- United States

- /

- Auto Components

- /

- NYSE:DAN

Dana (DAN): A Fresh Look at Valuation After Recent Stock Momentum

Reviewed by Kshitija Bhandaru

Dana (DAN) has caught some attention lately, especially as investors consider its stock price swings in recent months. The company’s recent returns show gains over the past month and 3 months, even as broader industry trends remain mixed.

See our latest analysis for Dana.

Looking beyond these recent moves, Dana's stock has picked up momentum over the past quarter, building on a 12.3% 90-day share price return. While the past year’s total shareholder return sits just under 1%, the latest moves suggest shifting sentiment as investors eye potential growth ahead.

If you're exploring other players in autos and mobility, now is a good moment to discover See the full list for free.

The real question for investors now is whether Dana’s current valuation reflects hidden upside, or if recent optimism has already been absorbed by the market. Is this a genuine buying opportunity, or has future growth been fully priced in?

Most Popular Narrative: 18.6% Undervalued

With Dana's last close at $20.01 and the narrative's fair value estimated at $24.57, analysts see further room for upside compared to where the shares trade today. This divergence sets the stage for a story built on operational pivots and future growth catalysts.

Dana's aggressive cost reduction and operational efficiency initiatives, such as the $310 million run-rate cost savings target by 2026, significant margin lift from stranded cost eliminations, and ongoing plant automation, should meaningfully increase net margins and profit sustainability over the next several years.

Eager to know why analysts see Dana far from its potential ceiling? Bold efficiency targets, significant moves into electrification, and a projected turnaround in profitability form the narrative’s backbone. The precise blend of assumptions fueling these numbers may surprise you. Tap for the full breakdown.

Result: Fair Value of $24.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps on aggressive cost cuts or over-reliance on a few large customers could quickly challenge the bullish outlook for Dana’s turnaround.

Find out about the key risks to this Dana narrative.

Another View: Multiples Paint a Harsher Picture

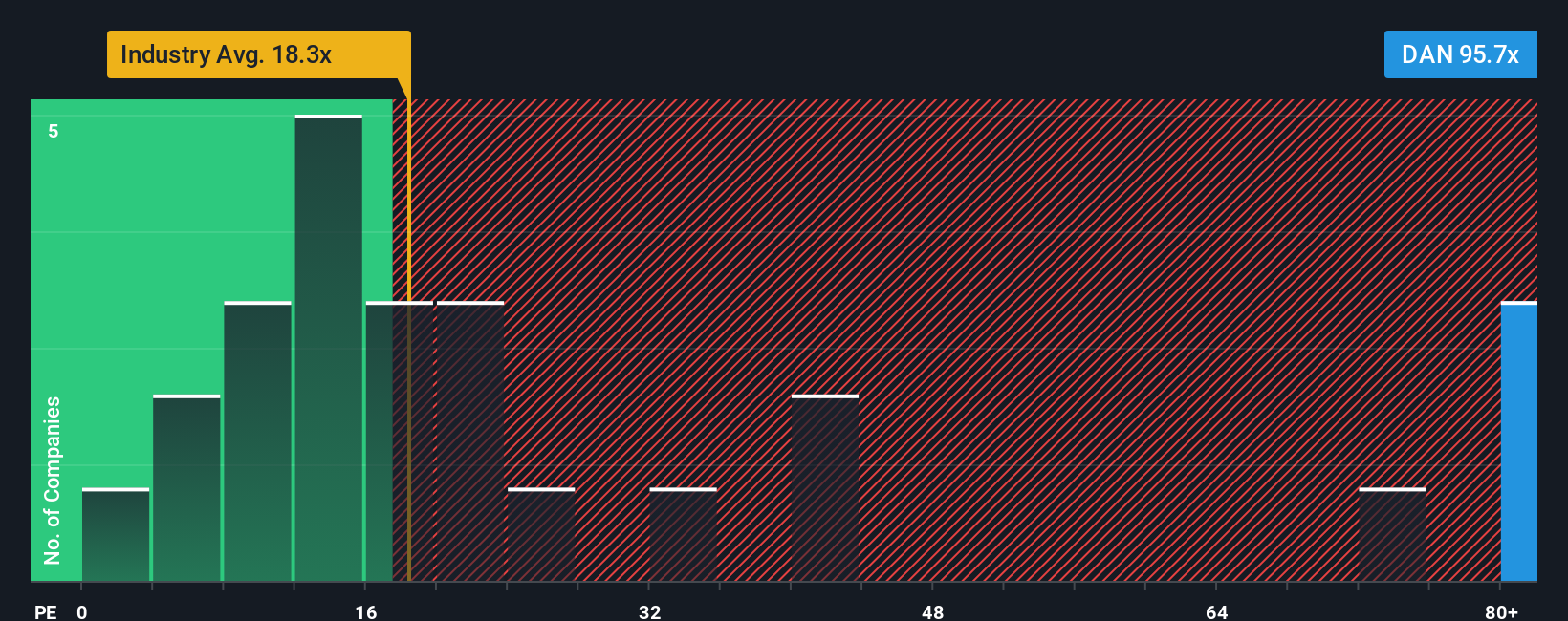

While analyst models point to Dana being undervalued, a closer look at market valuation multiples tells a different story. Dana currently trades at a price-to-earnings ratio of 93.7x, which is far above both the industry average of 18.7x and the fair ratio of 65.9x. This significant premium suggests investors are pricing in high expectations, which may leave little margin for error. Are shares riskier than they look?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dana Narrative

If you'd rather draw your own conclusions from the numbers or want to see things from a different angle, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your Dana research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for Your Next Investment Move?

You’re one step away from finding your next smart opportunity. Take a look at other stocks that match your goals with these tailored, time-saving ideas.

- Secure growing income streams by checking out these 19 dividend stocks with yields > 3%, which deliver strong yields beyond the market average.

- Get ahead of the curve by focusing on these 24 AI penny stocks, positioned for breakthroughs in artificial intelligence and automation.

- Spot value before the crowd by acting now on these 910 undervalued stocks based on cash flows, which trade below their projected fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAN

Dana

Provides power-conveyance and energy-management solutions for vehicles and machinery in North America, Europe, South America, and the Asia Pacific.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives