- United States

- /

- Auto Components

- /

- NYSE:AXL

Here's Why American Axle & Manufacturing Holdings (NYSE:AXL) Is Weighed Down By Its Debt Load

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, American Axle & Manufacturing Holdings, Inc. (NYSE:AXL) does carry debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for American Axle & Manufacturing Holdings

What Is American Axle & Manufacturing Holdings's Debt?

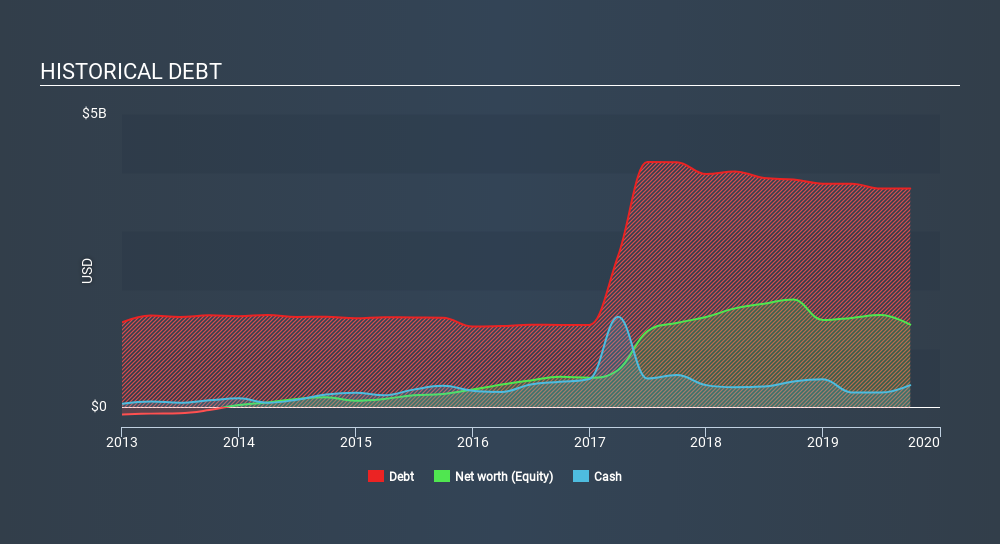

The image below, which you can click on for greater detail, shows that American Axle & Manufacturing Holdings had debt of US$3.73b at the end of September 2019, a reduction from US$3.89b over a year. However, it also had US$376.7m in cash, and so its net debt is US$3.35b.

A Look At American Axle & Manufacturing Holdings's Liabilities

We can see from the most recent balance sheet that American Axle & Manufacturing Holdings had liabilities of US$1.24b falling due within a year, and liabilities of US$4.67b due beyond that. Offsetting this, it had US$376.7m in cash and US$976.9m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$4.55b.

The deficiency here weighs heavily on the US$1.12b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet." So we'd watch its balance sheet closely, without a doubt After all, American Axle & Manufacturing Holdings would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While we wouldn't worry about American Axle & Manufacturing Holdings's net debt to EBITDA ratio of 3.3, we think its super-low interest cover of 2.2 times is a sign of high leverage. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. Worse, American Axle & Manufacturing Holdings's EBIT was down 36% over the last year. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if American Axle & Manufacturing Holdings can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, American Axle & Manufacturing Holdings's free cash flow amounted to 28% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

On the face of it, American Axle & Manufacturing Holdings's EBIT growth rate left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. And even its net debt to EBITDA fails to inspire much confidence. Taking into account all the aforementioned factors, it looks like American Axle & Manufacturing Holdings has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. Given our concerns about American Axle & Manufacturing Holdings's debt levels, it seems only prudent to check if insiders have been ditching the stock.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:AXL

American Axle & Manufacturing Holdings

Designs, engineers, and manufactures driveline and metal forming technologies that supports electric, hybrid, and internal combustion vehicles.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives