- United States

- /

- Auto Components

- /

- NasdaqCM:XPEL

XPEL (XPEL): Valuation in Focus after COLOR Paint Protection Film Launch and Q3 Earnings Reveal

Reviewed by Simply Wall St

XPEL (XPEL) grabbed attention this week with two material events for investors: a fresh third quarter earnings report and the live unveiling of its COLOR Paint Protection Film at the 2025 SEMA Show.

See our latest analysis for XPEL.

XPEL’s share price has turned upward recently, climbing 7% over the past month with short-term momentum boosted by its SEMA Show product launch and fresh Q3 financials. Even so, investors remain cautious, as shown by the one-year total shareholder return of -15% and a modest 10% gain over five years.

If news-driven momentum in auto accessories caught your interest, now is a great time to broaden your search and discover See the full list for free.

Yet with shares still down double digits from their highs and a sizeable gap to analyst price targets, the real question for investors is whether XPEL is trading at a discount or if the market already anticipates tomorrow’s growth.

Most Popular Narrative: 24.1% Undervalued

The narrative’s fair value places XPEL at a significant premium to its last close price of $36.16. This creates a clear disconnect between market perception and consensus projections.

Expansion into emerging and international markets (e.g., Thailand, Japan, China, Brazil, Europe, India, Middle East) is well underway, with further direct distribution efforts and M&A planned. This broadens XPEL's addressable market and diversifies revenue streams, supporting accelerated revenue growth and reducing regional concentration risk over time.

Want to know the growth blueprint behind this high valuation? The key element of this narrative is surging business in new global markets and a new platform primed for higher margins. Which bold financial forecasts and big margin jumps are used to fuel that price target? Dive in to uncover what truly powers this estimated upside.

Result: Fair Value of $47.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition overseas and unpredictable global auto sales could quickly challenge this optimistic scenario for XPEL, which could impact future returns.

Find out about the key risks to this XPEL narrative.

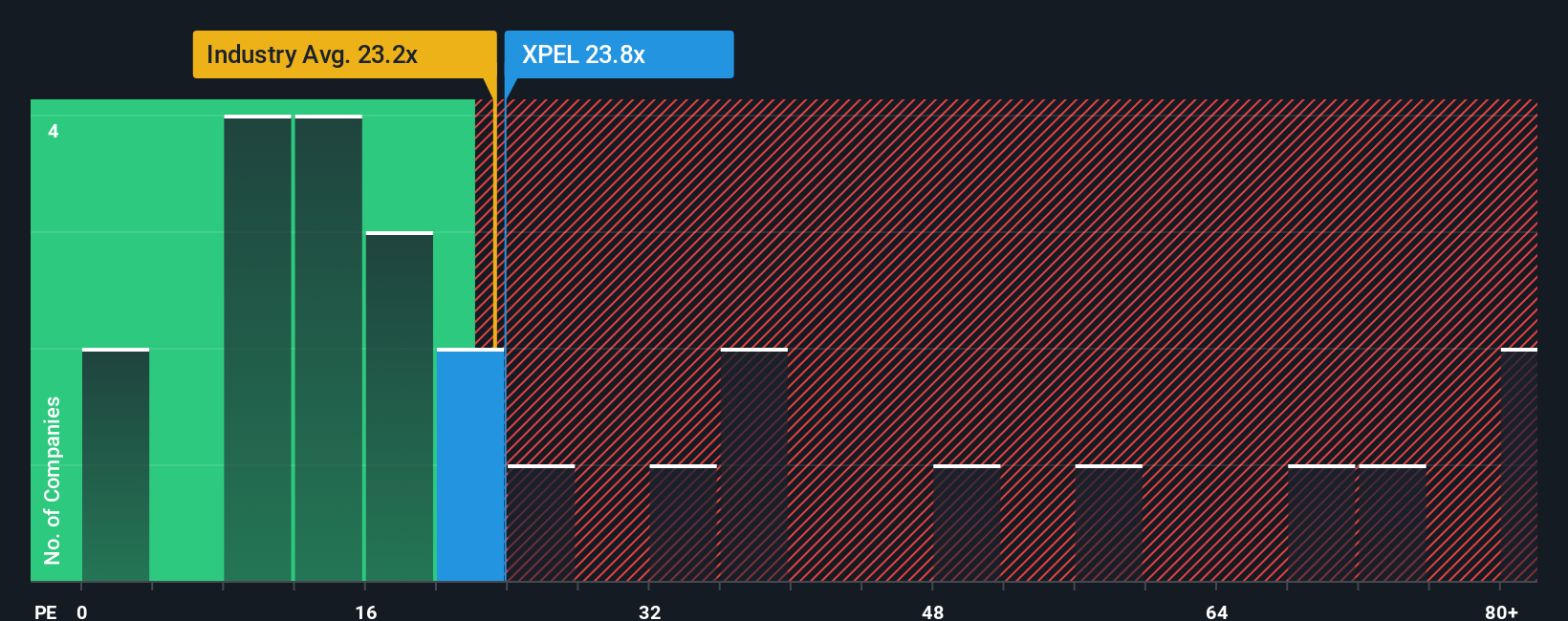

Another View: What Do Earnings Ratios Tell Us?

Switching lenses, many investors look at XPEL’s current price-to-earnings ratio of 21.4x. Compared to both its industry average (20.1x) and what’s considered a fair ratio (20.9x), shares actually look expensive today. This gap suggests buyers are paying a premium now. Is the market overlooking risks, or instead betting on stronger growth ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own XPEL Narrative

If you see the story differently or want to chart your own path, take a few minutes to dig into the data and build your outlook. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding XPEL.

Looking for More Smart Investment Ideas?

Don’t leave promising opportunities on the table. Take the next step and uncover stocks with explosive growth, durable dividends, or transformative technology that matches your investment style.

- Capitalize on the potential of artificial intelligence by focusing on these 25 AI penny stocks that are poised to transform entire industries.

- Secure reliable income streams by evaluating these 17 dividend stocks with yields > 3% offering strong yields to strengthen your portfolio’s foundation.

- Gain an edge in a changing market by identifying value with these 848 undervalued stocks based on cash flows where future growth opportunities could be hidden in plain sight.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:XPEL

XPEL

Manufactures, installs, sells, and distributes protective films, coatings and related services.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives