- United States

- /

- Auto

- /

- NYSE:GM

General Motors (GM): Evaluating Valuation as Layoffs, Leadership Changes and EV Strategy Shift Reshape Outlook

Reviewed by Simply Wall St

General Motors (GM) is making headlines after announcing permanent layoffs at its Detroit-based Factory Zero site, citing slower-than-expected electric vehicle adoption. At the same time, GM is increasing investment in internal combustion vehicle production and restructuring its tech leadership.

See our latest analysis for General Motors.

GM’s latest shake-ups come against a backdrop of strong momentum, with a 41.7% year-to-date share price return and a 34.2% total shareholder return over the past year. While executive departures and production pivots capture headlines, the stock’s robust 23.9% gain over the last 90 days signals that investors still see plenty of upside. This is occurring even as the market recalibrates its expectations for electric vehicle adoption and GM’s evolving product mix.

If GM's strategic shifts have you scanning the broader automotive space, now could be the perfect time to discover See the full list for free.

With GM’s impressive stock gains and strategic pivots, the key question remains: is the market underestimating further upside, or has the recent rally already factored in future growth potential for shareholders?

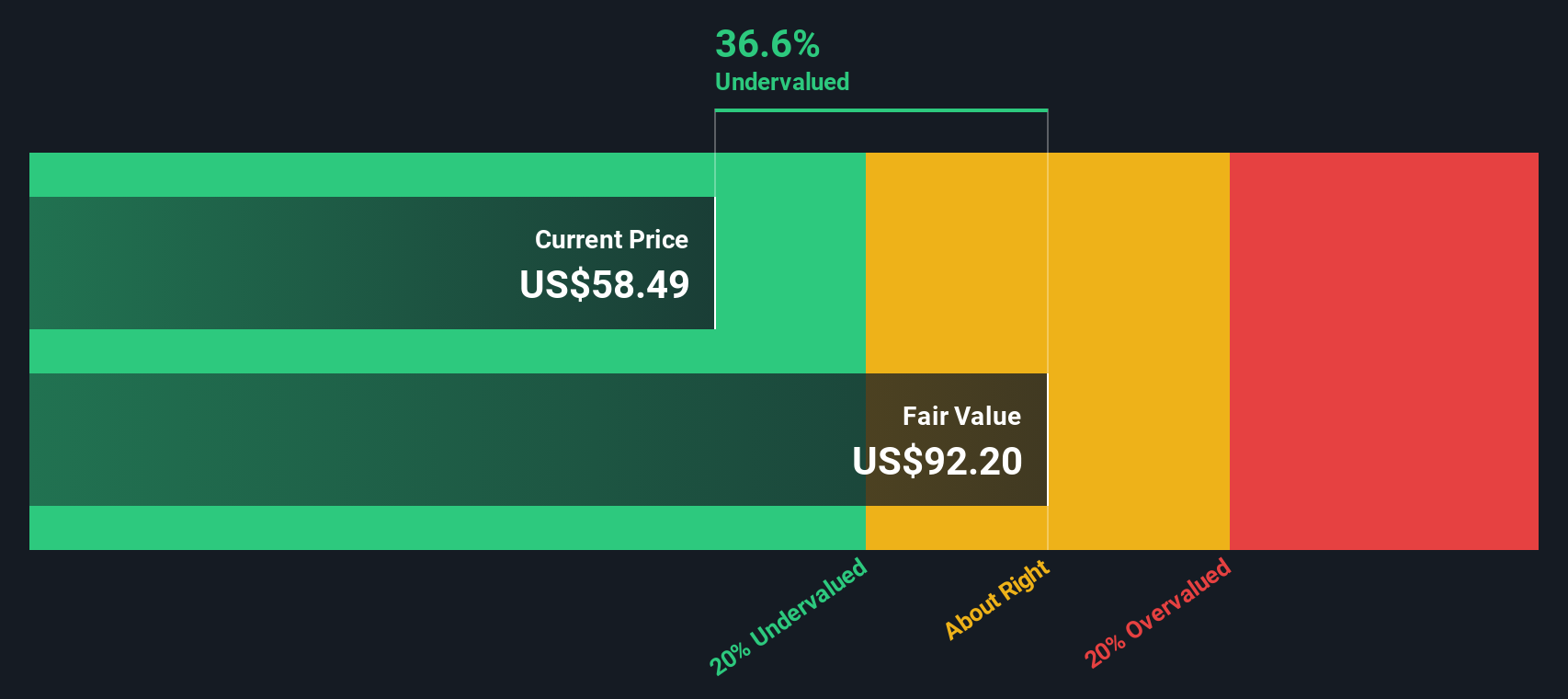

Most Popular Narrative: 1.9% Undervalued

General Motors closed at $72.78, sitting just beneath the narrative’s fair value target of $74.15. This minimal gap suggests the stock is teetering right at what analysts see as its intrinsic worth, even as its recent run captures headlines and debate swirls around underlying growth drivers.

GM's rapid expansion of its electric vehicle (EV) portfolio, especially through crossover success, luxury Cadillac EV leadership, and affordable models like the Equinox EV, positions the company to gain market share and drive revenue growth as global electrification accelerates and consumer demand recovers.

Curious what overlooked factors could push this stock higher? The fair value hinges on aggressive plans and bold projections where profits, margins, and strategic investments intersect. Find out which assumptions shape this razor-close price target and how the future could surprise both optimists and skeptics.

Result: Fair Value of $74.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high tariffs or rising warranty costs could quickly erode margins, challenging the bullish outlook and forcing a rethink on GM's valuation.

Find out about the key risks to this General Motors narrative.

Another View

The SWS DCF model provides a different perspective, estimating GM’s fair value at $60.06 per share, which is below the current market price. This suggests the stock might be somewhat overvalued based on long-term cash flow forecasts. Which model reflects GM’s real opportunity for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out General Motors for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 935 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own General Motors Narrative

Want to take a fresh look or dig deeper into the details? You can shape your own GM story in just minutes by using Do it your way

A great starting point for your General Motors research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Smart investors know it pays to look beyond the obvious. Let Simply Wall St’s curated stock ideas point you to your next big winner before others catch on.

- Uncover the potential for stand-out returns by exploring these 935 undervalued stocks based on cash flows with strong cash flows that the market may be missing.

- Tap into the global wave of innovation by discovering these 26 AI penny stocks that could benefit from developments in artificial intelligence.

- Secure reliable income streams for your portfolio by targeting these 14 dividend stocks with yields > 3% offering yields above 3% and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GM

General Motors

Designs, builds, and sells trucks, crossovers, cars, and automobile parts worldwide.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success