- United States

- /

- Auto

- /

- NYSE:F

Ford (F): Valuation Check as EV Strategy Faces Shift With Possible F-150 Lightning Production Halt

Reviewed by Simply Wall St

Ford Motor (F) is reconsidering its approach to electric vehicles, as reports suggest the company may stop production of its F-150 Lightning pickup due to weak demand, supply disruptions, and continued losses. This shift reflects a broader reevaluation of Ford’s electric vehicle strategy in light of changing industry trends.

See our latest analysis for Ford Motor.

Ford’s recent EV shakeup comes on the heels of a remarkable run in its share price, with the stock up 16.6% over the past month and boasting a year-to-date share price return of nearly 38%. Executive changes at FordDirect and a renewed emphasis on core gas-powered models have caught investors’ attention, with momentum clearly building in the short term. However, total shareholder returns over three and five years highlight the company’s ups and downs across the industry cycle.

If Ford’s pivot has you thinking beyond the big names, this could be a prime moment to see what’s happening among other automakers. See the full list for free.

With the stock's run-up and headlines swirling, the question now is whether Ford is undervalued at current levels or if the recent surge means that the market has already factored in its future potential. Could there be more upside, or is everything already priced in?

Most Popular Narrative: 8% Overvalued

Ford Motor's most-followed valuation narrative currently suggests the fair value is $12.27 per share, which is lower than the last close of $13.30. This signals that Ford may be trading above its fundamentally justified level according to widely tracked forecasts. This points to a gap between recent market enthusiasm and the earnings-driven valuation mapped out by analysts.

Ford's ongoing transformation of its Ford Pro commercial platform, with an emphasis on high-margin, recurring revenues from software, telematics, and aftermarket services, continues to outperform. Paid software subscriptions are up 24% year-over-year and aftermarket is approaching 20% of Pro EBIT. This shift toward recurring digital revenues supports structurally higher net margins and enhances earnings durability.

Want to know the secret playbook behind Ford’s premium valuation? There’s a bold earnings shift and future profit metric at the core of these numbers. Is it a bet on surging subscriptions, margin leaps, or something even bigger? Discover the pivotal projections powering this popular narrative.

Result: Fair Value of $12.27 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent EV division losses and industry pricing pressures could quickly challenge the positive outlook that supports current analyst valuations.

Find out about the key risks to this Ford Motor narrative.

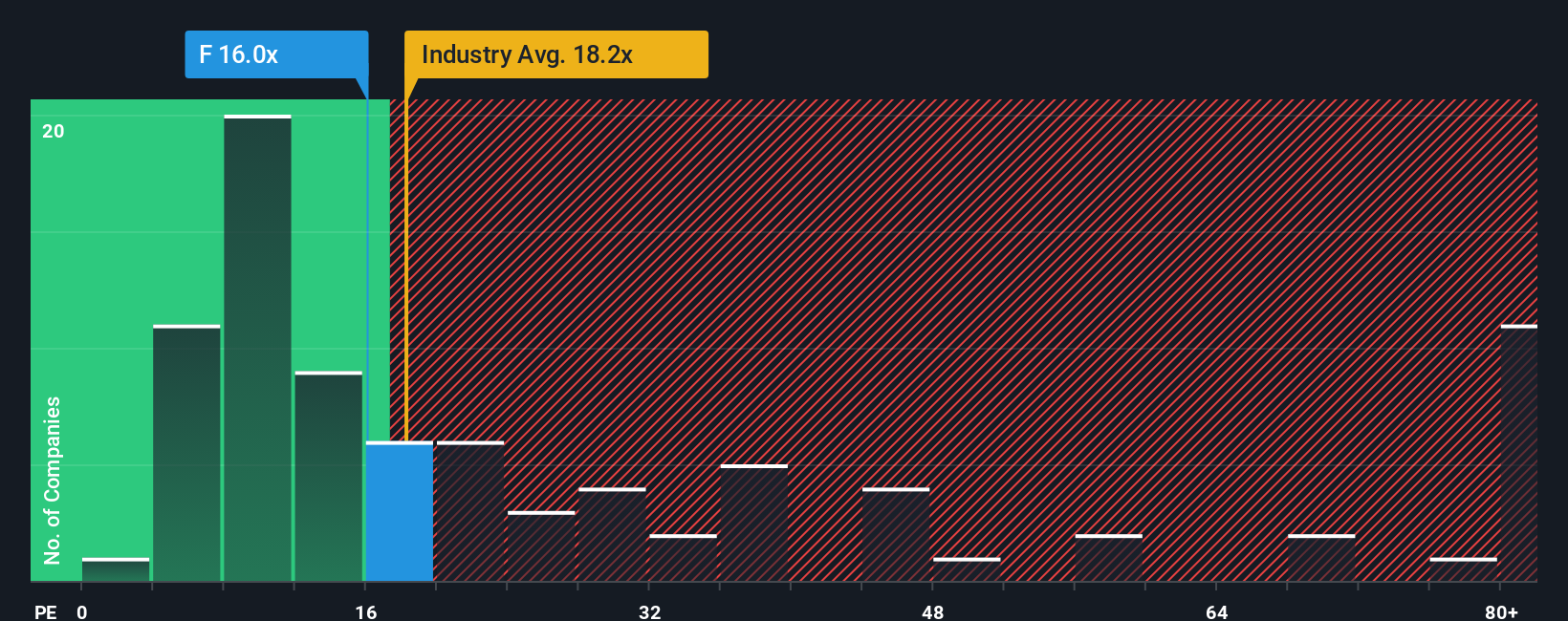

Another View: Multiples Tell a Different Story

While the popular narrative pegs Ford as overvalued, our comparison using price-to-earnings suggests something else. Ford trades at 11.3x earnings, well below both its industry average of 18.3x and peer average of 22.8x. Even the fair ratio sits higher at 17.2x. That wide gap hints at potential upside the market may be overlooking. Could this mean investors are missing a value opportunity, or is there a catch?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ford Motor Narrative

If the current narratives do not match your outlook, try diving into the numbers and crafting your own perspective in just a few minutes. Do it your way.

A great starting point for your Ford Motor research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about staying ahead of the market, do not limit yourself to just one company. Great opportunities are waiting if you know where to look.

- Capture high yields and reliable income streams by checking out these 15 dividend stocks with yields > 3%, which has a proven record of strong payouts and steady growth.

- Ride the next wave in AI innovation and uncover market leaders before they hit the spotlight with these 25 AI penny stocks.

- Maximize your search for value stocks currently trading well below their intrinsic worth by investigating these 855 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:F

Ford Motor

Develops, delivers, and services Ford trucks, sport utility vehicles, commercial vans and cars, and Lincoln luxury vehicles worldwide.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives