- United States

- /

- Auto Components

- /

- NYSE:ALV

Autoliv (ALV): Assessing Valuation After a Year of 40% Shareholder Returns

Reviewed by Kshitija Bhandaru

See our latest analysis for Autoliv.

After a strong run over the past year, Autoliv’s share price has gained solid traction, with a 40% one-year total shareholder return that highlights renewed optimism in the automotive safety space. The consistent momentum reflects not only recent stock gains, but also a broader belief in Autoliv’s positioning for sustained growth.

If surging interest in auto safety stocks has you curious, now is a good moment to see what else is gaining traction in the sector and discover See the full list for free.

With Autoliv posting strong returns and robust growth, the big question now is whether its recent rally leaves more room for upside or if future gains are already reflected in today’s share price.

Most Popular Narrative: 3.3% Undervalued

Compared to its last close of $125.52, the current most-followed narrative assigns a fair value of $129.74 to Autoliv. This implies that the stock remains modestly undervalued. The narrative provides a framework for how analysts are assessing Autoliv’s future performance and current market risks.

Recent success with new product launches in China and strengthening relationships with major Chinese OEMs suggest Autoliv is poised to benefit from rising vehicle ownership in emerging markets. This may lead to outsized revenue growth and market share gains in high-growth regions.

Curious what makes this valuation tick? The most popular narrative forecasts a compelling mix of profit expansion, cash returns, and strategic industry influence. But which critical financial levers are driving confidence in that higher fair value? Find out what’s behind the numbers and why this outlook could be a turning point for Autoliv’s future.

Result: Fair Value of $129.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued trade uncertainty and slowing global vehicle production remain key risks. These factors could pressure both sales growth and profit margins going forward.

Find out about the key risks to this Autoliv narrative.

Another View: Is the Market Price Telling a Different Story?

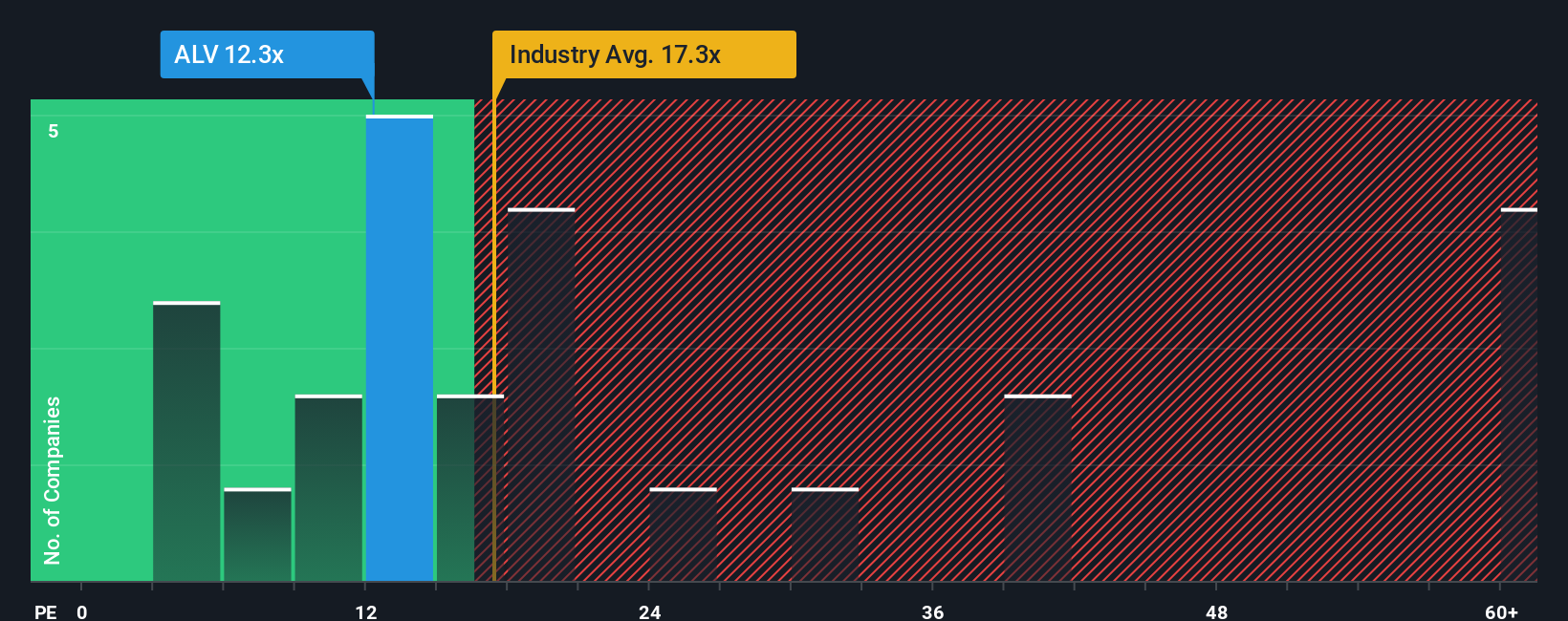

Taking a look through the lens of earnings, Autoliv’s valuation appears stretched compared to its estimated fair ratio. Its current price-to-earnings ratio sits at 13.5x, above the fair ratio of 12.1x, but still well below the Auto Components industry average of 18.7x and far beneath the peer group’s hefty 28x average. This suggests that while the stock looks expensive versus its long-term fair value, it remains relatively attractive next to industry peers. Does this gap represent hidden risk or a window of opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Autoliv Narrative

If the current conclusions do not quite align with your perspective or you are eager to chart your own path, dive into the data and assemble your own view in just a few minutes. Do it your way

A great starting point for your Autoliv research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Staying ahead means spotting opportunities where others hesitate. Don’t let potential gains pass you by. The Simply Wall Street Screener puts breakthrough ideas at your fingertips.

- Jump on fast-growing tech trends by checking out these 23 AI penny stocks and gain an edge with companies transforming industries through artificial intelligence.

- Capitalize on high yields and stable income by browsing these 19 dividend stocks with yields > 3%, where you’ll find stocks built to reward shareholders with robust dividends.

- Uncover tomorrow’s leaders before the crowd by searching through these 916 undervalued stocks based on cash flows and spot stocks trading for less than their true worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALV

Autoliv

Through its subsidiaries, develops, manufactures, and supplies passive safety systems to the automotive industry in Europe, the Americas, China, Japan, and rest of Asia.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives