- United States

- /

- Auto Components

- /

- NYSE:DAN

Trade Alert: The Executive VP and President of Off-Highway Drive & Motion Systems Of Dana Incorporated (NYSE:DAN), Aziz Aghili, Has Sold Some Shares Recently

Some Dana Incorporated (NYSE:DAN) shareholders may be a little concerned to see that the Executive VP and President of Off-Highway Drive & Motion Systems, Aziz Aghili, recently sold a substantial US$1.2m worth of stock at a price of US$26.00 per share. That diminished their holding by a very significant 64%, which arguably implies a strong desire to reallocate capital.

See our latest analysis for Dana

Dana Insider Transactions Over The Last Year

Notably, that recent sale by Aziz Aghili is the biggest insider sale of Dana shares that we've seen in the last year. That means that an insider was selling shares at slightly below the current price (US$26.74). As a general rule we consider it to be discouraging when insiders are selling below the current price, because it suggests they were happy with a lower valuation. However, while insider selling is sometimes discouraging, it's only a weak signal. It is worth noting that this sale was 64% of Aziz Aghili's holding.

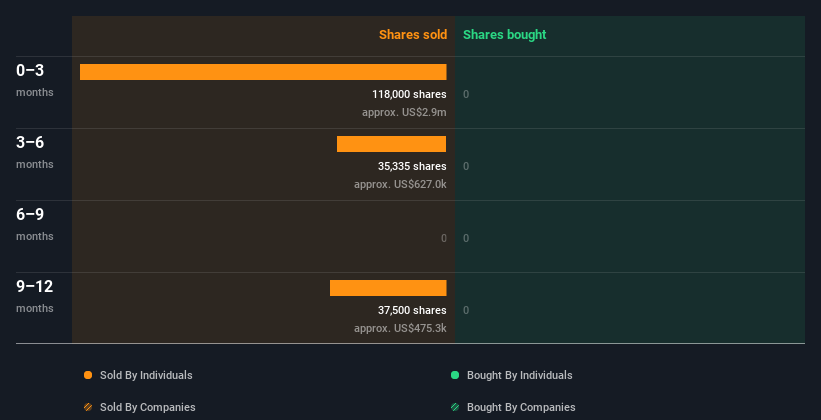

Insiders in Dana didn't buy any shares in the last year. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: insiders have been buying them).

Insider Ownership

For a common shareholder, it is worth checking how many shares are held by company insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Dana insiders own about US$32m worth of shares. That equates to 0.8% of the company. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

So What Do The Dana Insider Transactions Indicate?

Insiders sold stock recently, but they haven't been buying. And even if we look at the last year, we didn't see any purchases. While insiders do own shares, they don't own a heap, and they have been selling. We'd practice some caution before buying! In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Dana. Our analysis shows 4 warning signs for Dana (1 is concerning!) and we strongly recommend you look at these before investing.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade Dana, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:DAN

Dana

Provides power-conveyance and energy-management solutions for vehicles and machinery in North America, Europe, South America, and the Asia Pacific.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.