- United States

- /

- Auto Components

- /

- NYSE:BWA

BorgWarner (BWA): Evaluating Valuation After a 42% Year‑to‑Date Share Price Surge

Reviewed by Simply Wall St

BorgWarner (BWA) has quietly put together an impressive run, with shares up about 42% this year as investors warm to its role in the shift from traditional powertrains to electrified drivetrains.

See our latest analysis for BorgWarner.

That 42.6% year to date share price return has come as investors steadily reassess BorgWarner’s role in electrification, with the latest move toward 44.66 dollars reinforcing a sense that momentum is still building rather than fading.

If you like BorgWarner’s positioning in autos, it could be worth seeing what else is on the move among auto manufacturers today.

After such a strong run, some metrics still hint at a valuation discount versus both intrinsic estimates and analyst targets. This leaves investors to ask whether BorgWarner remains a buying opportunity or if markets already price in its future growth.

Most Popular Narrative Narrative: 10.8% Undervalued

With BorgWarner closing at 44.66 dollars against a narrative fair value just over 50 dollars, the valuation story leans in favor of further upside.

Ongoing operational restructuring and cost controls, alongside battery business consolidation measures, are yielding improvements in adjusted operating margins and free cash flow, indicating enhanced profitability and the potential for structurally higher net margins as the company pivots to electrified products. Balanced capital allocation with a disciplined approach to accretive M&A and substantial increases in both dividends and share repurchase authorizations demonstrates management's confidence in long term cash generation and earnings, while also providing downside protection and potential EPS accretion through buybacks.

Want to see what kind of revenue runway and margin reset could justify that higher value, and which future earnings multiple pulls it all together? The full narrative lays out a specific growth path, a profitability reset, and a valuation framework that might surprise anyone used to traditional auto supplier assumptions.

Result: Fair Value of $50.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained weakness in battery systems and a faster regulatory shift away from combustion technologies could undermine BorgWarner’s margin reset and long term growth narrative.

Find out about the key risks to this BorgWarner narrative.

Another Angle on Valuation

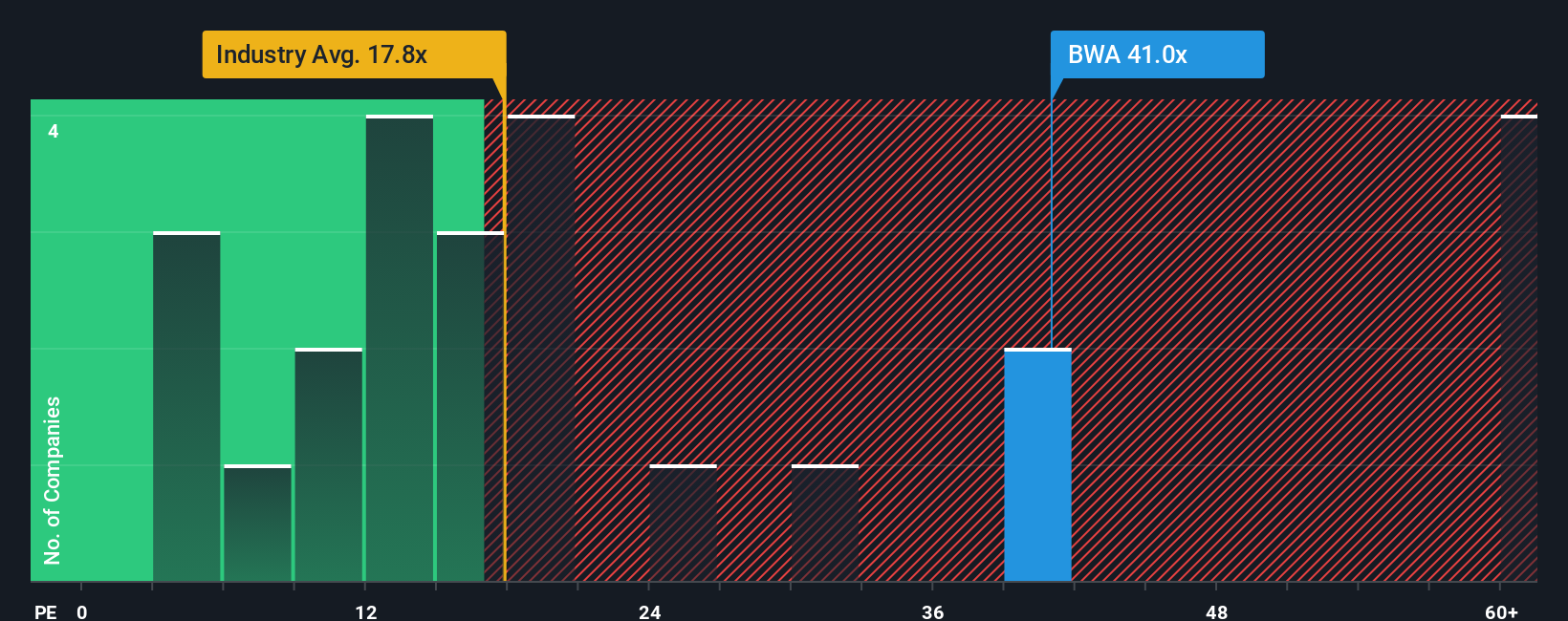

While the narrative fair value suggests upside, our earnings based lens sends a colder signal. BorgWarner trades on a 70.3 times price to earnings ratio versus an industry 19.2 times, peers at 23.9 times and a fair ratio of 17.7 times, which implies meaningful derating risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BorgWarner Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a fresh view in minutes: Do it your way.

A great starting point for your BorgWarner research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before markets move on without you, put the Simply Wall St Screener to work and line up your next high conviction ideas in minutes, not months.

- Target potential mispricings by scanning these 910 undervalued stocks based on cash flows that could offer stronger long term upside than widely followed names.

- Catch the next wave of innovation by reviewing these 26 AI penny stocks that are building real businesses around transformative AI technology.

- Rebalance for reliable income by filtering these 13 dividend stocks with yields > 3% that can help strengthen your portfolio’s cash flow without chasing risky payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BorgWarner might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BWA

BorgWarner

Provides solutions for combustion, hybrid, and electric vehicles worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion