the stock in the spotlight, fueling both optimism and fresh questions about how much upside is left.

- General Motors scores a 5 out of 6 on our core valuation checks, which is very strong, but is that the whole story? Let’s dig into the numbers behind this score, ways to look at what GM is really worth, and why the standard approaches might miss something important at the end.

Find out why General Motors's 25.8% return over the last year is lagging behind its peers.

Approach 1: General Motors Discounted Cash Flow (DCF) Analysis

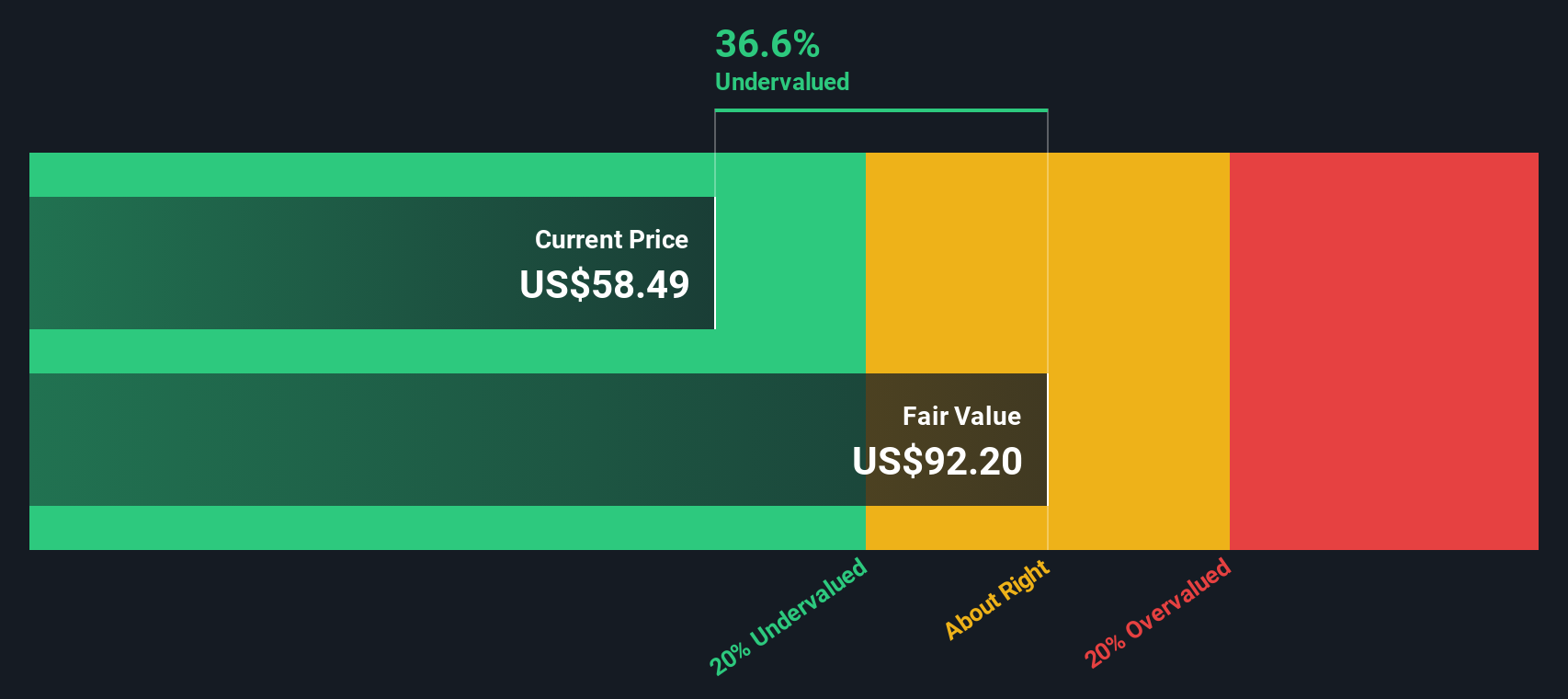

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those values back to today. This approach helps investors assess whether a stock is under- or overvalued based on expectations for the business's long-term performance.

For General Motors, the DCF model used is a two-stage Free Cash Flow to Equity calculation. GM generated $13.43 billion in free cash flow over the last twelve months, all reported in US dollars. Analyst estimates guide the next five years, predicting annual free cash flows such as $8.21 billion in 2026 and $8.40 billion by 2029. Beyond 2029, Simply Wall St’s system extrapolates further growth, projecting $9.43 billion in free cash flow by 2035. These numbers naturally involve more uncertainty the further out they go.

Based on these projections, the DCF valuation arrives at a fair value of $85.75 per share, which is 22.0% higher than GM’s current share price. This discount implies GM shares are undervalued according to this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests General Motors is undervalued by 22.0%. Track this in your watchlist or portfolio, or discover 842 more undervalued stocks based on cash flows.

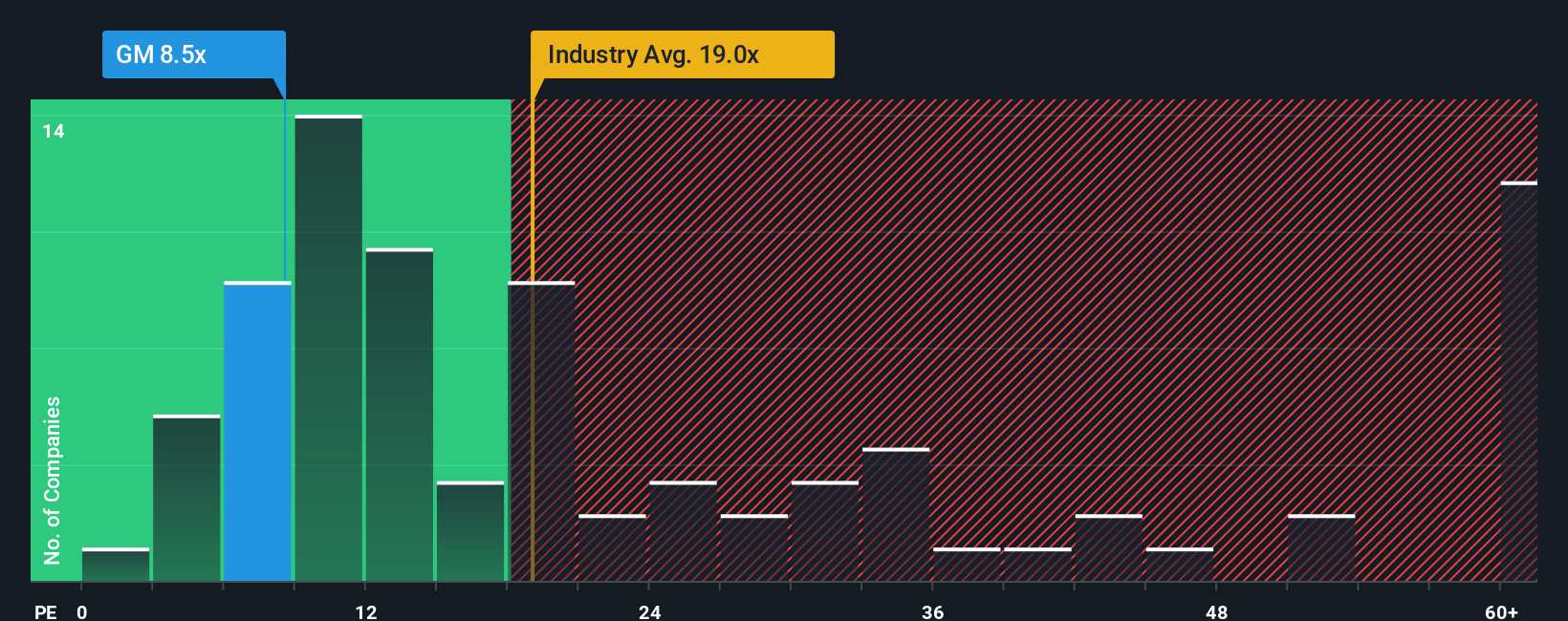

Approach 2: General Motors Price vs Earnings

The Price-to-Earnings (PE) ratio is the most common way to judge a company's value when it's reliably profitable, as it directly links the share price to earnings. For companies like GM, which consistently generate profits, the PE ratio offers a practical snapshot of whether the market's expectations are reasonable.

What qualifies as a “fair” PE ratio can shift significantly depending on factors such as expected future growth and risk. Companies with stronger earnings prospects or more resilient business models typically trade at higher PE multiples, while those facing more challenges or uncertainty might have a lower one.

General Motors currently trades at a PE of 13.1x. That is lower than the auto industry average of 18.0x and far below the selected peer group’s average of 22.2x. At first glance, GM looks undervalued compared to its sector.

Simply Wall St's “Fair Ratio” takes this analysis further by considering growth rates, profit margins, business risk, and company size. This proprietary metric, calculated at 19.2x for GM, offers a more comprehensive benchmark than peers or industry averages alone.

Comparing GM’s actual PE (13.1x) with its Fair Ratio (19.2x), GM’s stock appears undervalued based on this measure, suggesting the market may be underestimating its earnings potential and underlying strengths.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your General Motors Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your investment story, the specific reasons you believe in General Motors' future, combined with your expectations for its earnings, revenues, and margins. Narratives connect the why ("GM is likely to boost profits with its EV strategy and cost controls") to a forecast ("so I expect revenue to rise and margins to improve"), and then to a fair value you might assign the company.

The power of Narratives is that they're easy to use and available right now on Simply Wall St's Community page, where millions of investors share and compare their perspectives. Each Narrative automatically links your story and numbers to a fair value and lets you see at a glance how that stacks up to today's market price, helping you spot opportunities to buy or sell.

Best of all, Narratives are constantly kept up to date as new information and earnings arrive, so your investment thesis stays relevant without extra effort.

For example, one GM investor may forecast aggressive EV margin gains and assign a fair value of $80, while another, seeing competitive risks and slower growth, values GM at $38. Your Narrative can reflect your own outlook, letting you invest with confidence and clarity.

Do you think there's more to the story for General Motors? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GM

General Motors

Designs, builds, and sells trucks, crossovers, cars, and automobile parts worldwide.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives