- United States

- /

- Auto

- /

- NYSE:F

Ford Stock Surges 36.9% in 2025 Amid EV Progress—What Does This Mean for Investors?

Reviewed by Bailey Pemberton

- Ever wondered if Ford Motor stock is genuinely a bargain or just riding the hype? You are not alone. Getting to the real answer means digging deeper than headlines.

- Ford shares have gained 1.5% in the last week, surged 15.8% over the past month, and are up an impressive 36.9% year-to-date. This performance has caught the eye of both momentum traders and value hunters.

- Major developments, including the continued ramp-up in electric vehicle production and partnerships in advanced driver-assist technology, have fueled optimism. Ford’s proactive initiatives to streamline operations have also been making headlines, shaping investor sentiment around growth and transformation.

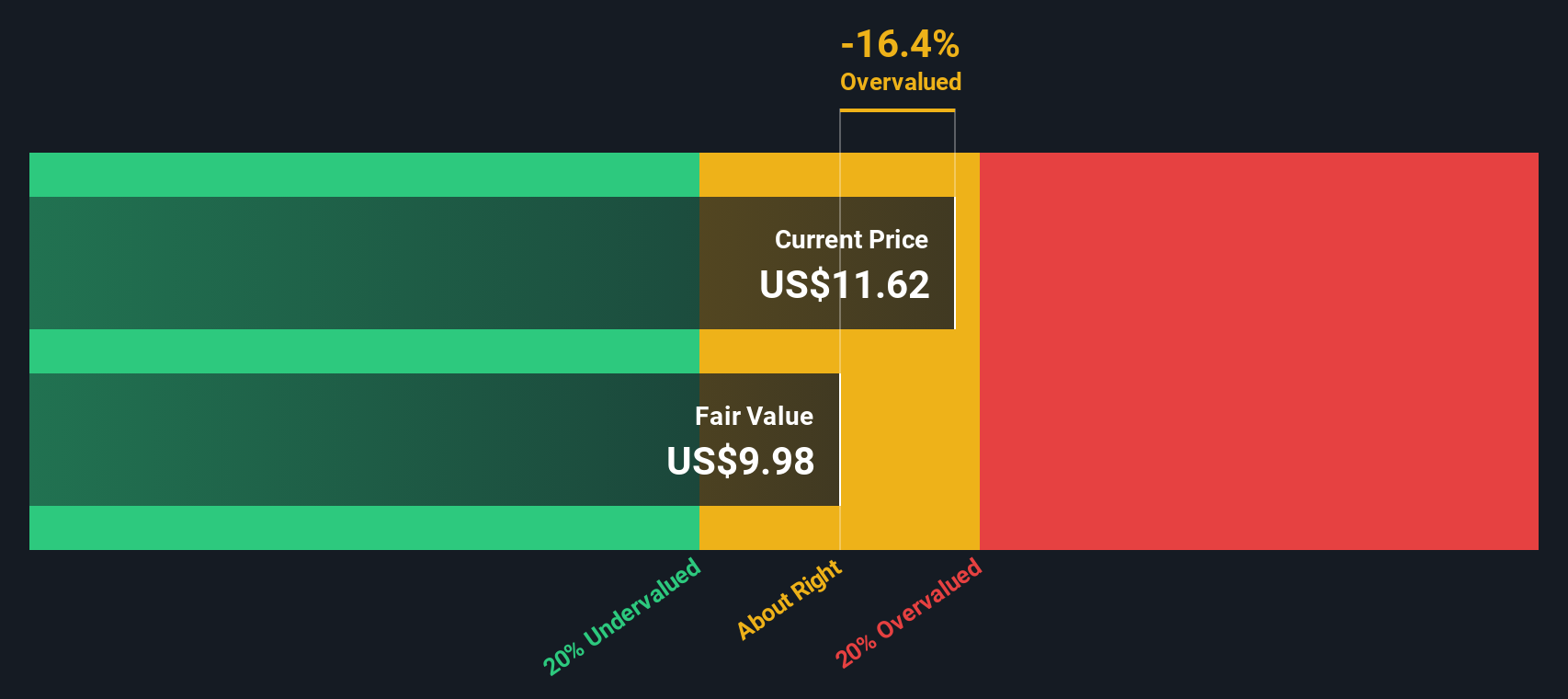

- Right now, Ford scores a 3 out of 6 on undervaluation checks. This is a decent score, but not the whole story. We will break down what each valuation approach says. Stick around, because the best way to judge if Ford is truly undervalued comes at the end of this article.

Find out why Ford Motor's 26.3% return over the last year is lagging behind its peers.

Approach 1: Ford Motor Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to their present value. This approach aims to capture what the business is fundamentally worth today, based on its future money-making potential.

For Ford Motor, the most recent twelve months’ Free Cash Flow stands at $11.75 Billion. Analysts forecast that by 2027, annual Free Cash Flow could decline to about $5.79 Billion. Projections stretched a decade further, using a combination of analyst estimates and automated extrapolations, suggest Ford's Free Cash Flow may drop steadily, reaching approximately $909 Million by 2035.

According to these long-range forecasts, the DCF model estimates Ford’s intrinsic value at $8.12 per share. Given that this value is 62.7% lower than the current share price, the DCF view suggests Ford is significantly overvalued based on expected future cash flows.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ford Motor may be overvalued by 62.7%. Discover 872 undervalued stocks or create your own screener to find better value opportunities.

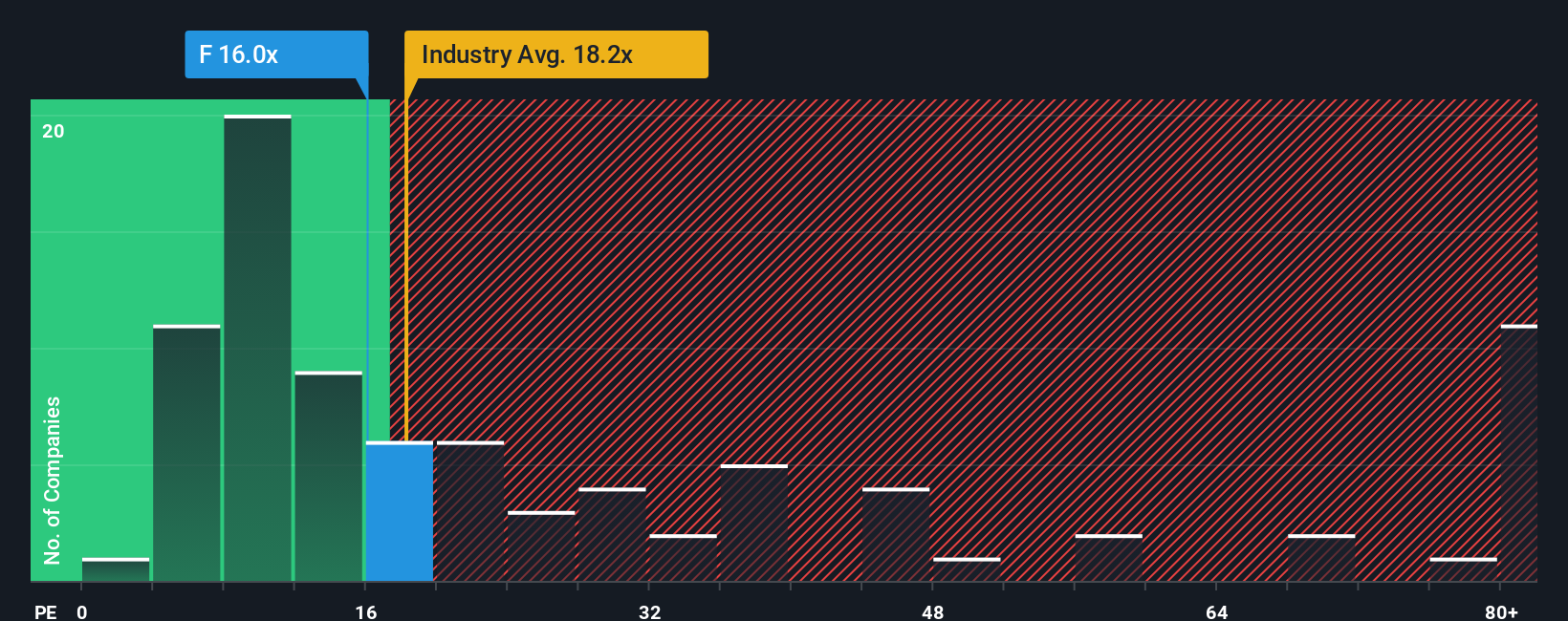

Approach 2: Ford Motor Price vs Earnings (PE Ratio)

The price-to-earnings (PE) ratio is the preferred metric for valuing profitable companies because it reflects how much investors are willing to pay today for a company’s earnings power. It quickly compares Ford’s current share price to its actual profits, making it a straightforward measure for established automakers like Ford Motor.

When deciding what a typical or "fair" PE ratio should be, growth prospects and risk levels play a major role. Companies expected to deliver strong earnings growth typically command higher PE ratios, while unstable or riskier businesses tend to see lower values.

Ford’s current PE comes in at 11.18x, which is well below the auto industry average of 18.04x and much lower than the average of key peers at 23.24x. At first glance, Ford shares look attractively priced, but comparisons with broad averages can be misleading.

That is where the Simply Wall St Fair Ratio comes in. Unlike standard benchmarks, the Fair Ratio factors in Ford’s unique mix of earnings growth, profitability, industry outlook, company size, and risk profile to define what investors should reasonably pay. For Ford, the Fair Ratio stands at 17.20x.

With Ford’s actual PE ratio notably below this proprietary benchmark, the shares appear undervalued using this method.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ford Motor Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal story of what you believe about a company, translating your assumptions about Ford Motor's future revenue, earnings, and profit margins into a single, actionable viewpoint. Narratives connect your vision of Ford’s future business, such as its shift to digital services, cost efficiencies, or EV expansion, to a financial forecast and ultimately to a fair value estimate.

On Simply Wall St’s Community page, millions of investors use Narratives as an easy and accessible tool to summarize their analysis and display exactly when they believe Ford shares offer value. Narratives instantly compare your fair value to the current price, clearly showing when Ford looks like a buy or sell based on your beliefs. Because Narratives update automatically whenever new news or earnings come out, your investment thesis always stays relevant.

For example, some investors might see Ford’s innovative connected vehicle strategies and cost discipline supporting a fair value as high as $16.00 per share, while others, worried about persistent EV losses and competitive risks, lean towards a lower value around $8.00. Narratives turn these different stories into clear, dynamic signals to guide your next move.

Do you think there's more to the story for Ford Motor? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:F

Ford Motor

Develops, delivers, and services Ford trucks, sport utility vehicles, commercial vans and cars, and Lincoln luxury vehicles worldwide.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives