- United States

- /

- Auto Components

- /

- NasdaqGM:WRD

Can WeRide's (WRD) After-Hours Robotaxi Approval Illuminate Its Path to 24/7 Autonomous Leadership?

Reviewed by Simply Wall St

- WeRide recently secured regulatory approval to conduct late-night Robotaxi testing on public roads in Beijing, allowing operations from 10pm to 7am as part of its drive toward a 24/7 autonomous ride-hailing network.

- This milestone showcases WeRide's technological strengths in addressing complex, real-world challenges like low-light and harsh weather, strengthening its position in autonomous mobility innovation.

- We'll look at how WeRide's expanded Robotaxi testing in Beijing reinforces its investment narrative and leadership in all-day autonomous driving.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 28 companies in the world exploring or producing it. Find the list for free.

What Is WeRide's Investment Narrative?

If I’m looking at WeRide as a potential investment, the core narrative is all about betting on the adoption of autonomous mobility and the company's ability to commercialize cutting-edge technology across global markets. Last week’s regulatory approval to test Robotaxi in Beijing overnight is a big win, it sharpens their competitive edge and could act as a near-term confidence boost, especially for those watching how fast commercial rollouts follow technical progress. This milestone may also improve sentiment around short-term catalysts, such as key city deployments and major partnerships like the equity placement involving Grab. On the other hand, the unprofitable profile remains, and risks from high cash burn, valuation multiples far above industry averages, and an inexperienced board are still in play. While robotaxi validation in Beijing is significant, it doesn’t fully offset the hurdle of achieving sustainable profitability in a sector known for its volatility.

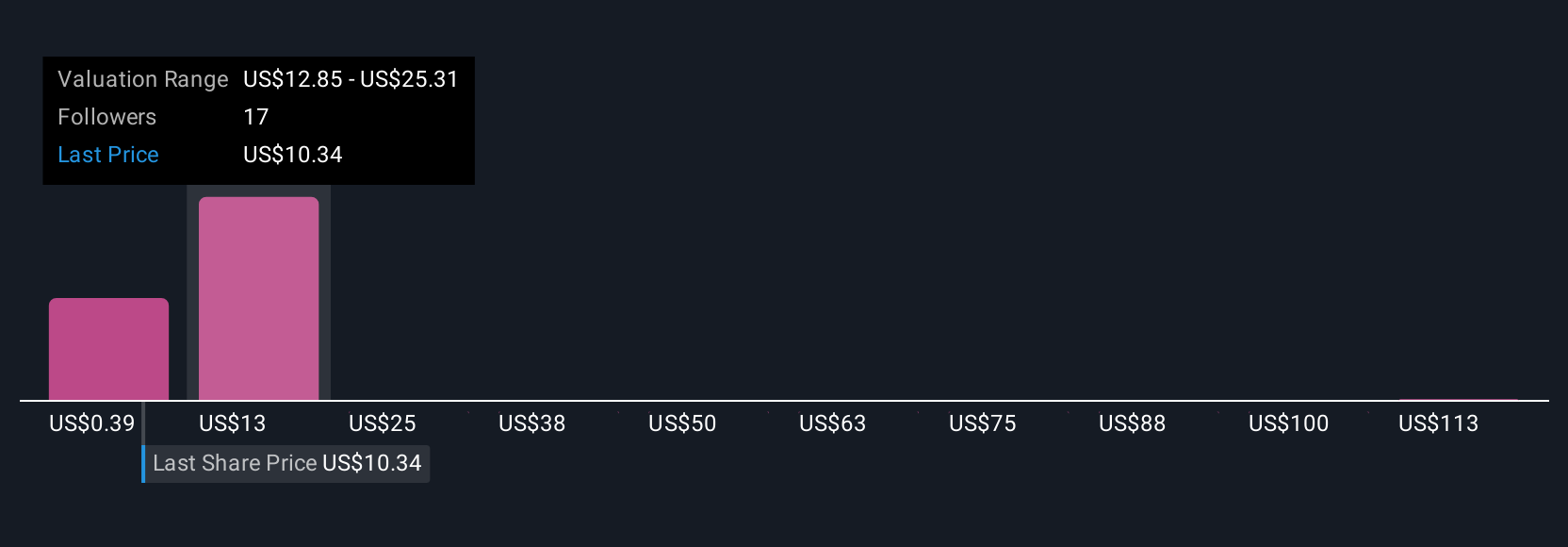

But keep in mind, board inexperience is still a concern, details you shouldn’t miss. The valuation report we've compiled suggests that WeRide's current price could be inflated.Exploring Other Perspectives

Explore 12 other fair value estimates on WeRide - why the stock might be a potential multi-bagger!

Build Your Own WeRide Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WeRide research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free WeRide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WeRide's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WeRide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WRD

WeRide

Operates as a mover in the autonomous driving industry and a robotaxi company.

Excellent balance sheet with limited growth.

Market Insights

Community Narratives